Index Options Advantages in Trading Index Options

Post on: 23 Июль, 2015 No Comment

An option is a financial derivative whose value is determined by the value of another asset (called the underlying).

Index options are calls or puts where the underlying asset is a stock market index i.e the Dow Jones or the S&P 500 index. Using index options enables option traders to bet on the direction or volatility on an entire equity market (or market segment) without having to trade option on all of the individual securities.

According to the Futures Industry Magazine the KOSPI was the largest in volume (number of outright contracts) during 2008. I would say though that the OEX, SPX and NDX are the biggest in terms of market capitalization. OEX, SPX and NDX options are all traded on the CBOE.

Index Option Valuation

Generally, the factors for the pricing of index options are the same as equity options with a European exercise. I.e the inputs of underlying price, strike price, interest rate, volatility, dividend, call or put are fed into the Black and Scholes pricing model to calculate the premium.

The main difficulty for traders pricing index options is the dividend estimate.

To calculate the dividend component correctly, an option trader will need to know all of the individual stock component dividends and weight them in proportion to each stocks weighting in the index basket. Large investment banks and hedge funds will have a research division to carry out this task. However, another way is to use a 3rd party source like Bloomberg who publishes the dividend yield for the index as calculated from all of the component stocks.

One way that I’ve seen trader’s workaround this is to not use any dividend estimates at all and instead base their options on the front month futures contract (instead of the index itself) to determine the theoretical forward of the option. This works well for front month options based off a front month future. For back month options, traders will use the front month future as the base contract and apply an offset to the forward price used to reflect the carry cost from the front month to back month. Traders usually use the futures roll price from the front month to back month to determine this carry cost.

With this method index option traders are assuming that the index futures contract has already priced the dividends into the futures market price.

Are all index options European style exercise?

Almost. There are a few exceptions, like the OEX (CBOE: OEX), which are cash settled American style index options. A trader may exercise OEX options at any time prior to the expiration date and the amount to settle will be based upon the closing price of all of the component stocks on the day the trader exercises.

An American style index option with a physical settlement would be a nightmare for option clearing houses. Say you were long a call option on the S&P 500 index and decided during the day to exercise. Your broker would have to arrange with the clearing house for delivery of all 500 stocks in their correct weighting and price at the time of exercise to you. And the seller would then be short all 500 stocks.

One exception to this is the SPI. SPI options (Australian All Ordinaries Index) are referred to as index options, however, they are technically futures options as the underlying security for the options is the SPI future. SPI options are American exercise and exercise into the appropriate futures contract.

Expiration

Most index options are serial: March, June, September and December. The exceptions (AFAIK) are the Hang Seng and the KOSPI. HSI and KOSPI have options every month for the first 3 consecutive months and then serial months thereafter.

Settlement

As most index options are European exercised (exceptions are SPI/OEX) where physical delivery is not possible, settlement is always done in cash and will occur on the next business day after exercise.

Determining the settlement price differs from index to index and option traders will need to refer to the contract specifications to be sure what method will be used to determine the price.

For example, the settlement price used for the options on the KOSPI index is determined by the weighted average price of all of the component stocks in the last 30 minutes of trading on the final trading day. The NIKKEI 225 index options are settled according to the weighted average of the opening price of all of the component stocks the morning after the final trading day. Options on the FTSE index are settled basis the Exchange Delivery Settlement Price (EDSP) as reported by LIFFE on the last day of trading.

Index option traders eagerly await the final settlement price, which is reported by the exchange. It is referred to as The SQ (which I believe is Settlement Quote. I’ve also heard it referred to as Special Quotation. I’m not sure which expansion is correct).

Another type of index option that is very popular to trade are options on Volatility Indexes.

Diversification

Options based on indices rather than individual stocks provide investors with diversification.

In finance, a text book will tell you that diversification means the removal of unsystematic risk. However, if you’ve ever come across the saying dont put all your eggs in one basket then you have already been introduced to the concept of diversification. It basically means spreading your investment across multiple assets, in this case, multiple stocks with the objective of reducing (or evening out) your overall risk.

A stock index is a compilation of many stocks. The S&P 500 is meant to resemble a portfolio made up of 500 individual companies. Index options based off the S&P 500 (SPX) give option traders the chance to construct option strategies and techniques to bet on the entire market rather than the performance of one individual stock.

Predictability

I don’t mean to mention that index options are easy to predict. But index options are generally less volatile than the component stocks that make up the index.

Earnings reports, takeover rumors, news and other market events are what drive volatility in individual stocks. An index tends to smooth out the wild ups and downs of the stock basket and hence options based off an index will also show lower fluctuations.

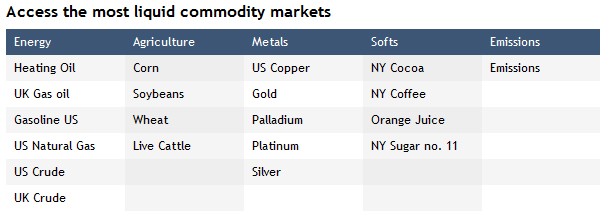

Liquidity

Index options are very popular for option traders, hedge funds and investment firms. This popularity drives up the volumes available to trade and reduces the spreads quoted in the market. This competition means that you will always have a fair price to trade at and plenty of volume too.