Incubator hedge funds allow you to start a hedge fund business quickly

Post on: 16 Март, 2015 No Comment

Hannah Terhune Articles

Why Start with an Incubator Hedge Fund? An incubator hedge fund allows you to create a marketable track record for your hedge fund. Our incubator hedge fund plan allows you to spread hedge fund development costs over a period of time. With positive, real-time trading results (i.e. not hypothetical or back tested results) presented in a real-time performance audit, you are positioned to make a stronger marketing pitch to potential investors than you could with hypothetical results or results from your personal trading account.

Incubator Hedge Fund Structure In the United States, the incubator hedge fund is established with two companiesthe hedge fund and its investment manager. In many other countries, a hedge fund incubator can be established with one company; the investment manager can be established at a later date. Contact Us for a Free Consult Generally, the difference between a full-fledge hedge fund and an incubator hedge fund is the ability to charge performance and management fees and the availability of offering documents. Learn More About Hedge Fund Offering Documents

You can deposit your own money as seed capital into the hedge fund, you can use your IRA and retirement money, and in some cases you can accept money from close friends and family. While you may be able to accept money from friends and family in your incubator hedge fund, generally you cannot charge performance and management fees although there are exceptions to this rule.

Why Start a Hedge Fund Business? Creating a hedge fund to protect and manage your assets or the assets of others for a fee is a practical way to earn a living. Successful hedge funds continue to attract the wealthy, the working not-so-wealthy, businesses, and pension funds looking for better investment options. Despite recent law changes, the United States still offers a favorable environment for smaller hedge fund startups.

One reason why active traders do not realize their dream of starting a fund is that they do not have a proven track record. Unless you are known as a successful trader and have a professional pedigree, you may not be able to attract investors into your fund until you can show them a performance record. For successful active traders like you, this is annoying. If you are planning to start a hedge fund you probably experienced success trading your own accounts or trading professionally.

Securities laws in most countries make it difficult and expensive to use your prior performance records to promote a new venture. Our incubator hedge fund strategy is a proven solution to a lack of credentials in the industry. By setting up an incubator hedge fund and following our protocols you create a performance record that can be marketed to prospective investors and clients.

Only when you are sure that investors will come aboard your fund, spend the money needed to convert your incubator hedge fund to a full-fledge hedge fund. Contact Us for a Free Consultation

Offshore Incubator Hedge Funds In many countries, a hedge fund incubator can be established with one business entity. However, a simple, one share class offshore International Business Company cannot be used as an incubator hedge fund. A two share class entity is required to set up an offshore incubator hedge fund. If you set up a one share class international business company, you create only a private trading company and not an incubator hedge fund. Learn More About Offshore Hedge Funds

How are Offshore Incubator Hedge Funds Taxed? Offshore incubator hedge funds are generally set up as corporations in tax-free countries. There are optional tax elections that can be made so that U.S. investors can treat their shares in an offshore fund structured as a corporation as a partnership interest for U.S. tax purposes. These tax elections (i.e. the PFIC election) is optional. In fact, it is not recommended if the offshore hedge fund trades on margin (i.e. uses leverage) and the U.S. investors are tax-exempt. Learn More About Hedge Fund Taxation

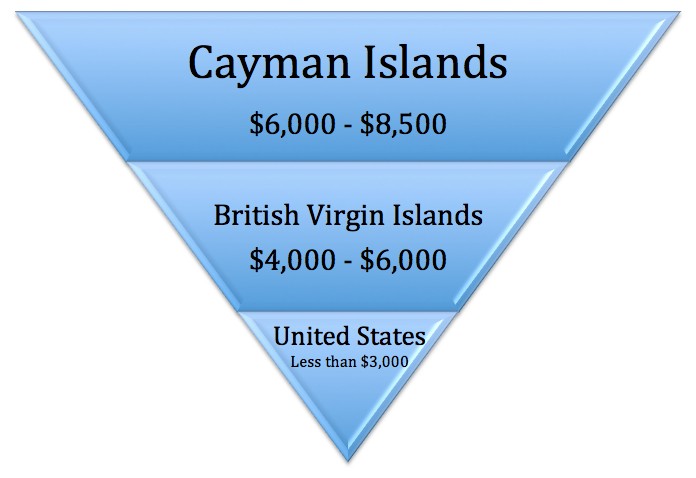

Should I set up an offshore incubator hedge fund? Outside the United States, the rules governing incubator hedge funds are more relaxed; however the start-up costs are a bit higher. It also takes a little longer to set up an offshore incubator hedge fund. In addition, when you are ready to convert an offshore incubator hedge fund to a full-fledge hedge fund, you will find that it takes more time and mental effort to do so (due to foreign regulatory issues) than it does in the United States. Learn More About Offshore Hedge Funds

Why the United States? Even if you are based in another country, consider forming a U.S. hedge fund. Remember, the United States is offshore to you. Delaware is one of the best offshore jurisdictions in the world. Need proof? Read the U.S. Government Accounting Office Report from 2006 on this topic and the Delaware LLC. The United States offers easy low cost access to the legal, tax, accounting, retail and institutional brokerage, and the regulatory services needed by a hedge fund sponsor to organize a hedge fund. Despite what some hedge fund sponsors think about the purported negativity surrounding the United States, many more establish U.S. based hedge funds because of the minimal expenses associated with starting a U.S. hedge fund and the sheer convenience of having their U.S. based family members and/or other U.S. investors able to invest in the hedge fund. Read our leading media articles: America the Beautiful Tax Haven and Strategic Hedge Fund Planning .