Implied Volatility Buy Low And Sell High

Post on: 19 Апрель, 2015 No Comment

In the financial markets, options are rapidly becoming a widely accepted and popular investing method. Whether they are used to insure a portfolio, generate income or leverage stock price movements, they provide advantages other financial instruments don’t.

Aside from all the advantages, the most complicated aspect of options is learning their pricing method. Don’t get discouraged — there are several theoretical pricing models and option calculators that can help you get a feel for how these prices are derived. Read on to uncover these helpful tools.

What Is Implied Volatility?

It is not uncommon for investors to be reluctant about using options because there are several variables that influence an option’s premium. Don’t let yourself become one of these people. As interest in options continues to grow and the market becomes increasingly volatile, this will dramatically affect the pricing of options and, in turn, affect the possibilities and pitfalls that can occur when trading them.

Implied volatility is an essential ingredient to the option pricing equation. To better understand implied volatility and how it drives the price of options, let’s go over the basics of options pricing.

Option Pricing Basics

Option premiums are manufactured from two main ingredients: intrinsic value and time value. Intrinsic value is an option’s inherent value, or an option’s equity. If you own a $50 call option on a stock that is trading at $60, this means that you can buy the stock at the $50 strike price and immediately sell it in the market for $60. The intrinsic value or equity of this option is $10 ($60 — $50 = $10). The only factor that influences an option’s intrinsic value is the underlying stock’s price versus the difference of the option’s strike price. No other factor can influence an option’s intrinsic value.

Using the same example, let’s say this option is priced at $14. This means the option premium is priced at $4 more than its intrinsic value. This is where time value comes into play.

Time value is the additional premium that is priced into an option, which represents the amount of time left until expiration. The price of time is influenced by various factors, such as time until expiration, stock price, strike price and interest rates, but none of these is as significant as implied volatility.

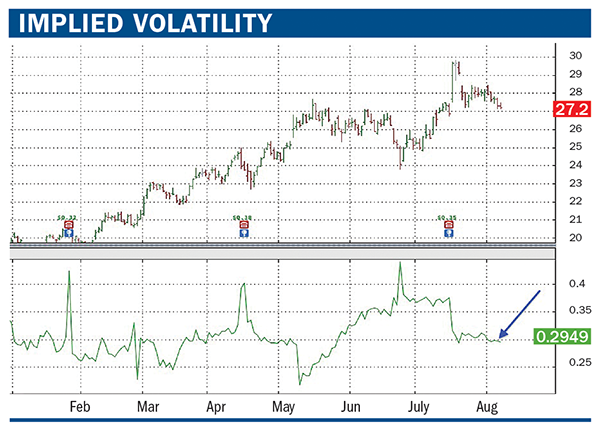

Implied volatility represents the expected volatility of a stock over the life of the option. As expectations change, option premiums react appropriately. Implied volatility is directly influenced by the supply and demand of the underlying options and by the market’s expectation of the share price’s direction. As expectations rise, or as the demand for an option increases, implied volatility will rise. Options that have high levels of implied volatility will result in high-priced option premiums. Conversely, as the market’s expectations decrease, or demand for an option diminishes, implied volatility will decrease. Options containing lower levels of implied volatility will result in cheaper option prices. This is important because the rise and fall of implied volatility will determine how expensive or cheap time value is to the option.

How Implied Volatility Affects Options

The success of an options trade can be significantly enhanced by being on the right side of implied volatility changes. For example, if you own options when implied volatility increases, the price of these options climbs higher. A change in implied volatility for the worse can create losses. however, even when you are right about the stock’s direction!

Each listed option has a unique sensitivity to implied volatility changes. For example, short-dated options will be less sensitive to implied volatility, while long-dated options will be more sensitive. This is based on the fact that long-dated options have more time value priced into them, while short-dated options have less.

Also consider that each strike price will respond differently to implied volatility changes. Options with strike prices that are near the money are most sensitive to implied volatility changes, while options that are further in the money or out of the money will be less sensitive to implied volatility changes. An option’s sensitivity to implied volatility changes can be determined by Vega — an option Greek. Keep in mind that as the stock’s price fluctuates and as the time until expiration passes, Vega values increase or decrease. depending on these changes. This means that an option can become more or less sensitive to implied volatility changes.