HowtoInvestOnline ETF Comparison Developed Country Diversified Equities

Post on: 5 Апрель, 2015 No Comment

ETF Comparison: Developed Country Diversified Equities

Equities of developed market countries such as Japan, Great Britain, Germany etc (about 25 in all) should be a key part of every Canadian investor’s asset mix. The diversification into economies that are not entirely in sync and into industries and companies that differ from the heavy resource structure of Canada’s can add stability to a portfolio. By their ability to offer such an investment in a large number of companies and countries at low cost, ETFs are an ideal vehicle. This week we will therefore review the strengths and weaknesses of the leading ETFs for this asset class. Our objective is to look for an ETF that can be a good long term holding with broad coverage of countries, industry sectors and companies.

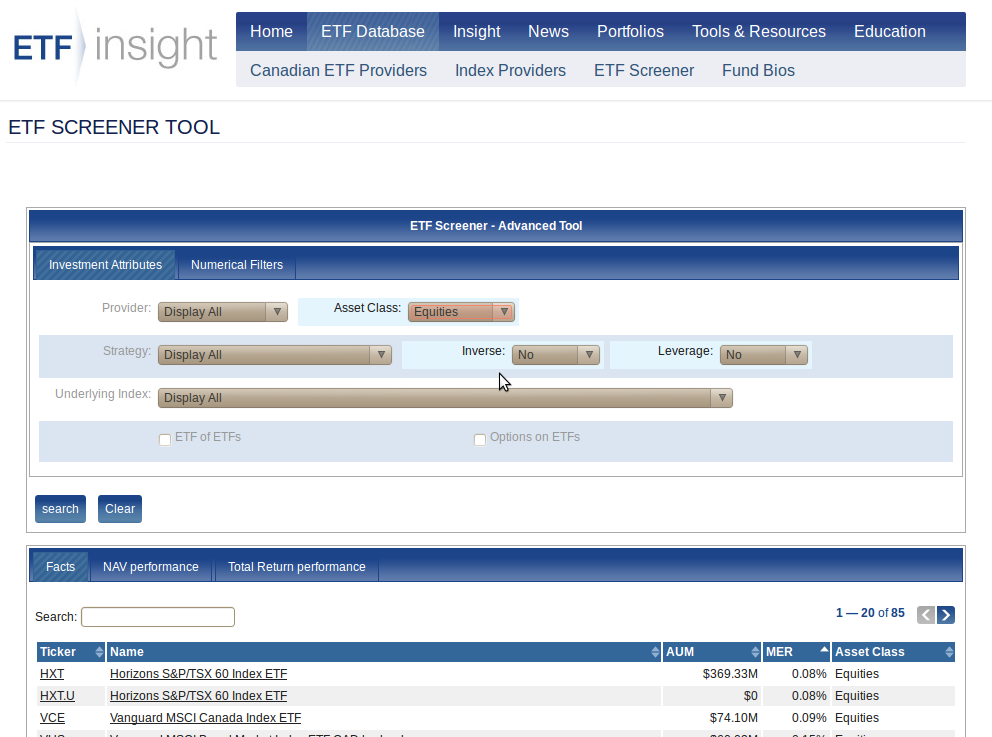

As with our recent review of Emerging Markets ETFs, we used ETF Database to find and get data on the US-traded ETFs in the category. For Canadian-traded ETFs, we used a combination of BMO InvestorLine (reviewed in our ETF Screeners post ) and ETF Insight .

Two sets of ETF choices.

As with Emerging markets ETFs, the largest divide in the options is between traditional passive, cap-weighted index portfolios and those based on a variety of alternative strategies that have been gaining popularity — such as fundamental accounting data weighting, high dividend payout and low portfolio volatility.

1) Traditional Cap-Weighted Index ETFs

Some are traded in US dollars on US stock exchanges, others in Canada on the TSX in Canadian dollars, though they all ultimately hold equities of developed markets countries. Thus, the risk, including any currency risk, is of those countries, not the USA. As our comparison table below shows, the asset base of US ETFs dwarf those of Canadian ETFs.

- Vanguard FTSE Developed ex North America Index ETF (NYSE symbol: VEA ) and its two Canadian clones which hold VEA but are traded on the TSX under symbol: VDU in a non-hedged version introduced this past August and VEF in a currency hedged version

- Schwab FTSE International Equity ETF (NYSE: SCHF ), which includes of fair dollop of Canadian companies

- iShares MSCI EAFE Index Fund (NYSE: EFA ), the grand-daddy behemoth of developed market ETFs and its currency-hedged Canadian clone XIN

- iShares Core MSCI EAFE ETF (NYSE: IEFA ) introduced only a year ago and catching on fast due to its lower MER fee cost and wider diversification than EFA; has an unhedged Canadian clone XEF .

- BMO MSCI EAFE Hedged to CAD Index ETF (TSX: ZDM ), which is not a clone but is hedged

Comparison Tables (click to enlarge)

Assets, MER, Performance, Taxes