How to Use Technical Indicators

Post on: 16 Март, 2015 No Comment

How to Use Technical Indicators 5.00 / 5 (100.00%) 1 vote

Many binary option traders use technical indicators to help identify good entry set-ups. Trading platforms have so many indicators built-in that selecting a few to develop an effective trading strategy becomes a daunting task. Inexperienced traders use too many indicators, or use them inefficiently, leading to information overload. Here are some basic rules to follow while incorporating technical indicators into your trading system :

Know your Indicators Well

Technical indicators are a series of data points that are derived by applying a formula to the price of an asset. Most technical indicators highlight a particular aspect of price behaviour. Study their characteristics inside-out until you know them well. Technical indicators are like a carpenters tools: skilled use can produce consistent profitable results, while unskilled use may lead to injury (or in your case, loss of money).

No One Indicator is Suited for Every Market Condition

There are two types of indicators:

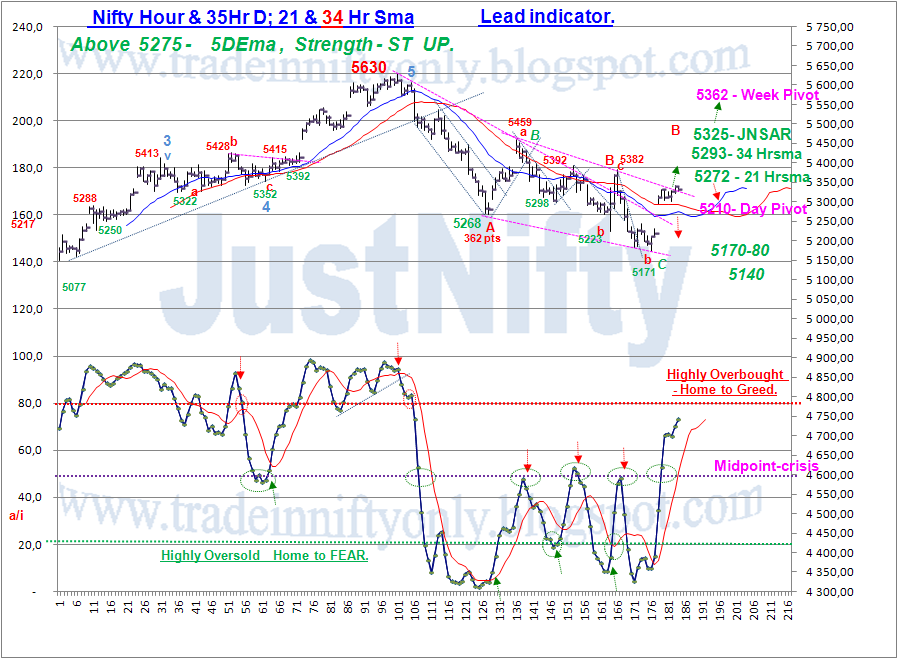

- Leading (Relative Strength Index, Stochastic, Williams %R etc.): Such indicators generally precede price movement, and are often used to generate buy signals.

- Lagging (Moving Averages, MACD etc.): These indicators are used as confirmation tools because they follow price action.

Leading indicators like oscillators are useful in non-trending markets where prices fluctuate between bands of support and resistance. During such times, lagging indicators will generate a lot of false signals. Moving averages and MACD are best used in identifying the broad trend of the market.

Keep it Simple

It is best to focus on two or three indicators. Use indicators as a supplement to price action. At the end of the day, buyers and sellers are what moves prices. Indicators are best used to confirm other technical analysis tools. If Momentum is waning, it may be a signal to watch-out for a break of price support. Similarly, a positive divergence may serve as an alert for a resistance breakout.

Use Complementary Indicators

Choose indicators that complement each other well, instead of those that move in unison and generate similar signals. For example, it would be redundant to use Stochastic and RSI simultaneously. Both of these indicators measure momentum and show overbought/oversold levels. A simple strategy is to combine a momentum indicator and a trend-following indicator. Since each indicator provides a different interpretation of the market, one may be used to confirm the other.

Optimize your Indicators

Most indicators allow for an element of customization by simply changing the user-defined variables such as the look-back period or the type of price data used in calculation. Optimize your indicator to suit the current market condition. However, it is important to note that if we increase the sensitivity of an indicator by reducing the number of periods, it will provide early signals, but the number of false signals will also increase. Conversely, decreasing the sensitivity by increasing the number of periods will lead to lesser whipsaw, but the signals will lag. There will always be a trade-off between sensitivity and consistency.

Don’t Search for the Holy Grail

Since technical analysis deals in probabilities rather than certainties, no combination of indicators can accurately forecast an asset’s price 100% of the time. Too many indicators, or the incorrect use of indicators, can blur a traders view of the underlying market condition. By selecting technical indicators carefully and effectively, you can identify high probability trade set-ups, increasing your odds of success in the binary options market.