How To Use Options To Protect A Long Stock Position

Post on: 28 Май, 2015 No Comment

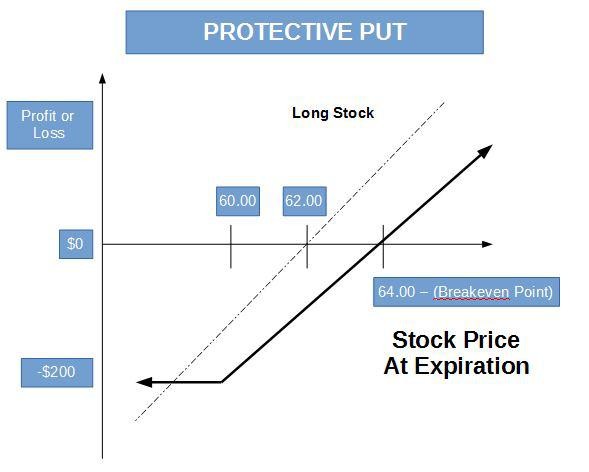

An Example Of How To Use Options To Protect A Long Stock Position

To use options to protect a long stock position you must first have a long position in a stock. Although they are relatively inexpensive, options cost money; therefore, options should only be used to protect a long stock position at times when it makes sense to buy such protection. If you just finished your due diligence regarding a stock and you just purchased the stock, there is no need to immediately start buying protection for your long stock position, if you bought the stock based on sound due diligence and feel strongly it will move higher over time based on fundamentals. Buying protection too early will just drive up the cost of your stock purchase. The time to use options to protect a long stock position is after a stock you hold has made a significant run higher and you want to ensure that you capture a profit in the event that the stock has a sharp pull back on unexpected bad news. Although stop-loss orders can also provide protection from unexpected stock price moves lower, stop losses can sometimes be triggered on quick dips and cause a premature exit from long stock position and stop losses do not protect against situations in which stocks gap down lower in the beginning of a trading session or after a trading halt, while options provide price protection against gaps down.

Here’s how you can use options to protect a long stock position. Let’s say you purchased Bank of America’s stock BAC during the prior recession at a level below $5 per share. Since then, BAC has rallied to over $10 per share. If you are worried that unexpected bad economic news could send BAC’s stock reeling lower, you can use put options to lock in your BAC profit at $10 per share. Buying put options with a strike price of $10 per share that cover the number of BAC shares that you own will ensure that if BAC takes an unexpected tumble below $10 per share, your profit will be guaranteed at the $10 per share level. If you think the economic outlook and BAC’s outlook are strong for the foreseeable future, there would be no immediate need to spend the money to protect your long position in BAC by buying $10 BAC put options; however, some traders use put options as insurance policies against unexpected bad news and moves lower in stocks and the stock market.

This article provides a basic explanation regarding how you can use options to protect a long stock position. Options can be used defensively to protect long stock positions, and are powerful tools that stock traders and investors can put to use to give themselves an advantage in the stock market.

Stay up to date on how to use options to protect a long stock position by getting on our FREE eMail list !

By clicking ‘Submit’, you agree to our Disclaimer and Privacy Policy. We are 100% Anti-Spam and will never share or sell your information!