How to Use Morningstar s Mutual Fund Screener Tool

Post on: 5 Август, 2015 No Comment

The Morningstar Users Guide is a series of articles discussing how to make the best use of the tools, research and analysis available at Morningstar.com .

T here are literally thousands of mutual funds out there. Finding the funds that are right for you often seems like searching for a needle in a haystack. Fortunately, Morningstar has a free tool that can helpMutual Fund Screener.

To find the screener, click on the Tools tab at the top of the home page on Morningstar, and then look for the screener section of tools. Youll note that some of the tools are part of Morningstars premium membership. Those tools provide additional functionality and is available for paid members only. I think youll find, however, that the free fund screener provides a lot of information.

Using the Mutual Fund Screener Tool

The search criteria that you can enter is divided into five categories: Fund Type, Cost and Purchase, Ratings and Risk, Returns and Portfolio. Under each category, youll find a number of options you can set to search for the type of mutual fund youre looking for. Youll also see a small, yellow light bulb next to each option. If you click on the light bulb, a window will open describing that option. For example, clicking on the light bulb next to the first option, Fund Group, produces the following description:

Fund Group

Are you looking for appreciation and dont need your investment for five years or more? Start your search with domestic- or international-stock funds. Otherwise, bond funds might be better for you. This first screen is the broadest, asking you to choose among five peer groups: domestic stock, balanced, international stock, taxable bond, and municipal bond.

With the basics out of the way, lets take a brief look at each of the five categories.

Fund Type

The Fund Type allows you to set up to three search criteria (you dont need to use them all). These criteria are the Fund Group, Morningstar Category, and Manager tenure. The Fund Group and Morningstar Category allow you to narrow you search by asset class. For example, you could search for U.S. large cap value funds by selecting the domestic stock Fund Group and the Large Value Morningstar category. Heres what it would look like:

The Manager tenure allows you to set the minimum number of years the funds manager as been at the helm. This is particularly important for actively managed funds, and I look for a manager to have been in place at least five years and preferably more.

Cost and Purchase

This section allows you to set three very critical search criteria: minimum required initial purchase, load or-no load, and expense ratio. The minimum required initial purchase is important if you are just starting out and have little money to invest at the start. The lowest initial investment amount in the search criteria is $500. With automatic monthly investments, many funds allow you to continue investing for just $50 or $100 per month.

The second option, called Load funds, allows you to determine whether your search will include funds that charge a sales commission. I allows set this to No-load funds only. With so many great no-load funds, why would you ever pay a commission? Finally, you can set the expense ratio criteria. I always seek funds that charge less than 1%, and try to keep my entire portfolio under 0.50%.

Ratings and Risk

The Morningstar rating system gets a lot of attention. You can bet that a 4 or 5-star fund will advertise its star rating. You can set the minimum star rating (from 1 to 5) if youd like. I dont own a fund with less than 3 stars, but not so much by design, and if a fund fell below 3-stars, I wouldnt run out and sell it. Here is Morningstars description of its star rating system:

Morningstar Rating for Funds

Morningstar rates mutual funds from one to five stars based on how well theyve performed (after adjusting for risk and accounting for all sales charges) in comparison to similar funds. Within each Morningstar Category, the top 10% of funds receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% receive one star. Funds are rated for up to three time periodsthree-, five-, and 10 yearsand these ratings are combined to produce an overall rating. Funds with less than three years of history are not rated. Ratings are objective, based entirely on a mathematical evaluation of past performance. Theyre a useful tool for identifying funds worthy of further research, but shouldnt be considered buy or sell recommendations.

As for risk, you can search by how risky the fund is relative to its peers. By risk, Morningstar means how much a funds returns fluctuate. A fund with a return range of -20 to 35% will be considered riskier than a fund in the same category with returns ranging from -10% to 25%. I rarely use this search criteria, but you my find it helpful.

As the name suggestion, the Returns option allows you to search funds by their past performance. This may come as a surprise, but I never use this search criteria. Sure, I look at a funds past performance before making a final selection, but sometimes poorly performing funds are the best investments. In other words, I take to heart the oft-repeated wisdom, past performance is no indication of future results. If you want to search by past performance, however, heres what it looks like:

Portfolio

The final category is called Portfolio, it allows you to set search criteria related to a stock and bond funds. Most of these are straight forward, but I do what to mention the first criteria, Turnover less than or equal to: Turnover refers to how much of a funds portfolio the manager buys and sells each year. A Turnover rate of 100% means that on average, the fund has bought and sold securities roughly equal to 100% of its investments per year. Why is this important? Well, a high turnover rate can create several problems: (1) it will increase transaction costs the fund charges you; (2) it may increase your tax liability if you hold the fund in a taxable account; and (3) it may suggest that the fund does not follow the buy-and-hold approach to investing (not necessarily a bad thing, but something you should be aware of).

Putting it all together

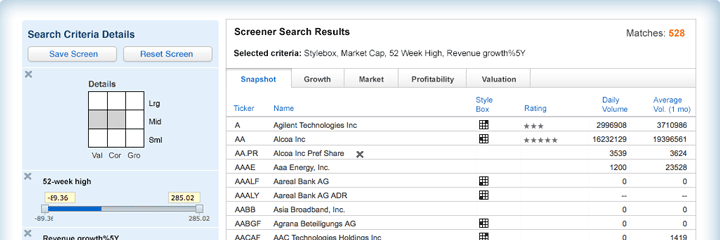

So how do we put all this together to find potential funds? Lets assume you are looking for a U.S. small cap value stock fund with a manager with at least five years at the helm, that is actively managed, is a no-load fund, is at least a 3-star fund, charges less than 1% in expenses, and has a turnover rate of less than 100%. Wow! Now thats a tall order. But if enter those search criteria in the fund screener as Ive described above, you actually get three fund options:

Try Morningstars fund screener tool for yourself to see what funds best meet your investing needs.