How to Use Andrews’ Pitchfork to Follow the Price Channels and Trends on Forex and Stock Markets

Post on: 15 Июнь, 2015 No Comment

The technical analysis space amidst the scope of forex market trade is wrought with innumerable options to track the market and deduce the multitude of trends that might be underway and governing the forex market movement. The patterns to follow, the trend that governs a trade and the final outcome they are all intrinsically linked to the basis of a strong and precise identification of the trading pattern and strategy based on one or more of these technical indicators. Some are very common while there are few that are rarely discussed like Andrews’ Pitchfork.

As the name clearly suggests, it is derived from the way the graph looks when plotted on the charts and also from its inventor, the famous educationist Dr Alan H Andrews. Traders generally use this tool to zero in on interesting and profit worthy trading opportunities as well as determining swing possibilities in the market. Not just in the short-term, even over the longer term, you can identify cycles and the impact on the spot activity as a direct fall out of that using Andrews’ Pitchfork charts. There are mainly two approaches to trading using these lines (bands). Either you can trade inline or outside the line.

Definition of Andrews’ Pitchfork

First and foremost is definition time. So, what do we understand by Andrews’ Pitchfork? Well, essentially it is an indicator used by technical analysts in forex or stock trading to identify support and resistance zones with the help of three parallel trend lines. These are created as a result of the placement of three distinct points after identification of clear cut trends. This is generally done with the help of placing these points in 3 subsequent peaks or 3 consecutive troughs. After the points are created, a straight line is drawn from the first point. This goes on to interest the middle points of the other two lines. This type of analysis is also known as ‘median line studies’.

Currently, this is available on many packages that include a collection of technical tools to analyze the market. However, what is unique about these median lines are that its utility and versatility is so obvious that both seasoned players, as well as newcomers in the forex trading space recognize the potential of this trading tool. The plotting of the key points is done in a way that would offer the user strong support and resistance points. The basic premise on which this analysis works is that the market price action is expected to shift towards the median line at least 80% of the time it is plotted. The rest 20% of time is accounted for by potential wild swings or a massive reversal in sentiment. This essentially means that the long-term trend may remain intact despite temporary blips. A new trend will be created once the shift in sentiment and price action is strong.

History & Initiation Of Andrews’ Pitchfork

This unique technical tool was developed by Dr Alan H. Andrews in 1960s. This is part of the series of the action/reaction technical analysis techniques that he devised for a clearer understanding and a more precise prediction of the forex market trends.

However, the credit for pitchfork is not Alan Andrews’ individual endeavor. He developed it under the guidance of Roger W. Babson with possible help from Andrews’ friend George Marechal.

Application Of Andrews’ Pitchfork

Now we come to the next important part, i.e. the actual application of this tool. First of all you will have to identify a high or low that has been hit earlier by the specific currency pair in question. So once you have chosen the pivot point on your chart; your next target is the peak and trough on the right of the chart. The points on the right of the pivot point essentially highlight correction in the trend from the previous high or low.

Thus after isolating these points, the pivot point serves as the median line (band), and the peak and the trough level give you the support as well as the resistance zone. After plotting the pitchfork, the trader can use multiple options in trading these. It can be either traded via the channels, or you could even choose to isolate these breakout points to the upper end or the lower end of the channel.

Another interesting option for traders is the initiation of positions is the support, or the resistance level is broken. As the price action gradually tries to return to the median zone, the windfall in the interim can be quickly capitalized by the trader.

There is a general rule for trading with the help of Andrews’ Pitchfork:

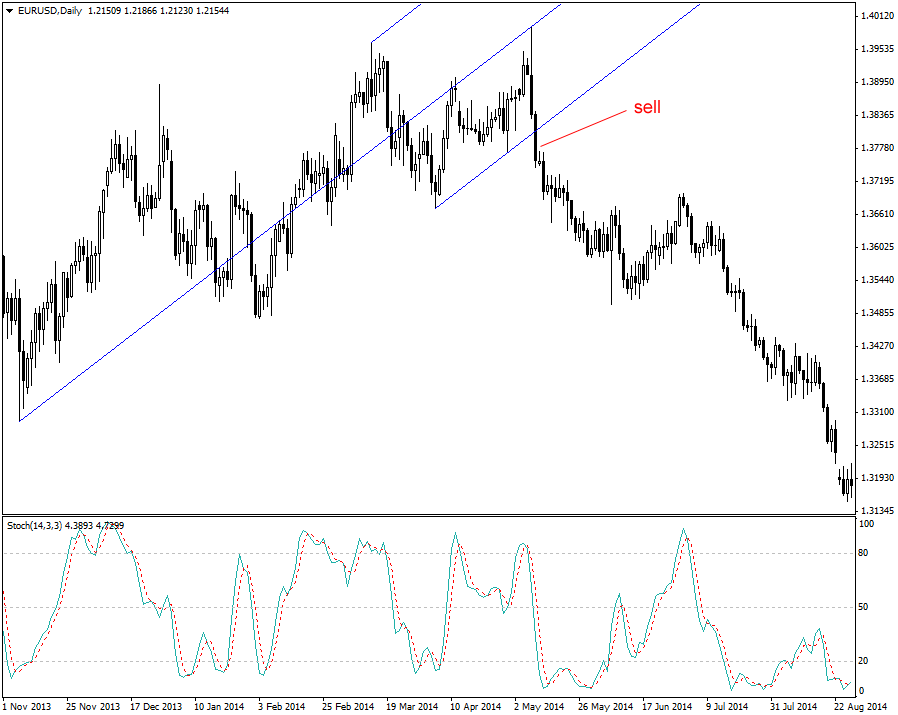

1. Do nothing when price is moving around the middle band .

2. Sell when price reaches the upper band.

3. Buy when price reaches the lower band.

4. On a downtrend, buy when price breaks above the upper band.

5. On an uptrend, sell when price breaks below lower band.

How to Trade within Lines Using Andrews’ Pitchfork?

Let’s assume you are tracking a specific currency pair, USD/CAD. After confirming the downside momentum in it with the help of some other technical tool like the Stochastic Oscillator, you decide to initiate an entry position in the counter. With the help of strong and monetarily prudent approach and appropriate stop losses in place, your trade can be executed at point where the price action is trying to shift back to the median zone and who knows you can actually get significant gains.

Sell Below Andrews Pitchfork Upper Band

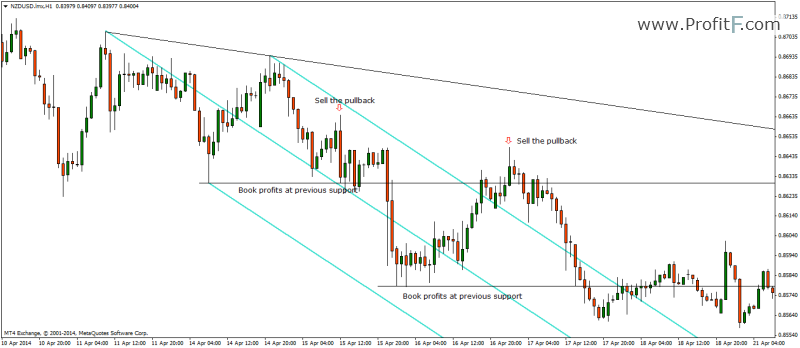

How to Trade Outside The Line?

Another option, though less frequently used is trading outside the lines. It can be used over an extended period albeit a slightly trickier way to tackle it is required. The assumption generally is that any potential break outside the lines could signal the beginning of a new trend. However, it helps to confirm the ongoing trend with another trend. This ensures that a catastrophic loss is prevented, and also potential false signals are avoided. For a better perspective, you can even isolate and zoom the area once the breakout is identified.

Initiating the trade and making an entry always acts as a crucial test. While playing for an upmove, for example, before anything first of all test the upper resistance level. This is to ensure that a downward spiral is not in the works to ruin your trading strategy. The price action breaking above the resistance line will confirm further upmove in prices and bear proof of additional buying interest. However strong this momentum might be, never forget to put your stop losses in place.

The General Analysis Trend

Major currency pairs like the EUR/USD or the GB/USD can be analyses a lot more precisely using this specific tool. They yield a far better result basically due the nature of their trade which is more trending than ranged. Trading in cross currencies is significantly more choppy, and the results and analysis using Andrews’ Pitchfork tend to be less satisfying because of this.

Identification of the trend patterns and confirmation of the broad patterns continues to be crucial. You have to ensure that price action has indeed broken through the median point. Another interesting element in this analysis is the formation of the ‘an evening star’. Essentially this pattern is a confirmation of an impending massive sell off in the forex market. This is a unique formation and an indicator of a distinct trend in itself. Not just a downside but a major nosedive in prices can’t be better predicted than the evening star and its significantly large impact on the overall trend formation.

Breaking Below the Lower Band (Sell Signal)

Advantages Of Using Andrews’ Pitchfork

Now of course we reach that crucial point about the key advantages of using this technical tool for analysis of forex market movement and how it can help you maximize your profit outlook. The various tools used for analyzing trade technically have a personality of their own, a unique essence and feel to it.

They carry with them a distinct mark of their creator’s interest, bias and individual genius which after all inspired them to propound their individual analysis armory. In that aspect, Andrews’ Pitchfork is known for its simplicity and ease of use.

1. A Simple Approach:

At the very behest what sets thing in motion for this technical analysis tool is the simplicity in its approach and methodology. With just three lines plotted on the graph, the identification of resistance and support areas becomes quite simplistic and easily recognizable. The other benefit is that the trader does not have to do any complicated calculation to reach an analysis; the pattern is broadly manifested in the chart.

2. Ease Of Use:

The simple approach thus makes use of this chart quite convenient for both seasoned forex market players as well as fairly novice participants who are just about learning the ropes of trade and taking baby steps in the realms of complicated technical analysis. Also, the basic visual representation improves its appeal significantly compared to many methods that entail complicated mathematical calculation. The widespread adaptability of this particular technical tool is another factor contributing to its overall popularity in the world of technical analysis. The resistance and support zones are easily identifiable using the three lines that make the pitchfork.

3. High degree of accuracy:

This perhaps is the best feature of this technical tool. The degree of accuracy is generally at par with most other effective technical analysis methods used across the forex industry. The precision level easily tops 60% that forms the benchmark for the most effective technical tools to analyze the market and predict a trend. Not only does it limit the prospect of falling for an unfavorable trade, but also helps you in identifying potential gorges in the overall trading scenario. Accuracy as I mentioned earlier is often interlinked with the efficiency of the trader using it. Coupled with the right means it is one of your surest ways to pinpoint a trend in the forex market as it is unfolding and at the same time with the help of the support and resistance zones, it gives you the opportunity to enter or exit your trade in a way that best preserves your profit.

4. Different Trends, Same Graph:

That perhaps leads us to its absolute unique element. It is one of those rare chart formations where the same set of lines can be used to analyze a variety of trends that together work towards making a certain pattern. Basically one part of the pattern can help you unveil the trade that might be underway in the other part. For example based on how the first bullish pattern unfolds, you can easily understand the intricate pattern that signals the outbreak of the second bullish pattern.

Disadvantages Of Using Andrews’ Pitchfork In Forex Trade

However like every other coin, this also has a not so favorable aspect. This kind of technical analysis is best suited for one-off trades. The success levels start faltering in case of bulk trades where multiple trading combinations might be operational. The bulk situation sometimes opens up the possibility of a false signal emanating as a result of the multiple trends that might be operational at any given instant.

Not only can this kind of situation set you back with significant losses but also it can be instrumental in initiating a major sell off or a bubble like euphoria on the basis of the wrong signals emanating due to these multiple value inputs.

Another major disadvantage I would say is the fact that this tool is too fragile to be used on a standalone basis. While it has a relatively high degree of precision and accuracy rate, the prospect of a false signal always makes it important to cross verify a trend or a breakout. Whatever the chats might be suggesting, confirmation of the trend is crucial, and confirmation has to be on the basis of an alternate tool. So it cannot be used in isolation. It is in soccer language a huge team asset that is rarely used for individual glory.

As we draw towards the end of this discussion on the uniqueness and usability of Andrews’ Pitchfork, I would like to add that this is one technical tool that can help a currency trader unveil a wide collection of profitable opportunities both in the short-term as well as over the longer term. Longer market swings and capitalizing on their potential implications over an extended period.

However, accurate application of pitchfork goes hand in hand with some strategic and important forex market trade practices aimed at bringing in an element of discipline in your trading endeavors.

- Look for confirmation of the trend using an alternate technical tool that is equipped to manifest the same.

- Sound money management forms the hallmark of any successful trade and trend confirmation is almost the first step I that direction.

- On any given time period that your trading graph might be charted, you will surely have a few sudden spike ups or sharp nosedives or a combination of both. It is best to weed out these abnormalities to get a more balanced and stable analysis.

With all these parameters in place, a pitchfork allows its traders to books a significantly higher profit figure that is sustained over a significantly longer duration of time.

Don’t Miss Our New Articles!

Be the first who receives our most recent articles:

Learn more: