How to Trade with Kase BarsNetPicks

Post on: 16 Март, 2015 No Comment

Posted on Thursday, March 22nd, 2012 at 12:00 pm.

What Are Kase Bars?

If you know NetPicks, you know we are always looking for ways to improve your (and our) trading. We like cutting-edge charting and tools that can give us a read on the market. That is one reason we use Renko and Range bars in our swing trading and even day trading. We have many customers and we encourage everyone to share their ideas and experiences so that we can share with others. This is what leads me to our discussion today…

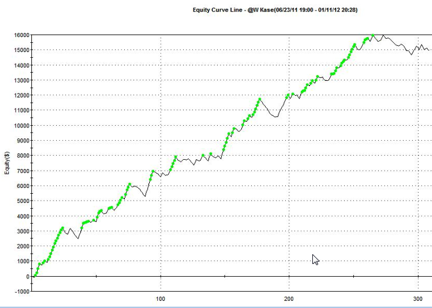

In December we released our latest Seven Summits Trader Automation and Strategy Back-Test software. Those SST Pro members could take their ideas and run some tradeplan tests. That is exactly what inspired Benjamin Gerard Sanchez. He took an idea on Wheat and tested it with Kase Bars. It had fantastic results, which we will share in this article.

But first, we need to educate you on Kase Bars and how they differ from Range bars. Basically, Kase Bars are very similar to Range bars, except they have a true range that is based only upon real price data. It takes into account gaps between the bar close and the current high or low of the bar. So, not all bars will be equal.

The True Range is Equal to the Maximum of the:

- High minus the low

- High minus the previous close

- Previous Close minus the low

One of the Benefits of a true range bar is that you can see breakaways, measuring or midpoint or exhaustion gaps, and other candlestick formations like island reversals. If you are running automation or strategies you will have greater reliability and accuracy since the orders generated come from actual price action and orders that actually happened in the markets.

Also, since you are charting True Range, you can use an ATR (Average True Range) on a regular time based chart and determine the best True Range or Kase bar value to use. So, think of it like this, if you know a good ATR of a market, you now know the very best Kase bar to trade off of and get the best picture of market for trading.

Take a look at these pictures of the TF on a Kase Bar .6 True Range and a .6 Range bar chart. Notice that some of the bars are longer or shorter than each other on the Kase bar. That is because it takes real price action and does not fill gaps. So, there is less volatility in the charting and therefore smoother charts.

There is no chop zone up/down in the middle of the chart above like the one below. Instead you see a smoother chart and it picked up the overbought market that the Range bar chart missed… giving a double win!

How to Use Kase Bars: Wheat Trade Plan

Here is Benjamin’s Research and Plan (we all owe him at heart felt thanks and appreciation for sharing this with others)…

Here is a Wheat Kase Bar trade plan. If you are not familiar with Kase bars, they are very similar to range except they print with a tick difference from close to open. They tend to stay with the trend more and not get knocked around in chop as much, and they definitely take some getting used to as to their cadence. This is a very simple plan that calls for a max 1 loss per day or 1 winner as long as it totals 8 ticks or more otherwise it will take another trade until it reaches its tick goal or gets stopped. It has 3 targets, 2 money management and a fixed target, no trailers. Here are the results.

Now for the Strategy Performance Report that was done with our Auto Trade Back Testing Software. It can help you test new ideas or maybe even a slightly different Kase size (the sky’s the limit!).