How To Trade Volatility Using The VIX Index

Post on: 3 Июнь, 2015 No Comment

Learning how to trade volatility is an extremely important aspect of options trading. Trading volatility can be very complex, but it is very easy to obtain a basic understanding and that is all most traders will ever need. I put together a reference guide on how to trade volatility if you want to check it out. Today, I want to talk about how you can use volatility, and specifically the VIX index, as a trading tool to help you make decisions on position sizing as well as entry and exit rules.

Position sizing and money management are some of the hardest things for traders to handle. Some people think that once you have your trading plan detailing you entry and exit rules youre set, but thats not the case. Money management is one of the most crucial aspects of successful trading. So, what does volatility have to do with money management?

1. Each option strategy will be either positive or negative Vega. Having a combination of positive and negative Vega trades can help lower your overall volatility risk.

2. You can set entry and exit rules based on volatility levels

3. You can create position sizing rules based on volatility levels

My primary trading strategies are Iron Condors. Bull Put Spreads and Bear Call Spreads which are all net short volatility trades. In order to hedge some of my Vega risk, I like to use some long volatility trades such as Calendar Spreads and Diagonal Spreads .

You can also use volatility as a trading entry signal. On my Iron Condor trading plan, I have 5 entry guidelines. One of these is to enter the positions on a down day (when volatility has spiked) as this will allow me to either a) bring in more premium or b) move my strikes further away from the market.

<< Click Here To Download a Copy of My Iron Condor Trading Plan >>

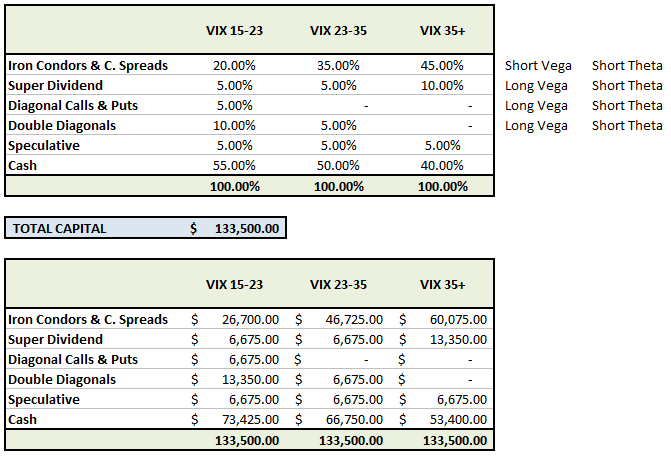

Also on my trading plan I include position sizing rules based on where volatility (as measured by the VIX Index) is trading. Below is an example of how you could structure your portfolio based on implied volatility levels. You can see that when the VIX is high, you allocate more capital to short vega strategies. I also discuss this concept in the video below.

I hope you enjoyed this article, if you have any questions, please email me at info@optionstradingiq.com .

Here’s to your ultimate success!