How To Trade Eurodollar Futures

Post on: 5 Июнь, 2015 No Comment

The socialist governments of Europe are now facing a major banking crisis, which can result in volatility of Eurodollar futures. This volatility can create opportunities for ambitious traders if they can tolerate the risk inherent in such price fluctuations.

What Are Eurodollar Futures?

Eurodollars are U.S. dollar denominated time deposits that are held outside of the United States. Eurodollar Futures prices are based on the London InterBank Overnight Rate (LIBOR), which is an interest rate benchmark for Europe that is comparable to the US Treasury Bond rate for an equivalent time period.

As they are offshore, Eurodollars are not under Federal reserve jurisdiction, and thus command higher margins.

Importance Of Eurodollar Futures

The post World War II strength of the US market and its economy is the major reason for why the US Dollar became the world’s currency of choice for international commodities settlements and other types of transactions. The Eurodollar came into existence as more US dollars began migrating to offshore financial institutions as currency reserves.

Originally, the primary overseas banks were in Europe, hence the term “Eurodollar” was coined. However, as international commerce has extended to the rest of the world, any non US held deposits that are US dollar denominated are categorized as Eurodollars.

Using Eurodollar Futures For Foreign Currency Hedging

Eurodollar deposits help to hedge currency fluctuation risk for foreign businesses that export to the US and are often used as loans. In the past decade, it is estimated that close to 90% of all international loans are via Eurodollars, making them the largest source of finance on the planet.

Trading Eurodollar Futures Contracts In Futures Markets

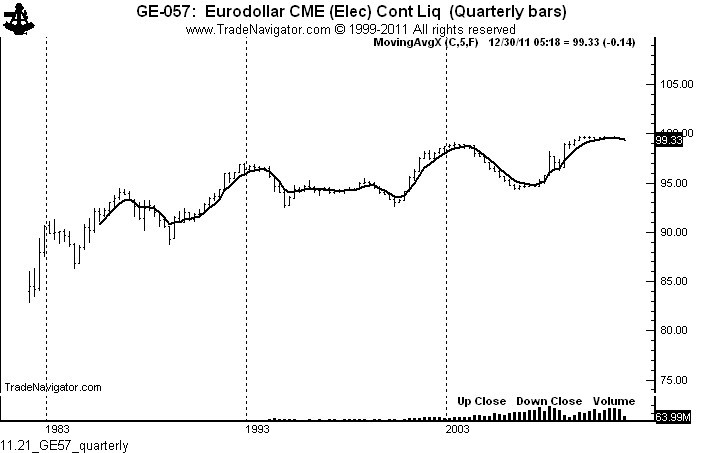

Eurodollar futures are options derivative contracts that trade on Chicago Mercantile Exchange (CME). The face value of a contract is US$1,000,000 and the price fluctuation is pegged to the 3 month LIBOR interest rate at settlement date, which is subtracted from par value. For example, a LIBOR quote of 4.00% would equate to par (100.00) 4.00, or a price of 96.00.

Trading increments are in half basis points (0.005%, or $12.50) and narrows to quarter basis points (0.0025%, or $6.25) in expiration months. As the interest benchmark is the 3 month LIBOR rate, expirations are listed quarterly (March, June, September, December) going out forward to ten years, as well as serially (January, February, April, May).

Daily Eurodollar Prices (CME)

Futures Trading Strategies How To Trade Eurodollar Futures

Eurodollars are routinely used for interest rate arbitrage strategies, spreads, sweeps, and swaps. Given the current banking liquidity crisis in Europe, the sovereign debt default of Greece, the pending S&P rating downgrades for the other PIIGS members (Portugal, Italy, Ireland and Spain), interest rates for European sovereign debt are soaring.

As a result, shorter term Eurodollars will likely reflect this short term weakness. A watchful trader might consider, for example, shorting near term Eurodollars and buying longer term Eurodollars in a calendar spread strategy to take advantage of the current European banking confidence crisis.

Other tactics could involve arbitrage swaps between different points along the 10 year yield curve to offset currency risk fluctuations or for creating synthetic loans or synthetic debt instruments by using the LIBOR fluctuation between as the profit spread during the time window, although it would be realized at the end of term rather than up front.

There are certainly other strategies that could be deployed in accordance with one’s corresponding risk appetite. The futures market for Eurodollar futures is a hugely liquid one, so traders need not fear of not finding a counterparty for any position chosen, long or short.