How to Read Your Form 1099B

Post on: 3 Июнь, 2015 No Comment

Instructions

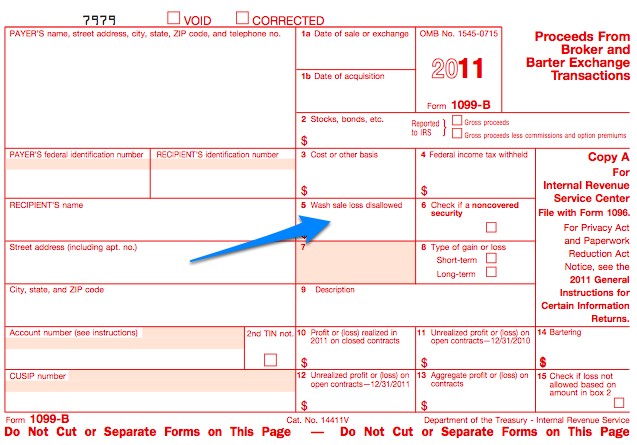

Box 1a of the form 1099-B shows the trade date of the transaction. If multiple transactions occurred, then no date is shown. For example, if you take a systematic withdrawal from a mutual fund, then no date is shown.

Box 2 can be considered the main box on the form. This box shows the aggregate proceeds of all sales that you made with the issuer of the form. For example, a brokerage firm that you trade with sends you a 1099-B that shows the aggregate proceeds of all of your investment sales for the year.

Resources

More Like This

How to Read Your Form 1099-DIV

What Is the Maximum Deduction I Can Claim on a 1099 Misc. for Food?

You May Also Like

IRS Form 1099-B is sent to those taxpayers who received proceeds from broker and barter exchange transactions. This article is written from.

If you sold securities and profited from the sale in a given tax year, you are required to report the income on.

Tax forms created by the Internal Revenue Service (IRS) include a number of 1099 forms for reporting various types of income not.

Form 1099-B is a form the Internal Revenue Service provides for the reporting of brokered transactions. Any sales of stocks, bonds, futures.

IRS Form 1099-B is an information return filed with the IRS at the end of each year. You will also provide a.

Form 1099-B is the Internal Revenue Service form used for the reporting of brokered transactions. Form 1099-B must be reported on Form.

Job compensation often includes more than just a salary; it is increasingly common for businesses to offer their employees stock options. If.

The Internal Revenue Service considers failure to report income on your federal tax return an error punishable with a fine. Form 1099-B.

Use the instructions on the form to see which lines to fill out once you get your total for Line 5. 4.

Form 1099 B Instructions; How to Report Commodity Trader Income on a Tax Return; How to Report K-1 Information on a U.S.

A 1099-B reports proceeds from broker and barter exchange transactions, which include sales or redemptions of securities or commodities. 1099-DIV.

Many people are not aware that the benefits derived from barter transactions are taxable and must be reported to the Internal Revenue.

There are 17 different forms which have the 1099 prefix. Of these, the most common is 1099-MISC, which covers a range of.

Successful investments may add thousands of dollars to your bottom line each year. As part of the wealth creation process, however, you.

Forms 1099-B, Proceeds from Broker and Barter Exchange Transactions, and 1099-S, Proceeds from Real Estate Transactions, are due to recipients on February.