How to read any Balance Sheet

Post on: 4 Май, 2015 No Comment

How to read any Balance Sheet

As a follow-up to my popular post How to read any P&L. I will elaborate a bit on how to interpret a Balance Sheet and its main components. Only after truly understanding a Balance Sheet, you can make your way to building financial models or drawing up a cash flow statement .

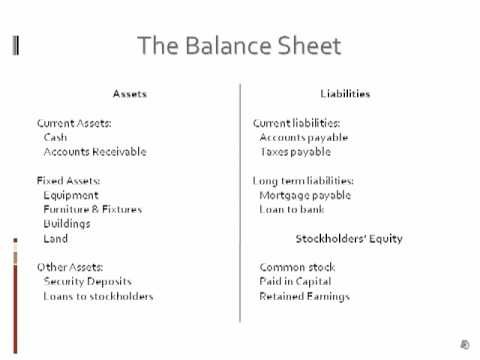

Every Balance Sheet in the world has 3 parts: assets, equity and liabilities. Assets are what the company owns, liabilities are what the company owes. Equity is what is left for the stockholders if all assets are sold and all debts are paid. In other words, liabilities list the sources of the money, assets show the application thereof. Every source has its application. That is why assets and equity+liabilities must always, at every day in the year, be equal. If I would apply this on an individual buying an iPod with his credit card: the iPod is the asset, the credit card is the liability.

There is a predefined methodology in which a Balance Sheet is written down: Assets are listed starting by what is most easily converted to money and then down. Liabilities fall roughly apart in loans and other future obligations. Equity is the balance of that: an owner may have put in 1 MUSD (=stocks), together with the accumulated retained earnings this may be well less (or more).

Have a look at a Balance Sheet from a company I work with:

Logically, we start with the most liquid of assets anyone can have: cash itself. That often falls apart in petty cash (literally bank notes in a lunch box with the secretary), bank accounts, and very-easily-convertible notes, like checks.

Accounts Receivables (A/R). often a big chunk of money. Wait no cash yet! A/R is the sum of all the invoices the company has sent out to customers, but have remained unpaid. An increase in A/R may seem like a good thing, but this is no cash until the invoice has been collected. Unless you have employees who like to get paid in A/R, this is an item that need to be kept at a minimum at all time. A change in A/R will influence the cash flow statement. Later we will see how the companys efficiency in this is gauged using DSO calculation.

Inventory. very close to A/R. Definitely a good application of the means..but as long as goods are bought and kept in inventory, they are not out there being sold to customers. Similarly, a change in inventory will need to be reflected in the cash statement. Similarly, inventory should not be kept to high. Money put in this is money that can not be applied somewhere else.

Goodwill. is the monetized surplus that has been paid to take over a business. It can be depreciated as if it were a companys phone book that has been bought over.

Buildings & Equipment. if a company still owns its own buildings, equipment and machines, this will represent the bulk of the assets. Usually very slow moving, so at the bottom of the list. Because this is such a big chunk, companies will move easily to options that dont require that much cash. See here why it makes sense to lease.

On the other side, we see both Equity and Liabilities.

Equity consists of two things: the sum of the values of all stockholders. So if a company has 1 Mio stock on the stock exchange, and stock is quoted at 30$, well the equity will be 30 MUSD. In a small business, then money that the owner brought in to start up will be put here. The second part will be the reserves, these are typically the retained earnings. The net income from the P&L, if not paid out, is added back to the company as retained earnings.

Liabilities are the other big source of money. Loans, both short term (< 1 year) and long term (> 1 year) are obvious.

Accounts Payable: are a part of liabilities, why? Whenever a company does not pay the invoices it gets immediately, that supplier actually gives a credit. If the electricity company sends a bill, to be paid in 60 days, it gives credit just like a bank. So it is a source of financing to the company.

Provisions: liability of uncertain timing and uncertain amount When a company has a current obligation (typically warranty on goods sold), it has to recognise it here.

Couple of notes:

- See the date on the sheet? A Balance Sheet does not necessarily have to be done at the end of the year it is there, a living thing, every second of the companys existence

- The totals do not mean much. Ok, it is nice to say the assets grow year over year, but that does not mean much for the companys welfare. In fact, some of the worlds most successful companies have tiny assets.

- What counts is that Assets and Liabilities match. Hence the name balance sheet. In between months, the result from a P&L is not allocated to owners or so. Then it is put in the sum of the liabilities.

- Typically, the depreciation will be booked separately of the initial investment value of the asset. Depreciation is sometimes in misalignment with the true market value of an asset, so its handy to keep an eye on both amounts.

- Often youll see assets and liabilities in one long list, liabilities having a minus sign.

I hope this all make sense to you. Let me know you have any questions, and if you liked it please share!