How to Profit from Employee Stock Options Regardless of Share Performance

Post on: 15 Апрель, 2015 No Comment

by Darwin on March 24, 2009

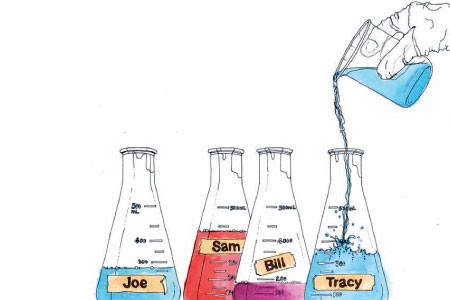

For workers fortunate enough to be granted employee stock options each year as part of their compensation package, of late, this has been a bittersweet perk. While its nice to have an opportunity to enjoy a leveraged return and share in the success of your companys share price, the vast majority of employees have seen their options either languish in out of the money territory or expire worthless during the past several years. Well, there is a way to make money on these employee stock option grants regardless of what happens to the company share price.

Employee Stock Options Explained

As part of a compensation package meant to reward employees for making moves that benefit the companys share price, rather than silo thinking, many companies offer employees an option grant as part of their annual compensation (or more often as it merits). On a given day, if a stock is trading at $100 per share and an employee is granted 500 shares, what that means is that the employee can now profit on any movement above $100 at a rate of $500 for every $1 that the share price moves. If you consider that the long-run return of US equities is around 9%, if your companys stock miraculously performed at exactly a 9% return per year, that grant would be worth $4,500 at the end of the first year, over $9,000 at the end of the second and so on, until the grant is exercised.

Some companies allow up to 10 years until a grant must be exercised. In the example above, at 9% per year, an employee would be looking at $68,000 for just that one years grant. If rolling over each years grant 10 years out, hows a $70,000 bonus sound? Not bad right? Well, thats not how its been panning out for many employees each year in a down/sideways market. If the share price drops from $100 to say, $90 at the end of the 10th year, nothing.

How to Lock in Profits on Employee Stock Option Grants Regardless of Share Price Performance

Similar to the example above, lets say youre an Apple employee. As of the date of this post, Apple shares closed at $107 per share. Lets say that similarly, you were awarded a stock option grant of 500 shares this year. These options vest immediately and are good for 5 years. If you go back a year, Apple was trading at $140, so you may be questioning why you continue to hold options each year when you may want be assured that youll get at least something each year for your grant. In order to do this, you can sell call options against your underlying option grant on a 1:1 basis (or less if you want to be conservative in your approach and/or retain the ability to enjoy a payday if shares run up to $200 again).

If you wanted to be able to capture some of the upside, but ensure some immediate income as well, you could do the following:

- Recieve option grant for control of 500 shares at $107 strike immediate vesting

- Sell 500 call options with Jan 2011 expiry at the $130 strike for $1983 each (contract controls 100 shares)

- This will net you an immediate $9915

- The $130 strike also allows you to participate in some decent upside before the sold calls hit at $130 (130-107)=23×500 share control = $11,500

To recap,

- If shares in Jan 2011 do nothing and stay at $107 or end lower, instead of having nothing to show for it, youd have the $9915 in initial option premium and you could re-execute the whole strategy again for say, Jan 2013 strike.

- If shares move up marginally and close at something above $107 but less than $130, you get the $9915 + 500xdifference in share price for a max of $9915+$11,500 = $21,415

- If shares rocket past $130 at the time of expiry, your max gain here would be the $21,415, while if you did nothing, they may have been wor th much more (unlimited upside thats the tradeoff!).

- Note, you CAN react to a rapid upside move to prevent your sold calls from being called on you prematurely. You could always buy back the $130s and sell something higher, like say, $150s to replace the cash outlay your just utilized. In the end, youll still end up ahead as long as this isnt a weekly occurrence. As this is a rather complex and unlikely scenario, perhaps understand the concept and potential, but in order to avoid altogether, just sell calls further out of the money, like say, $150 if thats a serious concern of yours.

How Do I Sell Call Options?

First, you need an online broker. Open an account at TradeKing. for the lowest-cost options at SmartMoneys#1 rated discount broker. You wont need complex trading platforms and customer service that come at a higher price with E*Trade or Ameritrade. Now, in this case, because your online broker wont just take your word for it that you have an options grant in another account from your employer, youll need to have a margin account with the ability to sell shares short. Generally, upon signing up for an account, you would need to sign a form stating that you understand the risks of options trading and selling short. Its easy enough to find the form in your account settings or email customer service and theyll send it to you. You would also need to have some collateral in your account. If youre not a trader, you could actually just leave some cash in the trading account money market, open a CD or leave it parked in some other equity with little volatility.

Remember, if the vesting period is say, 1 year minimum (meaning that during the 1st year, no matter what happens to Apples share price, you cant exercise those options), ensure that you sell a call with an expiry AFTER your options vested so you DO have that collateral to exercise at your disposal. So, if you were granted options on Jan 1, 2009, the earliest call options you should sell would be Jan 2010 strike.

This is an exercise in Tradeoffs. You can trade immediate guaranteed cash but forgo a payday later if your companys stock rallies. Conversely, if you choose to let it ride, you may end up with nothing to show for your hard-earned stock option grants.

To Stay Up to Date with other Financial Models and Ideas, make sure to Subscribe via RSS (what is RSS? ).

*Note If youre considering employing this method, consider that a) you may be leaving some upside on the table if shares move upward quickly; b) you may have your short calls called on you if you cant yet exercise your underlying grant while shares run up; c) if you dont fully understand all the scenarios that may manifest themselves, you should seek professional advice prior to attempting this.