How to Invest in Emerging Markets_3

Post on: 16 Март, 2015 No Comment

Error.

Updated Sept. 20, 2010 12:01 a.m. ET

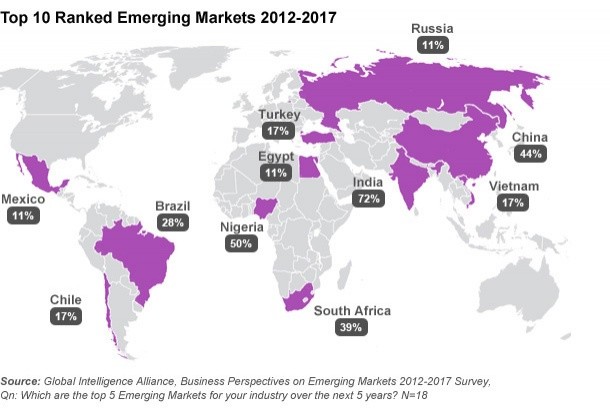

AS JEFF APPLEGATE SEES IT, the case for investing in emerging markets could scarcely be stronger. Big developing countries like China, India and Brazil, along with often overlooked but strong ones like Chile, will probably generate 70% of the growth in global domestic product this year, says Applegate, the chief investment officer at Morgan Stanley Smith Barney. Investing in emerging markets he adds, is like having a call option on that growth, and that’s why we’ve been almost chronically overweight emerging markets in recommendations for asset allocation.

Trouble is, not all the firm’s affluent clients share the enthusiasm. There is a subset of people who recall the emerging markets crises of the late 90s—the Russian government defaulting on debt, and Asia’s currency and markets collapsing— and they are skeptical, says Brian Pfeifler, a managing director who works directly with some of the firm’s ultra-high net worth individuals and families. Some of our clients tell me they agree they might get a higher return, but they don’t care. They have $100 million right now, and they don’t want to go back to having only $20 million. And that’s the risk they see in emerging markets.

Tension about just how actively to invest in the emerging markets—and by what means—is evident throughout the wealth management industry. Wall Street firms, banks and specialized investment firms have been sharply boosting their recommended allocations to these markets—in some cases doubling them from last year. But many clients are resisting, fearful of exposing the family fortune to excessive risk. They worry about political instability in developing nations, lack of financial disclosure by overseas companies and notoriously volatile markets.

Top Wealth Managers

Here is Barron’s listing of the top wealth-management businesses in the U.S. based on assets under management in accounts of $5 million or more as of June 30. All of the top 10 from last year’s survey remained in the group this year, though there was some reshuffling. N/A means data not available. (Click here .)

How these conversations play out could carry big implications for both the performance of families’ portfolios and the growth of the top wealth management outfits. The top 40 firms, which Barron’s ranks in the list below, look like they could use a little more growth. As of June 30, the group’s total assets under management were up only 6% from those of the top 40 a year earlier—half the gain of the broad stock market. Bank of America held on to the No. 1 spot, with $655 billion under management in accounts of $5 million or more. Morgan Stanley Smith Barney held on to No. 2 with assets of $536 billion in such accounts.

Playing the emerging markets right this year could make the difference between a mediocre year and a good one for both investors and their advisors. It will all come down to settling on the right allocation and then the right investment vehicles—ETFs, foreign securities, shares of U.S. companies with overseas operations, or other instruments. None of those decisions is easy, especially if you’re feeling wary of these markets.

IT’S NOT AS IF THE RICH don’t have good reason to be more cautious than others when it comes to investing in emerging markets, or following any other relatively new investment strategy. In many cases these families are aiming to pass their money along, intact, to the next generation and possibly several generations more. Conservatism comes naturally when that is the goal. What’s more, it’s no secret that Wall Street has had its share of bad ideas in recent years; maybe investing in emerging markets is just the latest.

But fans of emerging markets maintain that not moving into emerging markets is what would be imprudent. Says Chris Hyzy, chief investment officer at the U.S. Trust division of Bank of America Merrill Lynch: I would argue that the younger generations who will receive this money ultimately are going to need to grow that wealth, so passing up the opportunity is something that shouldn’t be done without talking to the whole family about the issues, the way the world is transitioning and how the portfolio should reflect that, he says.

He suggests that wealthy families allocate at least 20% of the assets in their portfolios to emerging markets, and possibly as much as 35%. That’s unquestionably at the high end of what wealth managers are recommending. But most are telling clients to get to at least 10% or 15%, up from a norm of closer to 5% several years ago.

For many private bankers, the key to convincing conservative investors to build positions in emerging markets is to show that a long-term structural change is under way in the world economy. In the second decade of the 21st century, investing in emerging markets is more than just a bet on the regions’ turbo-charged economic growth. Rather, it’s a way of offsetting excessive exposure to U.S. markets that appear trapped in a trading range; a home economy that, at best, may grow a few percentage points a year; and a domestic currency that seems