How to Invest at Lending Club

Post on: 30 Март, 2015 No Comment

I recently had a reader email with a follow-up question regarding p2p lending at Lending Club . He essentially wanted to know how to invest at Lending Club .

Here’s the question:

Could you explain to me how lending club works as an investor? What type of initial investment is needed? Do you fund individuals or across the board?

I thought the question would be good to address in this post.

Always remember this one fundamental rule with any type of investing don’t invest in something you don’t understand . This post should help you understand how to invest with Lending Club.

How to Invest At Lending Club

Once you have opened an account you’ll be able to start investing right away because you’ll get $25 to start investing right away . Investments require a $25 dollar minimum investment. In fact, it is a good idea to diversity your investments by buying several $25 notes instead of investing a lump sum into one loan.

Lending Club allows you to shop amongst hundreds of loans and personally select where you want to invest your money. As such, you are now responsible to do the work that any lender would typically do. You need to evaluate how likely it is that the person you lend money to will repay you. If you do it well you’ll get a higher rate of return. If you lend to the wrong people you’ll find it had to even keep the money you lent to people.

Fortunately, there are helpful tools to help you along the way.

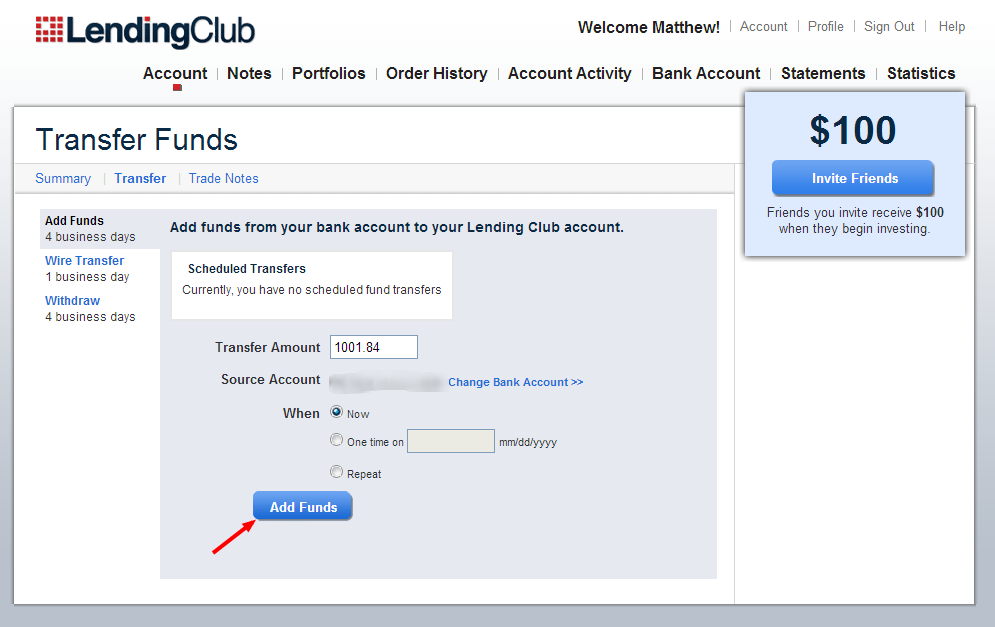

How to Invest Your First Lending Club Dollars

When you start investing youll have access to a lot of information that will allow you to choose the right investment. All the search options are shown below. In my opinion, the most important factors to look for are term, debt to income ratio, interest rate, and credit score.

If you prefer, you can start with a more standardized approach. Basically, you choose your targeted interest rate, and Lending Club identifies outstanding loans that will help you meet that portfolio goal.

However, you might prefer to look for loans that match your specific criteria.

As you can tell from the image on the left, you can ask to show notes that fit with your specific criteria. In this case, I’m willing to look for notes lodged under any category. However, I want people only with a good credit score, so I’ve selected 714+ only. I’m not picky about the term so that remains. Still, I’d like a lender with no more than a 15% debt-to-income ration.

Here’s a very important rule. Higher returns only come as the result of an increased exposure to risk. The lower the interest rate, the lower the risk.

After I narrow down my criteria, I’m shown the details for a person who is looking for a loan for a home improvement project. The person has a “B” Rating (A is the highest). The interest rate on the loan $19,000 is 10.75% for 60 months and it is 94% funded.

But, I still want more details. Which is good. I click on the borrower’s request and I now have access to:

The person’s gross monthly income, the loan repayment amount, current employer, debt-to-income ratio, length of employment, credit score range, open credit lines, revolving credit balances, delinquencies in the last two years, and more. In addition, I could ask the borrower a question if I thought that would influence my decision.

Necessary Precautions When Lending at Lending Club

You will find people who have had bad investing experiences with Lending Club. You will find people who have bad investing experiences with everything. I know people who started investing and bought a stock and that stock when south. They’ve never touched stocks again. The problem is not the stock, but the carelessness with which those people approached investing.

Like any investment there are risks involved.

What you need to do is to minimize the risks.

- Diversity – When you can invest only $25 per note, you can easily diversify a portfolio of several hundred dollars. Spread it out amongst several different loans.

- Do proper research.

- Limit these investments to 5-10% of your total investment.

Do I Recommend Lending Club?

Personally, I’ve only used it for entertainment purposes . I don’t have any retirement funds invested in any people 2 people lending. I do have a green light (as agreed by my wife and I) to use 10% of our retirement savings for me to ‘play’ with. If I didn’t have that money invested in other things, I might consider doing more lending.

My wife doesn’t feel comfortable with it because she’s a more conservative investor. So here’s how I approach it.

Let’s say that if I use Lending Club I can get a 10% rate of return on $500. That means I get $50 in returns at the end of the year. Otherwise, I could invest at 5% in a Term Deposit and get $25. Would I pay $25 so my wife could feel stress? Would I buy stress? No. So I don’t do much with it, though I like the idea and think it has some good possibilities.

Still, it is a creative way to increase your investment returns as long as you are a disciplined investor and properly understand the risks.

Affiliate Disclosure. I am a Lending Club affiliate. That means I get a referral payment if someone uses my link to sign up. I’ve done my best to give you 100% genuine thoughts.

If you would like to learn more or start investing, click here .

What are your experiences? Yes, I want to hear the good, the bad, and the ugly. Do you have any tips for people who want to start to invest at Lending Club?

Comments

Charles says

Darren says

Ive only invested a small amount, but Ive been happy thus far with my results. Like you said, the lower the return, the lower the risk. Thus far, Ive only invested in A grade loans. But as I get more experience with them, Ill branch out into higher risk/return loans.

My advice would be to just start investing. If you sign up through your link, theyll get $25 for free to try as long as they meet some requirements.

Peter says

Ive got about $1500 in there so far, and Im making close to 9.5% interest. Ive also had zero defaults thus far although a couple of loans have strayed into the late payment period. I think the key is to be careful about which loans you sign up for, and to have a process in place for which types of loans youll accept (how much, for what, borrower key indicators, etc). I started out slow with Lending Club, but since then Ive picked up a bit of steam just because Ive been so happy with my results so far.

Kendall McCormack says

Craig, I invested 20K with Lending Club in April of this year. Im retired and moved money over from a 401K. I only invest in 36-month notes in the B, C-3,4,5 and D-1 level. I also set the filter to select Consolidate Debt notes (only), 0 delinquencies in the past two years, own or mortgage (home ownership), DTI 20% or lower, and income of 4K or higher. I look at each note separately to determine where the borrowers live, where they work, length of employment, their revolving credit balance, and no public record indications. Because of the notes filtration and my personal considerations/rejections, It took almost two months @ $25/note to complete the investment (800 notes). So far, Ive reinvested $675 along the way (principal & interest). I plan to re-invest until the end of this year and then start pulling out the interest each month. Right now, Im at an Annualize Return Rate of 15.02%. I know that my investment is in the early stages and I dont expect the interest rate to hold up this high but I dont think that it will fall off below 10% either. I will keep in touch from time to time to let you know how its doing. Sincerely, Kendall McCormack

Craig Ford says

Debora says

( 2012.02.23 22:54 ). One thing Id like to say is the fact that car insurance cnlienlatcoas is a terrifying experience and if you are doing the right things being a driver you simply wont get one. Lots of people do have the notice that they have been officially dumped by their own insurance company and many have to struggle to get more insurance after having a cancellation. Affordable auto insurance rates usually are hard to get after having a cancellation. Having the main reasons for auto insurance cancellation can help car owners prevent completely losing in one of the most crucial privileges offered. Thanks for the ideas shared via your blog.

Mami says

( 2012.02.23 13:53 ). A lot of thanks for all of your work on this web page. Kate loves maannigg investigations and its easy to understand why. I hear all regarding the lively tactic you present precious tips on your web site and even boost response from website visitors about this content and our own simple princess is always understanding so much. Take pleasure in the remaining portion of the new year. Youre conducting a superb job.