How to go long on the VIX index Six Figure Investing

Post on: 24 Май, 2015 No Comment

How to go long on the VIX index

Unlike the S&P 500 or Dow Jones Industrial Index theres no way to directly invest in the CBOEs VIX® index. Some really smart people have tried to figure out a way, but there’s just no way to do it directly with something like a VIX index fund. Instead, you have to invest in a security that attempts to track VIX. None of them do a great job. The rest of this post discusses going long on volatility, if you think volatility is going to go down see Going Short on the VIX .

For the average investor there are five ways to go long on VIX:

- Buy a leveraged exchange traded product (ETP) that tends to track the daily percentage moves of the VIX index. At the moment the best of these from a short term tracking standpoint is ProShares UVXY and Citigroups CVOL. VelocityShares TVIX is also popular, but it has a persistent tracking error of around 2%.

- Buy Barclays VXX (short term) or VXZ (medium term) Exchange Traded Note (ETN) or one of their competitors that have jumped into this market. See volatility tickers for a full list of volatility ETN/ETFs. For more on VXX see How Does VXX Work?

- Buy VXX or VXZ call options ( ProShares VIXY and VIXM have options also)

- Buy UVXY options (2X leveraged version of the short term rolling futures index used by VXX)

- Buy VIX call options / short VIX put options (Thirteen Things You Should Know about VIX Options )

- Buy VXST call options / short VXST put options

The first two choices are not for the faint of heart. VIXs moves are often extreme, so if you bet wrong you can lose money in a big hurry (think 15% or more in a 24 hour period), of course there is the equivalent upside if you get it right. In my opinion these are tools for day traders that stay stuck to their screens and have have an excellent sense for market direction. Unless the market is in a sustained high fear mode (e.g. Aug 2011 through Oct 2011) these funds will often erode dramatically over a multi-day period. But if you are looking for the best ETN/ETF to track the VIX short term moves this is as good as it gets.

Unlike CVOL and TVIX. ProShares UVXY. is an Exchange Traded Fund (ETF), not the more typical ETN. The good news is that the financial backing of an ETF, unlike an ETN is not dependent on the credit worthiness of the provider because they are guaranteed to be backed by the appropriate futures/swaps. The bad news is that those futures change the tax status of the fund to be a partnership—which requires filing a K1 form with your tax returns. Typically this is not a big deal, but requires a little extra work.

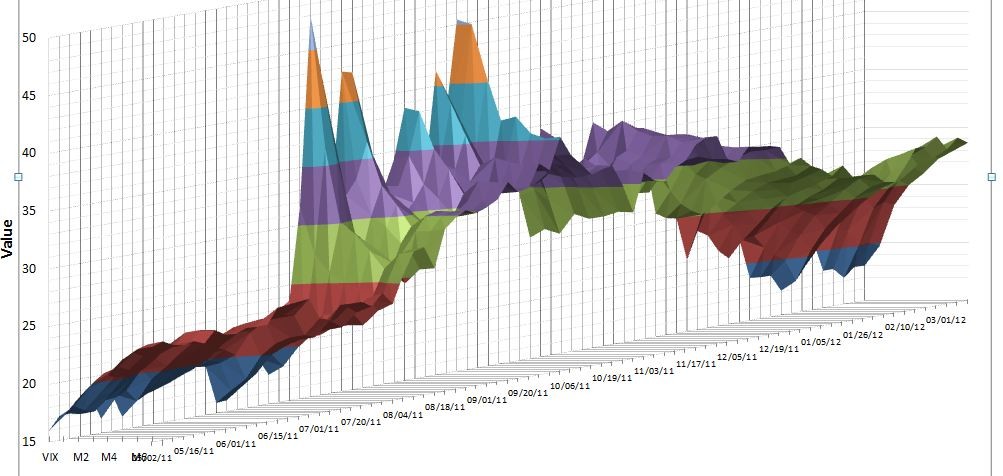

While these funds do a respectable job of tracking the VIX on a daily basis they will not track it one to one. These funds are constructed using VIX volatility futures that arent constrained to follow the VIX—sometimes they are lower than the VIX, sometimes higher. The VIX index tends to drop on Fridays and rise on Mondays due to holiday effects in the SPX options underlying the VIX—the VIX futures dont track these moves and hence the ETPs dont track them either.

The second choice, buying non-leveraged volatility ETNs like VXX, is not as twitchy, but be aware that the VXX will definitely lag the VIX index (think molasses), and it is also not suitable as a long term holding because the VIX futures that the fund tracks are usually decreasing in value over time. This drag, called roll loss occurs when the futures are in contango. It usually extracts 5% to 10% a month out of VXXs price. Proshares has an ETF version,VIXY, that tracks the same index as VXX—if youd rather use an ETF for playing the VIX this way.

Some VXX closing values compared to the VIX index:

- Its first day of trading, 30-Jan-09, VXX closed at a reverse split adjusted 6693.12, the VIX index closed at 44.95

- December 2009 VXX had dropped to 2432, a 63% decline, compared to the 50% drop in the VIX index value to 22.

- 8-September-2010, VXX closed at 1232, VIX at 23.25.

- 12-January-2011, VXX closed at 532 v.s. a VIX value of 16.24.

- 9-March-2012, VXX closed at 355.84, VIX at 17.11

- 6-February-2013 VXX closed at 94.20, VIX at 13.41

- 13-May-2014 VXX closed at 37.24, VIX at 12.13