How to find the right CD or money market account

Post on: 5 Июнь, 2015 No Comment

Modified on January 20th, 2015

This is a guest post from Richard Barrington . a Chartered Financial Analyst and 20-year veteran of the financial industry. Barrington blogs regularly at MoneyRates.com.

Conservative savings vehicles such as certificates of deposit (CDs) and money market accounts look especially appealing these days, despite low interest rates. But how do you pick the right savings vehicle for your needs? There are many options, and a little information will help you make the best choice for your situation.

[Article continued below. ]

First, lets define some basic terms.

Money market accounts pay an interest rate which can vary from day-to-day. Most money market accounts allow you to access your money via checks or an ATM card, but be sure to check on how many transactions you are allowed to make, as most money market accounts have a transaction limit. Relatively speaking, however, they provide a fair amount of liquidity.

In contrast, a certificate of deposit requires that you commit your money for a fixed period of time, with a penalty for early withdrawal. While this reduces access to your money, the benefit is that the interest rate is fixed for the term of the CD, and that interest rate will generally be higher than the interest on more liquid accounts.

Safety first

The number one goal of a conservative savings vehicle is to make sure you dont lose any money. Therefore, if you are trying to stay conservative, you want to make sure you are putting your money into a guaranteed account.

You may be aware that the Federal Deposit Insurance Corporation (FDIC) insures certain bank deposits. However, that does not mean they insure all bank financial products. For example, CDs, money market accounts, savings and checking accounts are all covered by the FDIC. Investment vehicles, such as mutual funds and annuities, are not covered, even if they are purchased through a bank. And some types of CDs that dont pay a predetermined rate of interest (but act more like investments and pay according to market performance) arent covered either.

Also be aware of FDIC insurance limits. In general, these are $100,000 per depositor with each bank, but for 2009 that limit has been temporarily raised to $250,000. There are other variables as well, so when opening an account, have your banker confirm in writing whether it is covered by FDIC insurance.

Liquidity vs. return

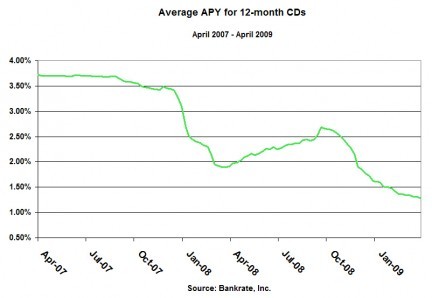

Once youve seen to the safety of your money by identifying guaranteed savings options, you can shop for the best rate. Interest rates go up and down all the time, but one of the biggest factors in determining the level of interest rates is the length of time for which you are willing to lock up your money. In general, the longer your money is committed, the higher the interest rate you will get.

This is why checking accounts, in which your money is subject to continual access, often pay no interest rate at all. High-yield savings accounts and money market accounts can do a little better for you, and CDs may do better still, especially if you are willing to lock your money up for a longer term.

By sacrificing liquidity — easy access to your money — you can generally obtain a higher return.

Shopping for rates: What to look for

As you shop for certificates of deposit and money market accounts, it may help to work in this order:

- Confirm that any vehicle you are considering is covered by FDIC insurance.

- Identify which vehicles fit the time frame in which you will need the money, remembering that longer commitments can yield higher interest rates.

- Shop for rates among vehicles which meet your time frame.

Using an online resource is an ideal way to shop for rates, because this brings together information from a wide variety of sources. This way, in just a few minutes you can make decisions which directly earn you extra money.

GRS is committed to helping our readers save and achieve their financial goals. Savings interest rates may be low, but that is all the more reason to shop for the best rate. Find the highest savings interest rates and CD rates from Synchrony Bank. Ally Bank. GE Capital Bank. and more.