How to Explain a Put Call Parity

Post on: 5 Июль, 2015 No Comment

Overview

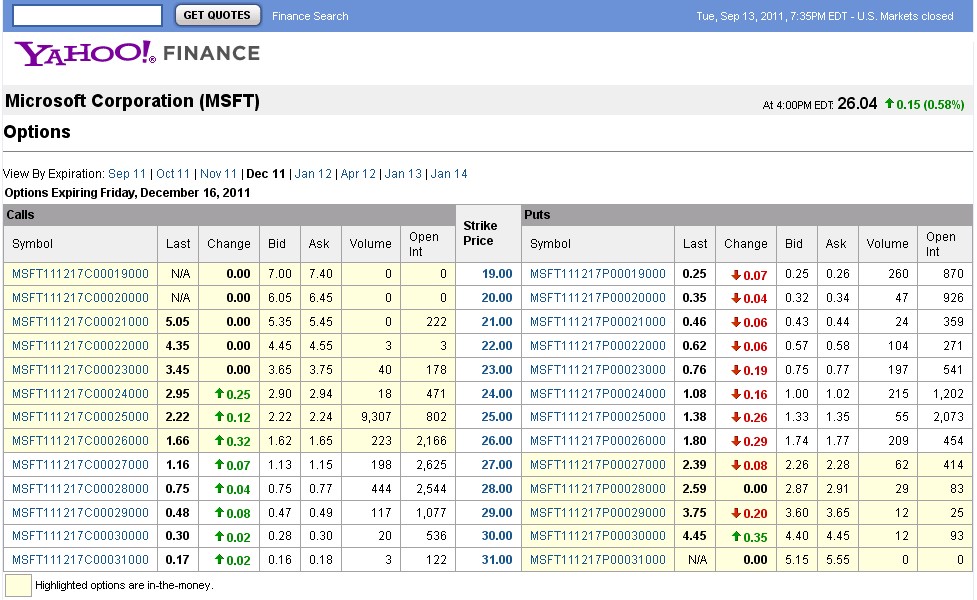

According to Investopedia, put-call parity means a principle referring to the static price relationship, given a stock’s price, between the prices of European put and call options of the same class (i.e. same underlying, strike price and expiration date). This relationship is shown from the fact that combinations of options can create positions that are the same as holding the stock itself. These option and stock positions must all have the same return or an arbitrage opportunity would be available to traders.

Overview

According to Investopedia, put-call parity means a principle referring to the static price relationship, given a stock’s price, between the prices of European put and call options of the same class (i.e. same underlying, strike price and expiration date). This relationship is shown from the fact that combinations of options can create positions that are the same as holding the stock itself. These option and stock positions must all have the same return or an arbitrage opportunity would be available to traders.

Spreadsheet

Step 1

Assume a stock is currently trading at $50. Track in a spreadsheet that an investor purchases 100 shares of the stock. Purchasing the 100 shares gives the investor any upside or downside in the stock’s performance.

Step 2

Purchase one call option with a strike price of $65 with a expiration date on the third Friday in September. This one call option gives the investor the right to purchased 100 shares at the strike price of $65. Purchasing the call option gives the investor the potential upside of the underlying stock.

Step 3

Purchase a put option with a strike price of $65 with an expiration date on the third Friday in September. This one put option gives the investor the right to put or to sell 100 shares at the strike price of $65. Purchasing the put option gives the investor the potential downside of the underlying stock.

Step 4

Assume the value of the stock went up to $75 on the expiration date. At this value, the stock owner will have a nice gain. The options owner will have a stellar gain on the call option and the put option will become worthless.

Step 5

Track the gain from owning the stock of the underlying company. Track the gained from owning both the call option and the put option. Both investment choices should emerge as equal assuming the company paid no dividends during the duration.

Tips

Any option pricing model that produces put and call prices that don’t satisfy put-call parity should be rejected as unsound because arbitrage opportunities exist.

Warning

While option contracts give the investor a right to purchase or to put or sell the stock at a specified price during a specified period, the option contracts do not give the investor the same rights as owning the stock. Owners of the stock will still maintain the right to vote and the right to receive dividends.