How to calculate an internal rate of return (IRR) and when not to use it

Post on: 2 Апрель, 2015 No Comment

Corporate finance

Calculating the internal rate of return (or IRR) of a project is one of the most popular methods that companies and managers use to determine whether a project is worth investing in. Now that Ive covered a bit about NPVs and DCFs. it makes sense to go through what IRR is, how to use it, and why its not an ideal measurement.

When using NPV to determine whether or not to invest in a project, the general rule is to accept the project if NPV > 0 and reject if NPV is negative (or zero).

But since NPV results in a dollar figure, some managers have a hard time conceptualizing what that number (the present value of future cash flows) really represents. Instead, they prefer to look at percentages, and thats where IRR comes in.

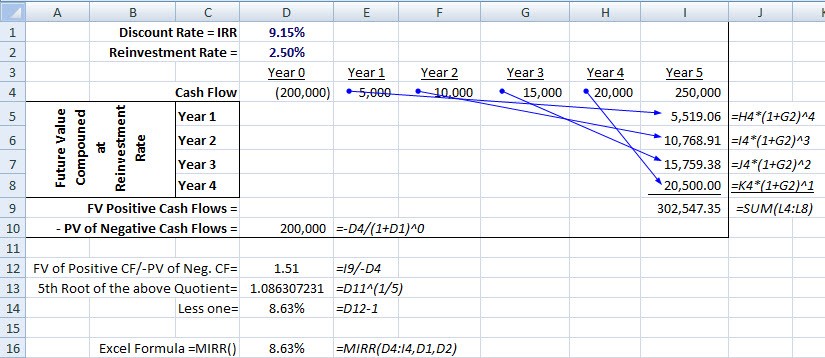

IRR is the rate at which the project NPV equals 0. It also provides the expected return rate of the project, assuming certain conditions are met. In other words, if C(n) is the cash flow for each period, then

NPV = C(0) + C(1)/(1+r) + C(2)/(1+r) 2 + + C(n)/(1+r) n

and youd find IRR by setting NPV = 0 and solving for r above. (Excels IRR function makes this all a cinch by running an iterations.)

Lets look back at Experiment in Finances NPV calculation as an example.

I noted in my previous entry that this sites NPV through July was $89.93. Here are the cash flows again:

Using Excels IRR function, I put in the series of cash flows and find that my internal rate of return is 38.2%. But since my cash flows are monthly, 38.2% must be the monthly rate. This is equivalent to an annual IRR of 4,751.8%! This means that I must set an annual discount rate of 4,751.8% before my NPV calculation will equal 0; alternatively, it means Im getting a seriously ridiculous return for my investment in my blog.

Whats the catch here? Well, recall that I dont include labor costs in my NPV calculation, and that if I do, the NPV is resoundly negative. In fact, all my monthly cash flows are negative. In this case, IRR is undefined: theres no discount rate small enough that makes NPV = 0. (A similar situation would happen if all my cash flows were positive.)

(WowI feel like a dot-com company. NPV and IRR are great if I ignore labor costs doesnt that just sound a little too much like the positive news on proforma and EBITDA earnings of yesteryear?)

Anyway, back to IRR. Managers like IRR because in theory, it gives them an idea of how much return theyll be getting on a project. And if the IRR is higher than the discount rate used in the NPV calculation (which in companies is usually a fixed figure dictated by Treasury or some other internal group), then the project obviously is worth investing in.

You can see yourself how IRR is appealing. Suppose I told you I have an investment whose NPV is $15,682. Should you invest? How about if I told you the IRR (or rate of return) on the investment is 15%? Then you could easily compare it to what youre getting on your savings account, CDs, or stocks. Intuitively it makes more sense, because were used to comparing investments using percentage rates.

Ah, but its a little too good to be true because, you see, IRR has serious flaws:

1) Any time a project is forecasted to have negative cash outflows after having cash inflows, IRR is probably not the best method to use.

Lets say I told you I had a project with an IRR of 50%. Would you be interested in it? On the surface, a rate of 50% sounds pretty good. But the following two examples both give an IRR of 50%, and as an investor, youd clearly be more interested in one than the other:

Opportunity 1: You put $1,000 into the project in Year 1, and in Year 2, you get $1,500 in return. IRR = 50%, NPV = $360 @ 8% discount rate.

Opportunity 2: You get $1,000 in year 1, and in Year 2, you put in $1,500 into the project. IRR = 50%, NPV = -$360 @ 8% discount rate.

Here, IRR doesnt give an unambiguous answer, but NPV does. Using NPV, youd reject Opportunity 2. Imagine if the situation were more complicated, and you received money in some periods and had to outlay money in others. IRR wont give you the right answer in these situations, but NPV will. (Notice that in my example earlier, all my cash outflows came before I started getting positive returns!)

Similarly, you can have a situation where NPV = 0 at two different IRRs. This can happen when you have a large initial investment (outflow), followed by a series of returns (inflows), followed by another outflow of money.

Why can you end up with two IRRs? If you remember back to finding zeroes in pre-algebra, youll recall that when solving equations, you can have more than one root as an answer. The same thing is happening here. In these situations, NPV isnt constantly increasing or decreasing with discount rates. Yet using NPV instead of IRR will give you the right answer in each case.

2) When two projects are mutually exclusive, IRR may give the wrong answer.

Lets say you have a situation where you need to upgade a machine. You could either invest $10,000 up front and get a benefit of $25,000 the next year through an upgrade, or you could invest $25,000 up front to buy a new machine that will give you benefits of $50,000 the next year. Which would you choose? If you use IRR, youll find that the first option gives an IRR of 150%, and the second 100%. Using NPV and an 8% discount rate, youll find the first situation is worth $12,174 and the second, $19,719. In reality, youll be richer in the second scenario.

Think of it this way. Im feeling awfully generous and let you choose one of two options. Option 1: if you give me $0.25, Im willing to pay you a dollar. Thats a 300% return. Not bad. Or you can give me $100, and Ill give you $300. Which would you choose, assuming you could find $100 to use for the transaction? Sure, your return would be worse in the second situation at 200%, but wouldnt you rather get $300 for $100 instead of $1 for $0.25?

There are plenty more pitfalls and scenarios where IRR should be used with caution. But, this little intro should give you an idea of what IRR is all about. As usual, if you have any comments, corrections, or requests, feel free to leave them below!

***************************************************