How to Buy a Covered Call

Post on: 26 Декабрь, 2016 No Comment

An online brokerage account can get you started trading covered calls.

Polka Dot RF/Polka Dot/Getty Images

More Articles

The covered call strategy uses shares of stocks and stock options to generate an attractive level of income into your brokerage account. A covered call consists of two parts: buying stock and selling call options; an online brokerage account allows you to open a covered call trade as a single transaction. The challenge of using covered calls is selecting the stocks to use with the strategy.

Step 1

Open an account with an online discount stockbroker if you do not have one, and request option trading privileges to be included on the account. If you already have an account, you can request to add option trading authorization. The broker will assign an options trading authorization level based on your financial assets and trading experience. Covered calls require a level 1 authorization, which most brokers will approve for any account.

Step 2

Select a stock and find the option’s pricing chain for the stock. Look up the share price using the online account quote screen and when you have the share price, there will be a menu choice or link for the option chain. A stock will have many options — both puts and calls — trading against it for a range of expiration dates.

Step 3

Narrow the choice of listed options using the tools of the options chain screen. Limit the view to call options, an expiration date two to three months in the future and strike prices near the current share price. The strike price is the price at which the buyer of a call option can buy the stock if the option is exercised. You will be selling call options, so the strike price is what you will receive per share if the calls you sell are exercised.

Step 4

Select a call option for your covered call trade. To start, select the call at the next strike price above the current share price and an expiration in two to three months. For example, assume the selected stock price is $48.50 and there is a call option with a strike price of $50 and the option is quoted at $1.25.

Step 5

Select Covered Call from the strategy selection menu on the option chain screen. With a call option selected, choosing the covered call strategy will take you to an option trading screen with the stock and option symbols and prices already populated to the appropriate places on the screen.

Step 6

Enter the number of stock shares to buy and call options to sell. Each option is for 100 shares of stock, so the numbers must be in a 100 to 1 ratio, such as buying 500 stock shares and selling 5 call options. The price of the covered call will be the net of stock minus the option price. Using the example, the price would be $47.25 — $48.50 minus $1.25. The cost is the price times number of shares plus commission.

Step 7

Submit your covered call order using the Trade button/link on the covered call screen. The broker’s system will buy the shares, sell the call options and you will have an open covered call trade showing shares owned and call options sold.

Step 8

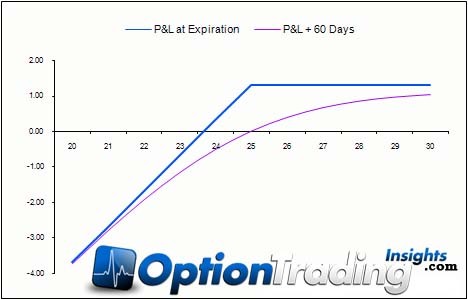

Monitor your covered call trade. There are several possible outcomes with a covered call:

If the stock is below the option strike price at expiration, the calls will expire and you keep the money from selling the call options plus retain the shares in your account.

If the stock is above the strike price at expiration, the shares will be called away and you will receive the strike price for the shares.

You can close the covered call trade by buying back the sold call options and then selling the stock shares.