How To Be Your Own Stock Broker

Post on: 17 Апрель, 2015 No Comment

How To Be Your Own Stock Broker

or copy the link

Do you want to take control of your portfolio? Do you want to make the decisions regarding where your money is invested? Do you have a firm grasp on trading strategies and market outlook? If you do, and you want to save some money while investing, you might want to consider becoming your own stock broker. While the process of managing your own portfolio can be very fulfilling, it can also be a lot of work. Don’t jump in until you know that you have what it takes to handle everything on your own.

Many people choose to use the services of a stock broker in order to minimize legwork, time and knowledge required for successful stock investment ventures. However, if you’re the do-it-yourself type or if you have a limited investment budget and don’t want to see a lot of your cash go to the broker in commission fees, then you may decide that the more hands on approach is right for you.

Even if you decide to “be your own stock broker” you need to understand that a brokerage service or firm is required to buy or sell stock. Stock market regulations require that a licensed individual or business perform all trades. Therefore, you will need to utilize a brokerage service to make any purchases or trades on your behalf.

So what’s the difference then between hiring a broker and using a brokerage firm or service? The difference really lies in the level or service you receive and the associated fees charged for that service. While a brokerage firm or service will act as a stock broker for you, you have a variety of options these days for what kind of service you employ.

You can go with a full-service firm that will assign a stock broker to you, manage your portfolio, make and make recommendation on which stocks to buy and sell. Or, you can save yourself a lot of money and simply use a service that only does the actually trading for you.

If you’ve done your homework and feel comfortable with your degree of knowledge on stock investment, then using an inexpensive online trading site could be a good choice for you. Such a site will allow you to initiate your own stock sales and purchases. While you initiate the sale or purchase, the site itself conducts the trade, and therefore remains within the regulatory constraints imposed on stock market trading by the government.

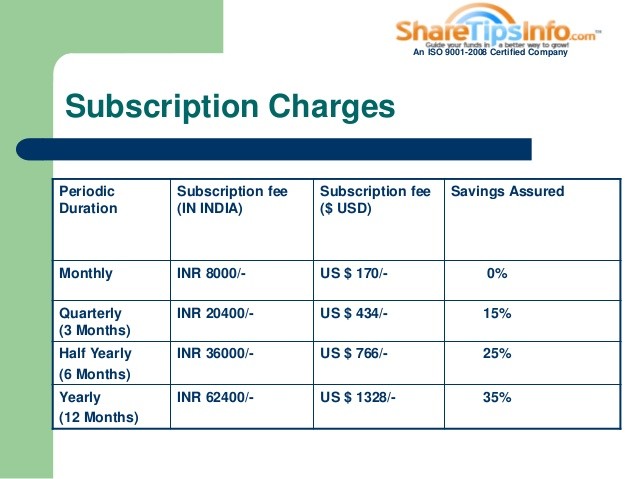

Many discount brokerage firms will charge a membership fee. Others charge fees only on a per trade basis. Before signing up with or using the services of any online brokerage firm or service you will need to do some research on the website provider. Ensure that the service has a good reputation and is in good standing with consumer reporting organization. You may also want to go with a provider that has been around awhile and has a well-established record of ethical and quality business practices.

If you are looking for an inexpensive means of building a viable stock portfolio, you have your work cut out for you. The primary reason people use stock brokers is to limit the time and energy involved in investing. They also use brokers to minimize risk, depending on the stock broker’s expertise in the financial arena to keep their assets as safe as possible and reduce potential losses.

If you decide to pursue stock trading on your own, then you’ll need to be well-informed in all areas of stock trading. Understanding the basic terminology is only the first step in the process of being your own stock broker. Educating yourself on stock market valuation tools, stock trading methods, and portfolio management practices is crucial to success.

You will need to create an investment plan and then closely monitor your purchases to ensure that they adhere to the plan that you have set. Do not dump all of your investment money into companies that you have not researched. You can save a lot of money by taking care of your portfolio monitoring and investment research needs yourself. However, if you don’t do the research required, you can end up losing a lot more than you would have spent. If you want to be your own stock broker, be prepared to put in the time and effort required.

Assignment: Last activity you chose whether you plan on working with a full service or discount broker.

• What did you choose?

• How much time do you plan on spending on investing each week?

• Is this enough time to carefully research and monitor your portfolio?

• If you plan on being your own broker, how will you organize and track your investment information?