How to Analyze Mutual Fund Performance

Post on: 16 Март, 2015 No Comment

What to Look For and What to Avoid

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Past performance of a mutual fund may not be a guarantee of future results but if you know how to analyze performance—if you know what to look for and what to avoid—you can make better investment decisions.

Apples to Apples: Compare Funds to Appropriate Benchmarks

If you look at your 401(k) statement and notice that one of your funds had a large decline in value but the others have performed well in a given time frame, this is no indication that the declining fund should be removed from your portfolio. Look at mutual fund types and categories first to understand if other funds in the category have had similar performance.

You may also use an index for a benchmark. For example, if the fund is a large-cap stock fund, a good benchmark is the S&P 500. If the S&P 500 declined 10% during the period you are analyzing but your fund declined 8%, you may not have reason for concern over the performance of your fund.

Know When Good Performance Can Be Bad

If you are investing in a mutual fund, especially a stock fund, it is likely you plan to hold it for at least three years or more. Making this assumption, there is rarely a need to look at time periods of less than three years. However, this is not to say that short-term returns, of say 1 year, are irrelevant. In fact a 1-year return for a mutual fund that is incredibly higher compared to other funds in its category can be a warning signal.

Yes, strong performance can be a negative indicator. There a few reasons for this: One reason is that an isolated year of unusually high returns is abnormal. Investing is a marathon, not a race; it should be boring, not exciting. Strong performance is not sustainable. Another reason to stay shy from high short-term performance is that this attracts more assets to the fund. Smaller amounts of money is easier to manage than larger amounts. Think of a small boat that can easily navigate the shifting market waters. More investors mean more money, which makes for a larger boat to navigate. The fund that had a great year is not the same fund it once was and should not be expected to perform the same in the future. In fact, large increases in assets can be quite damaging to a fund’s prospects for future performance. This is why good fund managers close funds to future investors; they can’t navigate the markets as easy with too much money to manage.

Understand and Consider Market and Economic Cycles

Talk to 10 investment advisors and you’ll likely get 10 different answers about what time periods are most important to analyze to determine which fund is best from a performance perspective. Most will warn that short-term performance (1 year or less) won’t tell you much about how the fund will perform in the future. In fact, even the best mutual fund managers are expected to have at least one bad year out of three. Actively-managed funds require managers to take calculated risks to outperform their benchmarks. Therefore, one year of poor performance may just indicate that the manager’s stock or bond selections have not had time to achieve expected results.

Focus on the 5 and 10-year Periods

Just as some fund managers are bound to have a bad year from time to time, fund managers are also bound to do better in certain economic environments, and hence extended time frames of up to three years, better than others. For example, perhaps a fund manager has a solid conservative investment philosophy that leads to higher relative performance during poor economic conditions but lower relative performance in good economic conditions. The fund performance could look strong or weak now but what may occur over the next 2 or 3 years?

Considering the fact that fund management styles come in and out of favor and the fact that market conditions are constantly changing, it is wise to judge a fund manager’s skills, and hence a particular mutual fund’s performance, by looking at time periods that span accross differing economic environments. For example, most economic cycles (a full cycle consisting of both recessionary and growth periods) are 5 to 7 years in time duration. For example, over the course of most 5-year periods, there are at least 1 or 2 years where the economy was weak or in recession and stock markets responded negatively. And during that same 5-year period there is likely at least 2 or 3 years where the economy and markets are positive. If you are analyzing a mutual fund and its 5-year return ranks higher than most funds in its category, you have a fund worth exploring further.

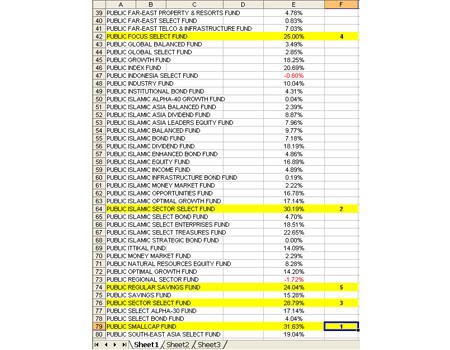

Use Weights to Measure Fund Performance

Common time periods for mutual fund performance available to investors include the 1-year, 3-year, 5-year and 10-year returns. If you were to give heavier weights (more emphasis) to the most relevant performance periods and lower weights (less emphasis) to the less relevant performance periods, your humble mutual fund guide suggests weighting the 5-year heaviest, followed by the 10-year, then 3-year and 1-year last. For example, you could create your own evaluation system based upon percentage weights. Let’s say you give a 40% weight to the 5-year period, a 30% weight to the 10-year period, a 20% weight to the 3-year period and a 10% weight to the 1-year period. You can then multiply the percentage weights by each corresponding return for the given time periods and average the totals. You can then compare funds to each other. The simple way to do this is to use one of the best mutual fund research sites and do your search based upon 5-year returns, then look at the other returns once you’ve found some with good potential. This weighting and/or search method assures that you will choose the best funds based upon performance that gives strong clues about future performance.

Don’t Forget About Manager Tenure

Manager tenure must be analyzed simultaneously with fund performance. Keep in mind that a strong 5-year return, for example, means nothing if the fund manager has been at the helm for only 1 year. Similarly, if the 10-year annualized returns are below average compared to other funds in the category but the 3-year performance looks good, you might consider this fund if the manager tenure is approximately 3 years. This is because the current fund manager receives credit for the strong 3-year returns but does not receive complete blame for the low 10-year returns.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.