How should I invest Fidelity Investments

Post on: 21 Июнь, 2015 No Comment

Fidelity offers a range of solutions to help take the guesswork out of investing your plan contributions.

I want Fidelity to do it for me.

- Consider target -date or lifecycle funds. With target-date or lifecycle funds you just pick the fund with the target year closest to when you want to retire. The investment professionals then select, monitor and adjust the mix to become more conservative over time. Fidelity offers these options through Fidelity Freedom Funds ®. (Not all plans offer these type of funds.)

Click here for more details on Fidelitys lifecycle funds. Consider Fidelity Portfolio Advisory Services at Work. PAS-W is a managed account that puts Fidelity’s investment professionals in charge of your workplace savings. Not only do we select and monitor investments for you, but we also align your account to enhance growth and manage risk. Plus, we conduct annual check-ups to keep your investment strategy on track. (Availability may vary depending on your plan)

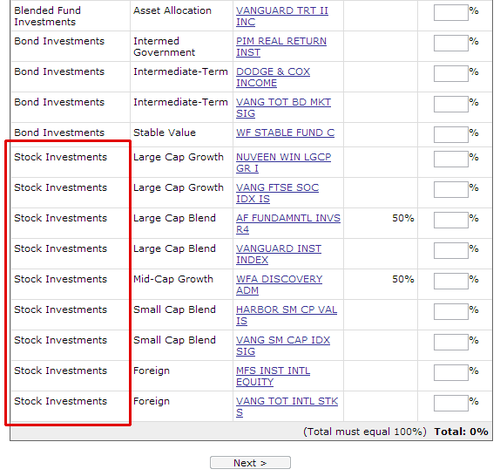

I prefer to do it myself.

If youre comfortable building a diversified portfolio and managing it through market ups and downs, Fidelity offers tools and guidance to assist you.

- Portfolio Review. With our Portfolio Review, you get an easy-to-use, online planning tool that helps you assess your own investment mix. If anythings off, well give you an action plan to help get it back on track. Note: You must be enrolled in your plan to access Portfolio Review. Fundamentals of Investing explains how diversification can work for you within your plan.

Keep in mind that neither diversification nor asset allocation ensures a profit or guarantees against loss.

The investment risk of each Fidelity Freedom Fund changes over time as its asset allocation changes. They are subject to the volatility of the financial markets, including equity and fixed-income investments in the U.S. and abroad, and may be subject to risks associated with investing in high-yield, small-cap, commodity-linked, and foreign securities. Principal invested is not guaranteed at any time, including at or after their target dates.

Portfolio Review is an educational tool.

Fidelity ® Portfolio Advisory Service at Work is a service of Strategic Advisers, Inc. a registered investment adviser and a Fidelity Investments company. This service provides discretionary money management for a fee.

Before investing in any mutual fund, please carefully consider the investment objectives, risks, charges and expenses. For this and other information, call or write Fidelity for a free prospectus or, if available, a summary prospectus. Read it carefully before you invest.