How Regular Investors Can Predict Which Stocks Will Go Up

Post on: 19 Апрель, 2015 No Comment

Insidersâ Guide

These days, many top executives receive the bulk of their compensation in the form of stock options and grants. But because the awarded shares are essentially an alternate form of income, theyâ re often sold right after theyâ ve cleared. This means itâ s worth noting if corporate insiders have substantial holdings of their companyâ s shares, and when theyâ re adding to those holdings. Usually, inside ownership of more than 2 percent of total shares is considered significant. Anything over 5 percent is considered high. Insiders, who include both executives and directors, must report their holdings and related buying or selling activity to the Securities and Exchange Commission (SEC). So investors can monitor this data to learn not only the extent to which insiders invest in their own company, but also their expectations for the companyâ s future performance. While executives can sell for a variety of reasons, buying activity usually means one thing: Insiders think shares are undervalued. Additionally, investors can scan a companyâ s annual 10-K SEC filing to find out if the stock awards are tied to the companyâ s long-term interests. When executives are compensated based solely on profits, companies can be exposed to accounting shenanigans intended to artificially boost earnings. Instead, more concrete metrics, such as sales growth and ROIC, make it much more likely that management is thinking strategically instead of quarter to quarter.

HeROIC Effort?

Return on invested capital gauges how well management is doing its job: allocating capital to projects that pay off in high organic growth. To calculate ROIC, take the companyâ s net operating profit after taxes (NOPAT) and divide that by the firmâ s total capital, which includes long-term debt and preferred and common stock. The more common version of ROIC uses net income instead of NOPAT. But NOPAT is better since it isolates the profits of the core business by removing numbers that can obscure actual performance, such as one-time items and non-cash adjustments. Although companies donâ t typically report NOPAT, you can calculate it this way: Multiply a firmâ s earnings before interest and taxes (EBIT) by the firmâ s effective tax rate.

Making the Grade

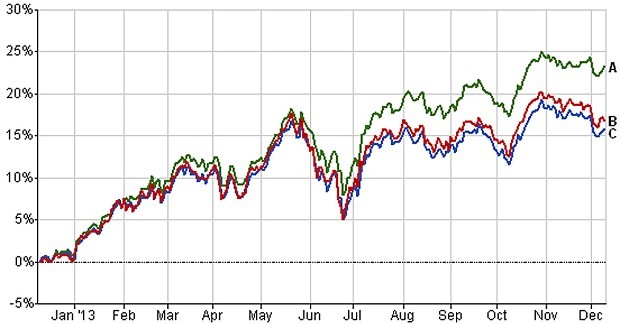

Based on these two metrics, I screened the universe of domestic stocks down to a manageable list of promising names. A standout value investment was W.W. Grainger (GWW ), an industrial distributor with a number of favorable characteristics. Grainger acts as a middleman for over 3,500 suppliers for everything from lab equipment to electrical products. To facilitate sales, Grainger has several hundred branches in the US, as well as catalogs and an online ordering platform. The industrial distribution industry is highly fragmented, and management hopes to further expand through acquisition. The company has high inside ownership, with insiders holding nearly 15 percent of shares outstanding. The awarding of executive shares is tied to sales growth for a specific year; the shares are actually awarded two years after that, and only if ROIC targets were achieved during the vesting period. These incentives have worked well: During the past five years, Grainger has generated a stellar ROIC 20 percent annualized. The stockâ s performance itself has also been impressive. Over the past 10 years, itâ s gained nearly 15 percent annually, far surpassing the marketâ s 7 percent annual return. Although Graingerâ s business is prone to cyclicality, the stock dropped just 8 percent in the bear market year of 2008, a far cry from the S&P 500â s 37 percent loss.