How Investment Banking Interviews Have Changed in Recent Years and How You Should Prepare

Post on: 28 Май, 2015 No Comment

One of the most common questions I get goes like this:

Ive read all the usual interview advice. Every guide cover-to-cover. Message boards, Mergers & Inquisitions. and anything else I can find online. But Im worried that interviews now (2009) are different and that the standard advice doesnt apply .

How have investment banking interviews changed in recent years? And what can I do to prepare?

Some of what you see in investment banking interviews doesnt change much from year to year but a lot does change in a recession.

And interviews today are definitely different than they were 5 years ago.

So heres how you prepare:

What Hasnt Changed

Some things never change

Your Story

It doesnt matter whether its 1985 or 2005 or 2025: your story is always critical whether youre selling something, youre becoming a celebrity, youre networking. or youre trying to ace your interviews.

And when the economy is bad, its even more important to get this one right because the standards are much higher .

So dont think you can waltz in and say, Im from [Insert Name Here] prestigious school / job, have xx GPA, and therefore I deserve this.

The Usual Technical Testing Questions

In 1st round interviews, theyre trying to assess who knows something about finance vs. who is completely clueless .

So if you cant walk through a DCF or you cant explain how to link the 3 statements together, forget about banking.

Even if you have finance experience, you could still get very basic questions like this in interviews because they know a lot of people with finance experience are actually BSing about what they did.

Structure & Format

Most interviews are still around 30 minutes long, usually with 1 banker but sometimes with 2. And to get an offer at a bank, you have to go through multiple interviews on your Superday.

And the same advice that youve seen before about Superday interviews still applies the MDs call the shots. and your likability trumps your technical ability .

Whats Different

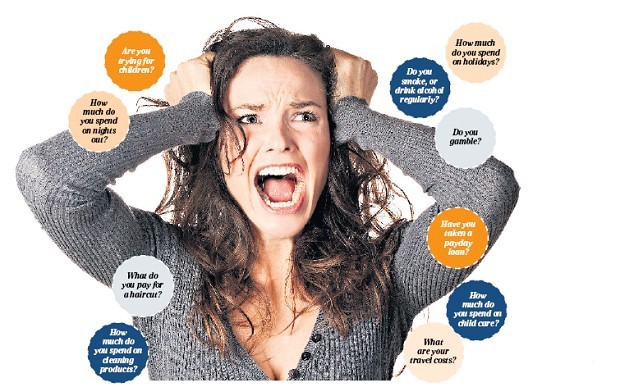

These are not your same old interviews anymore

Theyre More Technical

In bubble times, you might be able to spin and BS your way through interviews with marginal knowledge of finance especially if you dont have a finance background.

But when banks only need 10 Analysts or Associates rather than 100, their standards go up .

If you have banking experience, you will get lots of advanced technical questions but even if you dont, you could still get these types of questions.

What do I mean by more advanced?

In a normal interview youd be expected to walk through a DCF but more advanced questions might ask about the mid-year convention. how different capital structures affect the output, or how buying a factory in Year 4 affects the Terminal Value.

So you have to think on your feet and understand the concepts as opposed to just regurgitating answers.

They Focus Heavily on Transaction Experience

If youve had investment banking, private equity, hedge fund, or even corporate development experience, expect the interviewers to focus on any transactions on your resume.

- Introduction: A few sentences on the companys financials (revenue, EBITDA, market cap), what they did, and why they wanted to sell or buy another company.

- Rising Action: What kind of sell-side or buy-side process did you run for them? How many buyers / sellers did you approach? What did they like / not like about your company?

- Climax: What was the crux of the deal? Did it come down to price? An IP issue? Synergies? Lack of faith in the market? And did you create any unique models or contribute to solving whatever the key issue was?

- Dénouement : Did the deal close? Is everything still pending? Sometimes its better to pretend the deal is still up in the air rather than admitting that it collapsed.

Along with all this, interviewers will also re-frame technical questions in the context of your transactions.

So you wont just get Walk me through a DCF.

Youd get Walk me through how you completed a DCF for this company and the key challenges with the model.

They Expect You to Know About Restructuring and Distressed M&A

You might expect these questions for Restructuring groups but you will also get them even if youre not interviewing with a group that works with distressed companies .

Dont believe me?

With the recession and many companies going bankrupt, how would you modify the usual valuation methodologies for a distressed company?

Thats a very standard valuation question that you might get in any investment banking interview during a recession and you need to know how you change a DCF, public comps, and transaction comps appropriately.

Then you need to know the basic options available to a distressed company refinancing, selling itself, restructuring its debt, filing for bankruptcy and the advantages and disadvantages of each.

And youll need to go well beyond these basic questions if youre actually interviewing for a Restructuring group .

Theyll Give You Case Studies

This ones more common if youre interviewing for more senior positions, if youre recruiting off-cycle, if you have more experience, or if youre in a region like Europe where assessment centers are common.

Much of what you learned about private equity case studies applies to these as well: focus on communicating simple points clearly rather than giving a lecture on advanced finance topics.

Whats a summary of this companys current situation? What options do they have available? Whats the advantage and disadvantage of each one? What should they do, and what numbers do you have to back it up?

Sometimes these case studies will be combined with the interviews themselves so the interviewer might spend 15 minutes presenting you with a company and its financials and then asking about what their best option is and how they should execute it.

They Can See Through Your Fabricated Stories

Even with the standard fit questions you have to make sure you can back everything up because interviewers can easily detect the sniff of a fabricated story .

But you may not know what qualifies as a good story or good support for an answer unless someone in the industry tells you directly.

The best solution: go through practice interviews with anyone whos willing to help you and who knows what interviewers look for.

The next best solution: look at sample interviews and the responses that interviewees give and see what they do right, what they do wrong, and how you should change your answers based on that.

So Whats the Solution?

You already have a better idea of what to expect and how to prepare but I cant possibly cover all these topics in-depth in a single article.

So what should you do?

Except in this case you need to wait a few days and you wont be getting overpriced bottles of Cognac at a club, but rather a completely revamped interview guide that covers everything here and more .

But hey, if theres enough demand maybe Ill throw in some free bottles as a bonus