How I Calculate My Asset Allocation

Post on: 15 Июнь, 2015 No Comment

I was logging into my Vanguard account when it told me that my current mix of investments differed from my target by more than 5%. A few years ago, sometime shortly after I opened the account, I set the target asset allocation based on the classic 120 minus your age rule of thumb for your investment mix of stocks and bonds. Ive seen the rule expressed as 120 minus your age, 110 minus your age, or a nice round 100 minus your age. The higher the first number, the more aggressive the investment mix.

Rules of thumb work well when you need an answer quickly. They are a terrible idea when you have the time to do a more rigorous analysis and you decide to use the rule of thumb because its easier. Theyre also bad because they make you feel like you did the work when you didnt. The best way to figure out your asset allocation, at least in my non-financial planner opinion, is to separate your money into goal buckets and then decide the rate of growth you need for each and then determine your allocation that way.

What are Goal Buckets?

Lets say you want to buy a house in 5 years thats a goal. The money you save towards that goal goes into that bucket. I call that a goal bucket. Theres probably a fancy CFP term for it but who needs that? Anyway, if you want to save up for a downpayment on a house in 5 years, how much do you need? Well, you pull out your trusty calculator and start calculating how much you need to contribute each month and start saving. If you need $20,000, thats $333.33 per month for 60 months.

Your Money Should Grow Right?

But youre not going to put that money into a checking account right? Given the riskiness of the stock market, I dont think its a good idea to invest money you need within the next 3-5 years. Sadly, the safer options yield very little but its better than nothing. Given a 1% APY, your contributions drop down to $325.21 per month. Lets say you found a magic safe investment vehicle that gives you 3% a year, what does that do to your contributions? It drops your monthly contribution to $309.37. What if you invested it in the stock market and were able to get 10% return? Your contributions would be $258.27.

Since the stock market is more volatile than a simple savings account, by taking on the added risk (and getting 10% return), you could contribute $80 less per month to reach your $20,000 goal. The question is whether thats worth the risk of you not having $20,000 at the end of 60 months because we hit a rough path in the market. Just look at the S&P 500 stock chart over the last year and youll see how much movement there is in the market. If you bought a house in March, maybe you hit a little peak where its above 1400. Or if you bought a house in early June, you might have hit the trough under 1300. Thats a big swing (of course, if you were close to buy a house, youd likely pull your cash from the market but the volatility idea holds true check out a 5 year chart for similar swings).

Now Apply This to Retirement

Now take the different buckets and set them next to the retirement bucket money youll need to retire when youre X. For me, I set X at 65 just because its a convenient number that everyone uses. Maybe I retire earlier, maybe I retire later, I figure that the target number will be set once I get closer (at least when I get over 50).

How much do I need to retire? I work backwards from how much income Ill need a year from my nest egg and based on current expenses, plus a lot of fudge factor, I simply assume Ill need $100,000 a year in retirement to enjoy the finer things in life. I then cheat and use the 4% rule that says I can safely draw down my nest egg if I spend just 4% each year. That means my nest egg needs to be $2.5 million dollars and I have 30 years to get there.

How much do I need to contribute to a retirement account in order to reach $2.5 million in 45 years (back dating this to when I turned 20)? A mere $238.49 a month, as long as it grows by 10% a year. Thats $2.5 million in todays dollars, which are worth less than 2057 dollars. To account for inflation, we need to discount our rate of return by 3%, down to 7%, and that makes our monthly contributions to a more sobering $659.18. (we didnt do this for the house because over 5 years it has a much smaller impact)

As you play with the rate of return, your contribution amount will increase or decrease. This is why they talk about asset allocation and how you need to be more aggressive when youre young. If you can save more aggressively or investment more aggressively (and see a higher rate of return), then youre more likely to hit your target. If youre too safe, you run the risk of not getting the returns you need and your nest egg not hitting your number.

One thing I dont consider is taxes and tax brackets. I know some of my investments are tax free (Roth IRA) and some are tax deferred (401k, Rollover IRA) but I figure those will balance each other out. The fiscal cliff nonsense has taught me that trying to predict tax rates is impossible.

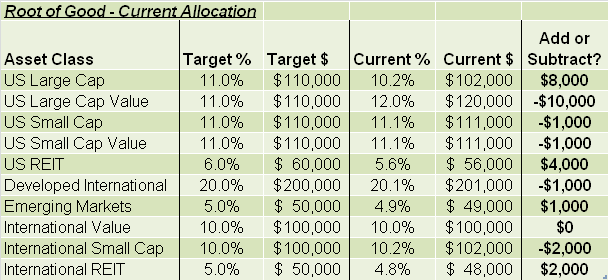

How Do You Pick Your Asset Allocation?

So you have an idea of what your growth rate has to be and this is how you set your asset allocation. The average return of the S&P since the beginning of time (late 19th century) has been around 10%. Its extremely volatile, with years where it goes down a lot and years where it goes up a lot, but people always peg the average return at around 10%. What I like to do is look at specific funds Ill invest in and check out the 10 year history. Historic returns are not indicative of future results (blah blah) but I just use it as a guide anyway.

So we have the Vanguard Total Stock Market (I use Vanguard so thats why I am using their funds as an example, you can use whatever funds your broker offers) vs. the Vanguard Total Bond Market. The 10 year return on the stock fund is 7.83%. The 10 year return on the bond fund is 5.07%. If you need a return greater than 7.83%, you need to have all your money in the Total Stock market and you need either find a riskier investment or contribute more. If you need a return somewhere in between, do the math and set your allocation. If you need a return below the bond fund, then you pick just the bond fund.

The ten year gives you a nice average to worth with and when you see the 3 and 1 year returns, you get a sense of how volatile each one is. The charts for the Total Stock fund has enjoyed double digit returns for the last 3 years but the 5 year average is just 2.18%, which is hiding a few years of massive losses considering the 1 year return was 16.25%. Would you have enjoyed the wild ride the last five years knowing youd only now be looking at a 2.15% average return after all was said and done?

Is This Perfect?

Is my way of setting an allocation perfect? Probably not. I just think its better than using a rule of thumb to guide my decisions. Rules of thumb are nice when a deeper analysis wont help or there are too many variables for you to accurately predict (like using 4% for drawing down a nest egg), I think setting an asset allocation is easy enough and it has the benefit of helping you plan for the future when you think about your goals.

How do you set your allocation?