How does the behavior of VIX futures differ from the VIX index

Post on: 19 Март, 2016 No Comment

Related Topics

My answer assumes prior knowledge of the basic workings of the VIX index and futures contracts. If not, please read my answer to How does the VIX index and its related futures contracts work? first.

Remember that, unlike most futures, VIX futures do not have an underlying that can be used to hedge. Futures that can be hedged (everything from corn to the S&P 500 index) almost always follow arbitrage-free pricing. That means that the futures price will not go high enough to allow someone to sell the future, buy the underlying in the spot market, and make a profit by holding until the future expires. Similarly, the futures price won't go low enough to allow someone to profit by buying the future and selling in the spot market. Therefore, other futures have a well-defined relationship to the spot market. Since there's no spot market for VIX, these rules don't apply. Instead, the VIX index is calculated from the implied volatility derived from the prices of SPX futures.

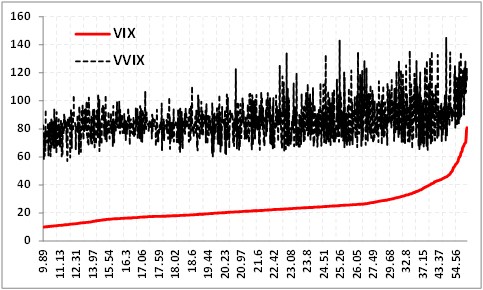

So, with all that preamble, the answer is that the VIX futures price reflects the market participants' best collective guess as to what the VIX index will be at settlement. This is most predictable when VIX is at extremely high or low values — if VIX is at 40, it's unlikely it'll still be that high a month later, so a futures contract that expires a month out will likely be priced lower (and the farther-out contracts lower still).

This estimate of the settlement value of VIX will be less subject to fluctuations than the VIX index. For example, if VIX is at 30 and a contract that expires in a month is at 28, a one point move in the VIX will usually produce a smaller move in the futures price. In this example, the market expects VIX to come down by a month from now; if VIX goes up, the market will discount part of that move as being temporary, since the expectation is for VIX to come down. If VIX goes down, the market will discount part of that move too as being part of the expected decline. The futures price will track the index more closely as the settlement date approaches.

Also, changes in sentiment can affect traders' expectation of what VIX will do between now and expiration. It's not uncommon to see days where the futures trended up (or down) throughout the day even though the VIX index was largely flat. Something other than the VIX index made the traders think that volatility was going to go up (or down) in the coming days.

One last important difference I'll share is that there'll be a day each month when the calculation of the VIX index will switch to using options with different maturity dates. That can often cause a point or two overnight change in the VIX, but will have no effect on VIX futures, since traders already knew about the upcoming changes in VIX calculation.