How do I Sell Covered Call Options

Post on: 22 Декабрь, 2016 No Comment

Covered call trading can build cash in your brokerage account.

Jupiterimages/Photos.com/Getty Images

More Articles

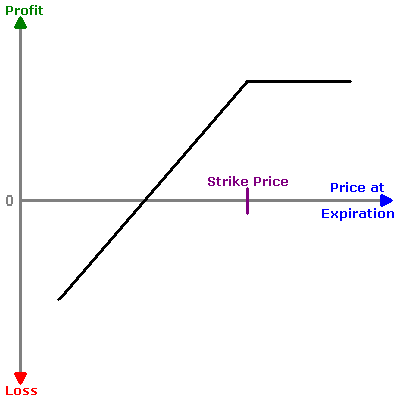

The covered call options strategy is viewed as one of the most conservative ways to use options. Successful covered call trading will generate an attractive level of income for your stock brokerage account. Covered call trades are sometimes referred to as buy/write trade options since you buy shares of stock and sell — write — call options against those shares. Covered call trading is most effective when the stock market is flat to slowly rising.

Step 1

Check to see if you have options trading privileges on your stock brokerage account. If not, you can add option trading by completing a couple of forms for your broker. Options trading can be added to any type of brokerage account including margin, cash and IRA accounts. Covered call trading requires level 1 option trading authorization, which is the lowest of five possible levels. Higher levels allow option strategies that involve higher levels of risk.

Step 2

Use the stock symbol of the stock on which you want covered call trade to look up current options prices. Option prices are listed in option chains with calls and puts listed under the different expiration dates and with a range of exercise or strike prices. For a covered call trade, look for an expiration date 1 to 3 months out and with a strike price just above the current share price of the stock. For example, your selected stock is at $24.50 per share and options with strike of $24 and $25 are available. For the example, the $25 strike call option is priced at $0.50.

Step 3

Select the specific option you want to use for the covered call trade and select covered call from the strategies menu on the options chain screen of your online brokerage account. The selection will take you to a covered call trading screen with the stock and call option information already populated. In the example, the call with the $25 strike price was selected.

Enter the number of stocks shares and option contracts you want to trade. You must have 100 shares for each call option since each option contract is for 100 shares. The minimum trade size would be 100 shares and one call option. The cost of the trade is the net debit of the share price minus the option price. In the example, the cost would be $2,400 plus commissions with the stock price at $24.50 and the option at $0.50.

Let the covered call run until the expiration date or close it out early by buying back the call option and selling the stock shares. If the shares are not called away before or at expiration you can sell more call options against the shares in your account.