How Companies Use Derivatives for Hedging Risk Management

Post on: 18 Май, 2015 No Comment

How Companies Use Derivatives for Hedging & Risk Management

How Companies Use Derivatives for Hedging & Risk Management

Hedging

Hedging, in simple words, means reducing or controlling risk. This is done by taking a position in the futures market that is opposite to the one in the physical market with the objective of reducing or limiting risks associated with price changes. A simple example will help us understand it better.

A wheat farmer can sell wheat futures to protect the value of his crop prior to harvest. If there is a fall in price, the loss in the cash market position will be countered by a gain in futures position.

Derivatives

Derivatives are financial instruments whose values depend on the value of not only the underlying financial instruments but on any underlying asset. We can take the same example of the wheat farmer.

Here, the wheat farmer can protect itself of any fall in price by entering into a contract with the merchant.

The main types of derivative instruments are: Futures, Forwards, Options, Swap.

So, to sum up, Hedging can be defined as a method whereby one can reduce the financial exposure faced in an underlying asset due to volatility in prices by taking an opposite position in the derivatives market in order to off-set the losses in the cash market by a corresponding gain in the derivatives market.

The sentence might appear to be a bit long but captures the basic essence of derivatives hedging.

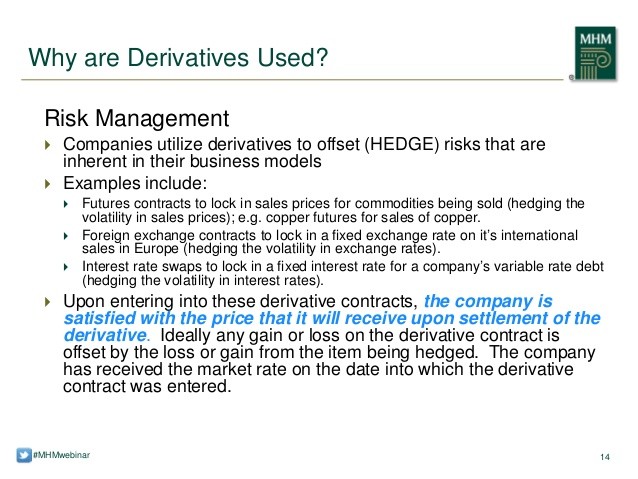

Now having understood the basic meaning of hedging and derivatives, we would now see how corporate use these derivative instruments for hedging.

Foreign Exchange Risks

The most common corporate uses of derivatives is for hedging foreign-currency risk, or foreign exchange risk, which is the risk that a change in currency exchange rates adversely impacts business results.

Let’s consider an example with Infosys Technologies, a multi-national IT company which even exports softwares to other countries, and mainly to US. Let’s make an assumption that Infosys Technologies exports software worth 1000 Crores to US in 2006-07 when the price of per US Dollar was at Rs. 40 (assumption).

When the rupee per dollar exchange rate increases from Rs. 40, Rs. 42, Rs. 44, it takes more rupees to buy one dollar, meaning the rupee is depreciating or weakening. As the rupee depreciates, the softwares which Infosys exports would translate into greater sales in rupee terms. This demonstrates how a weakening rupee is not all that bad: it can boost export sales of Indian companies.

Now let’s illustrate a simple hedge that a company like Infosys Technologies might use to minimize the effects of any Rupee / USD exchange rates, Infosys purchases 2000 foreign-exchange futures contracts against the Rupee / USD exchange rate. The value of the futures contracts will not, in practice, correspond exactly on a 1:1 basis with a change in the current exchange rate (that is, the futures rate won’t change exactly with the spot rate), but we will assume that it does anyway. Each futures contract has a value equal to the gain above the Rs. 40 Rupee/USD rate. (Only because Infosys took this side of the futures position, somebody — the counter-party — will take the opposite position.)

Of course, it’s not a free lunch: If the strategy of Infosys goes against it, that is, if the dollar were to weaken instead, then the increased export sales are mitigated (partially offset) by losses on the futures contract.

Hedging Interest Rate Risks

Companies can hedge interest-rate risks in various ways. Consider a company that expects to sell a division in one year and at that time to receive a cash wind-fall that it wants to park in a good risk-free investment or a company had an unexpected profit, if the company strongly believes that interest rates will drop between now and then, it could purchase (or ‘take a long position on’) a treasury futures contract. The company is effectively locking in the future interest rate.

Fair Value Hedges — The Company [XYZ] had two interest rate swaps outstanding at January 1, 2008 designated as a hedge of the fair value of a portion of fixed-rate bonds. The change in fair value of the swaps exactly offsets the change in fair value of the hedged debt, with no net impact on earnings.

XYZ Company uses an interest rate swap. Before it entered into the swap, it was paying a variable interest rate on some of its bonds. (For example, a common arrangement would be to pay LIBOR plus something and to reset the rate every six months.)

Here the Swap is receive variable and pay fixed.

Now let’s look at the impact of the swap, the swap requires XYZ to pay a fixed rate of interest while receiving floating-rate payments. The received floating-rate payments are used to pay the pre-existing floating-rate debt. XYZ is then left only with the floating-rate debt, and has. therefore. managed to convert a variable-rate obligation into a fixed-rate obligation with the addition of a derivative. Here. we can call this as a perfect hedge: The variable-rate coupons that XYZ received compensates for the company’s variable-rate obligation.

Commodity or Product Input Hedge

Companies that depend heavily on raw-material inputs or commodities are sensitive, sometimes significantly, to the price change of the inputs. Airlines, for example, consume lots of jet fuel. Historically, most airlines have given a great deal of consideration to hedging against crude-oil price increases — although they need to be very careful and a great forecasting before going for such a strategy because the strategy itself would cost them a lot.

Conclusion

We have reviewed three of the most popular types of corporate hedging with derivatives. There are many other derivative uses, and new types are being invented. The derivatives we have reviewed are not generally speculative for the company. They help to protect the company from unanticipated events: adverse foreign-exchange or interest-rate movements, and unexpected increases in input costs. The investor on the other side of the derivative transaction is the speculator. However, in no case are these derivatives free. Even if, for example, the company is surprised with a good-news event like a favourable interest-rate move, the company (because it had to pay for the derivatives) receives less on a net basis than it would have without the hedge.

Warren Buffett’s stand is famous: he has attacked all derivatives, saying he and his company view them as time bombs, both for the parties that deal in them and the economic system.