How Call Options Work I The Basics

Post on: 22 Июнь, 2015 No Comment

P reet, the full time Bay Street stock broker and blogger at WhereDoesAllMyMoneyGo . has written another great article for MDJ about How Call Options Work. I initially planned to write the article, but thought it would be best to have an article from a trader experienced with the ins and outs of options. This is Part 1 of a 3 part series.

Thanks again to Frugal Trader for asking me to create a guest post for his readers. I was asked to create a primer on call options this time so here is my shot at it I hope you find it informative!

The first thing to note is that OPTIONS when used in the context of CALL and PUT OPTIONS are different from EMPLOYEE STOCK OPTIONS which are issued by companies to their employees. EMPLOYEE STOCK OPTIONS are an employee benefit that represents the ability to purchase treasury shares right from the company at a specified price for a specified period of time (usually 2 years or thereabouts). This post is not about employee stock options.

No, this post is about the other type of options of the CALL option and PUT option varieties. Options are both a very simple concept and at the same time a very versatile and complex portfolio management tool. There are very conservative option strategies and VERY risky option strategies. More press is given to the riskier strategies unfortunately, and quite frankly I think most investors should explore the use of the more conservative options strategies for their own portfolios as I will attempt to show. Every time I explain some simple option strategies to investors, eyebrows are raised and questions are asked There just isnt enough information and investor education on options out there.

Lets begin by talking about Call Options today. Options are a type of derivative and a derivative is a security whose value is derived from the value of something ELSE. What it means in this case, is that when you purchase a call option on a stock you havent actually bought the stock, but the value of the option is related to the value of that underlying stock. Ill spare you the academia from this point on and just get right to the nitty-gritty J

When you buy a Call Option, you are buying the OPTION to purchase a stock in the future for a set price, for a set period of time. This would be advantageous if you thought the stock was going to go up in the future. Also of note, is that call options provide for a degree of leverage (allowing you to increase your potential returns) and also limit your potential losses.

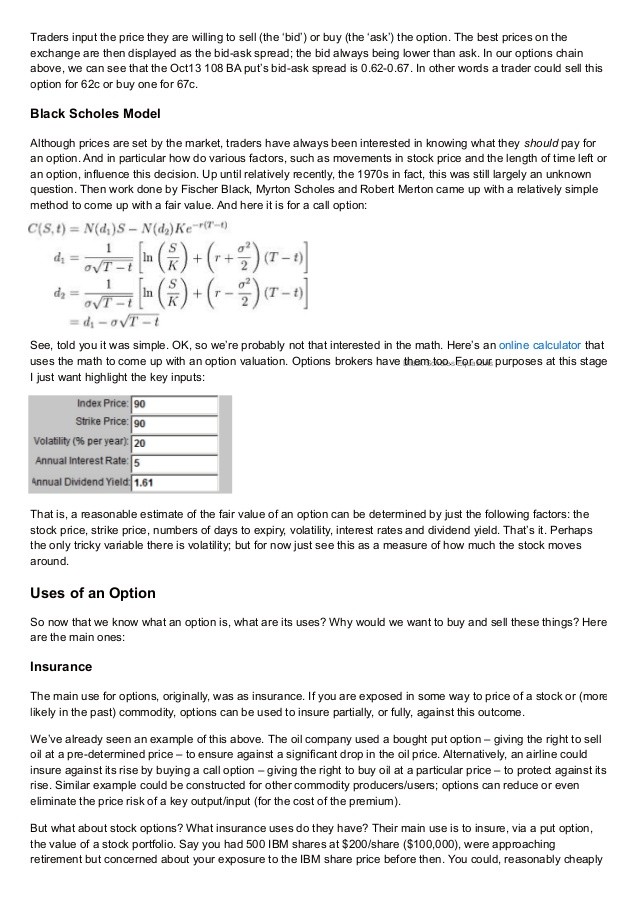

Lets examine a typical Call Option quote on the stock ABC, which has a current stock market price of $50: