How A Put Option Strategy Can Beat The Market Regardless Of Direction

Post on: 29 Май, 2015 No Comment

Options are the rights to either buy or sell a particular underlying equity. Put options in particular are the rights to sell a particular equity. If the investor is long a put option (investor = bearish), he has bought the right to sell a particular equity at a particular price up until a particular time. If the investor is short a put option (investor = bullish), he will have sold the right for someone else to sell him a particular equity at a particular price up until a particular time. These rights have value, and such derivatives can be used protectively for investors who understand how to use them.

Investors largely looking to take bullish stances in broad-based index funds may want to consider using a simple options strategy of selling cash-secured put positions. This strategy has several unique advantages that offer both insurance-like characteristics while capturing the growth potential of the underlying equity. This elementary play is best understood through the following example, which for the sake of simplicity ignores commission expenses:

SCENARIO:

- The current price (1/17/2012) of the SPDR S&P 500 (NYSEARCA:SPY ) is $129.34. John sells to open one put contract with a strike price of $125/sh for the underlying equity of SPDR S&P 500. The expiration date he chose was for December 31, 2012. Upon completing this transaction, John immediately received $1,057. Simultaneously, he opened a short position for the option at $10.57 and holds in reserve of his own cash in the amount of $12,500.

RESULT:

If John does nothing for the remainder of the year, the following will occur:

- If the price of SPY on January 1, 2013 is above $125/share, John will keep the $1057 and the short put position will close unexercised.

- If the price of SPY on January 1, 2013 is below $125/share, John will keep the $1057 and the short put position will be exercised, forcing John to buy 100 shares of SPY at $125/share from the reserve of $12,500 he was holding onto. Effectively, John will have bought 100 shares at $114.43/share.

CONCLUSION:

Therefore, utilizing one transaction, John has effectively either gained $1057 (8.45% return on cash held) or bought shares at a discount of almost 12% off the current share price one year from now.

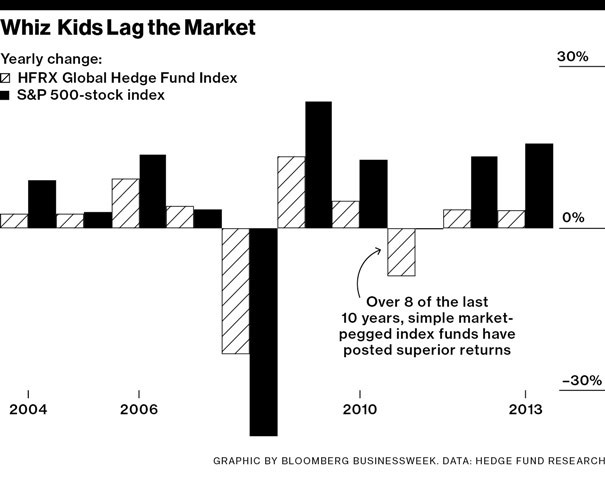

When one considers the fact that the annualized return for the S&P 500 from January 1, 2000 to December 31, 2011 has only been 2.42%, this basic options strategy shines quite brightly. Not only did the strategy beat the market in the past dozen years, but more importantly, it did so irregardless of the direction of the market.

Several inherent advantages are built inherently into this particular strategy:

1. Time Decay. Much of the value of the transaction carries the time cost for the buyer of the option to use his right. Therefore, if SPY were to trade at the same price of $129.34 in June 2012, we would expect the value of the short position to be significantly less than it was in January, which is advantageous to the investor.

2. The Ability to Buy Back. All options of a similar nature are considered equal and able to be offset. Let us pretend that SPY rose to $135/share in February. The investor will likely have seen his short position in the option drop a relatively similar amount to around $6 from its original $10.57. Instead of waiting until January 2013, the investor can take profits now if he so chooses by buying to close the position at the current market price.

3. Flexibility. The strike price of $125 was an arbitrary price. Options allow investors to set their strike prices and their expiration time frames and allow the market to set the values of those positions. Unlike an equity position, options come with the ability to choose values at which to operate, thereby offering tactical positioning.

4. Lower Cost of Entry. By selling an option, investors can often lower their cost of entry into the underlying equity position where the option to eventually be exercised. As a result, the investor can guarantee a lower cost of entry than the current price.

5. Upfront Return. Cash is king. By selling a secured put position, the investor gets the maximum return upfront, which could be used to gain additional interest elsewhere, if so desired. For margin trading accounts, the held cash reserve also retains additional benefits.

It is important to remember that options work best when there is a thriving market available for investors. Popular ETFs provide inherent stability while offering a large enough trade volume to effectively enter and exit a given option position. New investors to options in particular would do well to avoid popular leveraged ETFs such as the ProShares Ultra S&P500 (NYSEARCA:SSO ) or the Direxion Financial Bull 3X Shares (NYSEARCA:FAS ). As the trading action is already accelerated with the use of options, the increased volatility in SSO or FAS may be a bit reckless. The following list of ETFs are ideal for effectively selling cash-secured put options on a broad-based index fund. Current prices and last options’ expiration time frame were noted as of January 17, 2012.