Horizontal and Diagonal Spread Strategies

Post on: 16 Апрель, 2015 No Comment

Related Combined Techniques: Creative Risk Management articles

Horizontal and Diagonal Spread Strategies

Vertical spreads involve options with identical expiration dates but different striking prices. Another variation of the spread involves simultaneous option transactions with different expiration months. This strategy is called a calendar spread. or time spread .

The calendar spread can be broken down into two specific variations:

- Horizontal spread in this strategy, options have identical striking prices but different expiration dates.

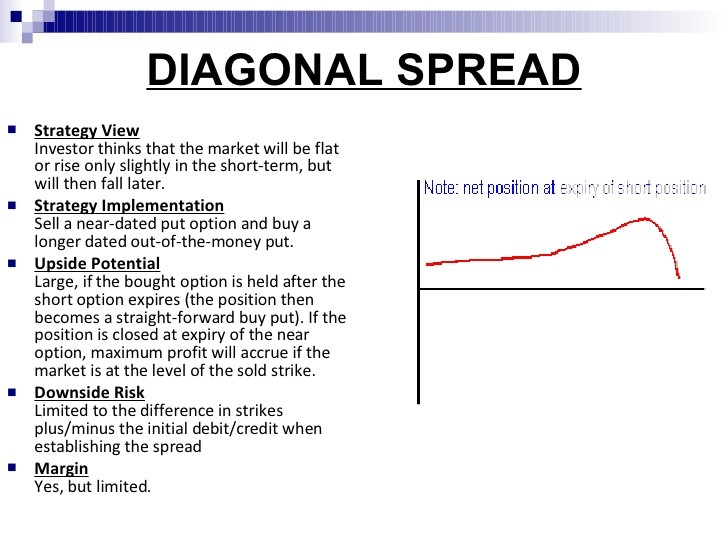

- Diagonal spread in this strategy, options have different striking prices and different expiration dates.

Going Horizontal: You create a horizontal calendar spread. You sell one March 40 call for 2, and you buy one June 40 call for 5. Your net cost is $300. Two different expiration months are involved. The earlier, short call expires in March, while the long call does not expire until June. Your loss is limited in two ways: by amount and by time. This strategy is illustrated in Figure below. If, by March expiration, the first call expires worthless, you have a profit in that position and the second phase goes into effect. The short position no longer exists. If the stock rises at least 3 points above striking price before expiration, the overall position is at breakeven; above that, it will be profitable.

The Diagonal View: You create a diagonal calendar spread. You sell one March 40 call for 2, and you buy one June 45 call for 3. Your net cost is $100. This transaction has different striking prices and expiration months. If the earlier-expiring short position is exercised, the long call can be used to cover the short call. In other words, as owner of the long position, you can exercise the call when your short position call is exercised. If the earlier call is not exercised, the overall risk is restricted to the net cost of $100. After expiration of the short call, breakeven is equal to the long calls striking price plus the cost of the overall transaction. In this case, the net cost was $100, so the breakeven price (not allowing for trading costs) is $46 per share. This is illustrated in Figure below.

Profit and loss zones for an example of diagonal calendar spread.

Giving different spread strategies the names vertical. horizontal. and diagonal helps distinguish them from one another, and makes it easier to visualize the relationships between expiration and striking prices. These distinctions are summarized in Figure below.

Comparison of spread strategies.

Devices like the horizontal spread sometimes come about in stages; for example, the long, later-expiring side can be opened to avoid exercise in a previously established short position.

Avoiding Exercise Horizontally: You sold a covered June 45 call last month. The stocks market value is above striking price. You do not want to close the position because that will create a loss, and you also would like to avoid exercise. By buying a September 45 call, you create a horizontal spread. If the June 45 call is exercised, you will be able to use the September 45 call to fulfill the assignment. However, if the call is not exercised, you own a later-expiring call that has its own potential for profit within a time span of an additional three months.

A diagonal spread combines vertical and horizontal features. Long and short positions are opened with different striking prices and expiration dates.

Reduced Risk with Diagonal Strategies: You create a diagonal spread. You sell a March 50 call for 4, and you buy a June 55 call for 1. You receive $300 net for these transactions. If the stocks market value falls, you will earn a profit from the decline in premium value on the short position. If the stocks market value rises, the long position calls value rises as well, offsetting increases in the short call. Maximum risk in this situation is 5 points; however, because you received net premium of $300, the real exposure is limited to two points (five points between striking prices, less three points net premium). If the earlier, short call expires worthless, you continue to own the long call. With its later expiration, you have potential profit for three more months.

This variety of spread becomes far more interesting when combining LEAPS options for the long side and shorter-term options for the short side. Because so much time is involved in the LEAPS option up to three years you have far more flexibility in designing, modifying, and developing strategies for horizontal and diagonal spreads.

For example, it is likely that by selling short-term options against the longer-term LEAPS, the strategy can be repeated many times. Enough premium income could be generated by selling calls to offset the cost of the long-position LEAPS. As the stock price changes over time, the corresponding horizontal or diagonal differences can be adjusted as well. The result could be to maximize premium income without risking exercise. Remember, the greatest decline in time value occurs in the last quarter of an options life span. So you maximize this strategy by timing to offset long positions: You would seek short positions with higher striking prices (for calls) or lower striking prices (for puts).

The box spread adds complexity but opens the possibility for variations on this theme. A box spread employing long-position LEAPS and a series of offsetting shorter-term option short sales enables you to modify the range as the stocks price moves in either direction.

Altering Spread Patterns

The vertical, horizontal, and diagonal patterns of the spread can be employed to reduce risks, especially if you keep an eye on relative price patterns and you recognize a temporary price distortion. Going beyond reduction of risk, some techniques can be employed to make the spread even more interesting. Combining LEAPS options with shorter-expiring options also increases the flexibility in spread strategies. In the best possible outcome, you will be able to profit both from spreads and on the underlying stock.

Adapted from Getting Started in Options.