Home Mortgage Interest Rates Affect Housing Prices

Post on: 20 Май, 2015 No Comment

by Mike Holman

Were obviously coming off of a period of very low interest rates. When rates were low, I thought to myself now is a great time to buy a house, since I can get a great rate on my mortgage. Amusingly, the truth of this statement made it incorrect.

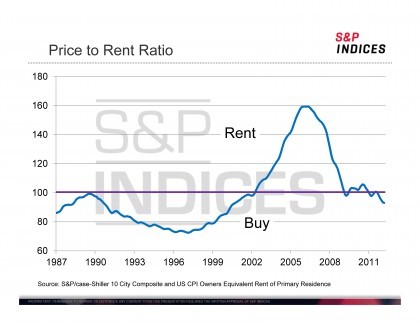

When interest rates are low, you arent the only one who notices. Many people decide its time to buy their first property (or upgrade to a larger property), and consequently prices get driven up: supply and demand. When interest rates are high, no one wants to buy. This causes people who HAVE to sell to either give a super deal, or to provide vendor financing at a more reasonable interest rate, which is itself a super deal.

Much as buying stocks when the market is down makes sense, often buying real estate when interest rates are high makes sense for similar reasons. With the stock market, the masses have been scared off, so you dont have competition. Similarly with real estate. Bidding wars happen when lots of people can afford to buy.

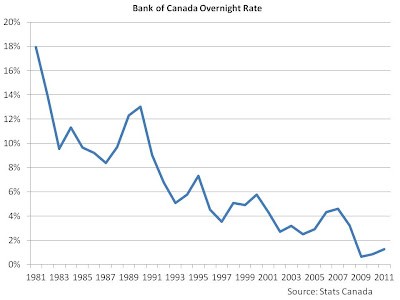

In theory the best approach might be to buy when interest rates are high, get a variable mortgage, then when you renew if rates are lower, borrow as much as you can and get a fixed rate. If youre renewing when rates are high, obviously get another variable rate mortage. Supposedly the long-term average interest rate in Canada is around 10%, so you can use that to decide when rates are high or low. Personally I like fixed-interest mortgages, just because it helps me plan my cash flow better. I realize Im supposedly paying more for this, but as far as insurance goes I feel like its pretty cheap. If my mortgage was above 10%, theres no way I would consider a fixed-rate mortgage (variable would be totally the way to go at that point).

You could also try to sell when interest rates are low, since thats probably when there will be the most buyers available and you should get the best price.

If you can afford a big down-payment during high interest periods, not only would putting the money into your property be a good idea (since high interest periods also have high inflation and real estate is a great inflation hedge), but since youd have a smaller mortgage, you wont be paying as much at the super-high interest rate. Alternatively you could make the case that a big mortgage is still worthwhile, since you can benefit from the inflation (and if you have a variable mortgage, youll get immediate advantage when rates drop). Obviously dont buy more house than you can afford!

You still need to be a savvy buyer and negotiate hard. Paying a higher rate due to mortgage insurance or long amortization isnt all that helpful (this is an expensive way to purchase a house for people who dont have any other options). If you pay top dollar for a property in a high-interest environment, the results wont be pretty (although the seller will probably be laughing all theł way to the bank).