HighYield Bond ETFs

Post on: 11 Июнь, 2015 No Comment

Bond ETFs News:

Wall Street’s fear gauge, the CBOE Volatility Index, has remained quiet despite the market’s recent choppiness on fiscal cliff fears and Europe’s debt crisis flaring up again. However, popular high-yield bond ETFs are telling a different story.

The VIX fell 7% during Monday’s stock rally and is hovering near multiyear lows. The index tracks S&P 500 options to measure the market’s expectations of volatility for the next month, and tends to rise when investors panic.

The VIX is almost “sleepwalking” and even the entire post-election sell-off in domestic stocks couldn’t get the fear index to its long term average of 20, says Nicholas Colas, ConvergEx Group chief market strategist.

Rather, it is U.S. high-yield bonds where options traders see the greatest potential for increased volatility in coming weeks. The implied volatility for this asset class is up 64% over the past month, versus an essentially flat VIX over the same period, he notes.

‘Tis the season

There are several exchange traded products designed to track VIX futures contracts. They let investors hedge long portfolios or speculate on market pullbacks. The largest one, iPath S&P 500 VIX Short Term Futures ETN (NYSEArca: VXX). slipped to a new all-time low on Monday. [‘Subdued’ VIX ETFs Suggest Complacency]

“Part of this, truth be told, is seasonal. In point of fact the last two weeks of December are rarely a period of outsized volatility. Options traders know this and rarely bid up volatility ahead of these end-of-year doldrums,” Colas wrote in a note Tuesday.

However, based on implied volatility, high-yield bonds have seen “an outsized change in their expected risk profile in the last month,” he added. “That would be like the VIX moving to 24, instead of its current reading of 15.”

‘Hunt for yield’

Indeed, options traders are placing a record volume of bearish short bets on SPDR Barclays High Yield Bond (NYSEArca: JNK). the second-largest ETF for junk bonds. JNK and iShares iBoxx High Yield Corporate Bond (NYSEArca: HYG) have seen outflows of more than $1 billion combined so far this month. [High-Yield ETFs Suffer Outflows]

Colas, the ConvergEx strategist, has these observations on what high-yield bond ETFs are currently saying about the overall market:

- High yield bonds have been a favorite of retail and institutional investors since the March 2009 lows for risk assets. Over the last three years, for example, U.S. listed ETFs have seen $21 billion of new money into funds dedicated to this investment class.

- Sentiment about this asset class has turned south more recently, with $1.6 billion leaving these same funds thus far in the fourth quarter of 2012. If you exclude internationally-focused funds and limit the analysis to ETFs which focus on the U.S. market, that number moves closer to $2 billion in outflows. In just the last week, $852 million of capital has left high yield bond ETFs.

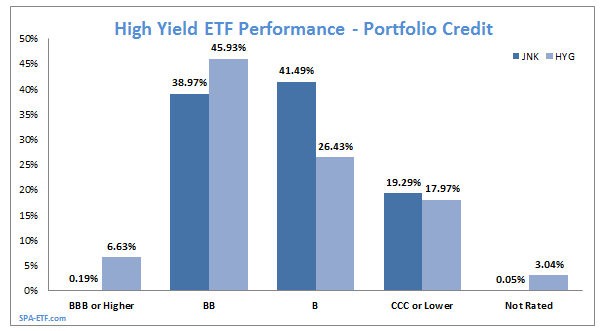

- Two ETFs – the iShares iBoxx High Yield Corporate Bond Fund (HYG) and the SPDR Barclays High Yield Bond ETF (JNK), represent just over 80% of all high yield bond fund assets under management. Unlike many equity indices, neither has any individual position weighting over 2.0%. They are, in short, reasonable proxies for the state of the high yield market generally.

- The only question that matters, therefore, is whether the market’s concern over near-term volatility in high yield bonds is a “Canary in a coalmine” warning. High yield bonds are, ultimately, very much like equities. The cash flows of the business they capitalize must cover the coupon for the bond as well as any necessary capital expenditures and working capital. And, unlike “Reported earnings,” the operating results of these enterprises must actually convert into cash flow. Equity markets can be fooled on occasion into mistaking one for the other; high yield markets never fail to spot the difference.

- My inclination is to think that options players may well be right on this call, but they are also early. Just as with publically held companies, high yield issuers have done yeoman’s work in the past four years improving their cost structures. Any downturn in economic growth – as a result of a badly handled Fiscal Cliff or simply the next slowdown for the U.S. economy – will filter through highly levered balance sheets and hurt the value of these bonds. But to place that bet right now seems premature. The hunt for yield is an overarching theme of the last few years, and barring a truly epic meltdown, investors will be looking for opportunities in high yield as we enter 2013.

iShares iBoxx High Yield Corporate Bond

Full disclosure: Tom Lydon’s clients own HYG, VXX and JNK.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.