High Frequency Trading and the Markets

Post on: 16 Март, 2015 No Comment

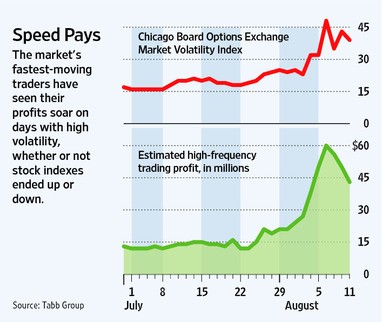

High frequency trading is the practice of using high speed computers and automated programs to move in and out of trades very quickly. High speed trading is typically performed by large institutional trading firms which may hold positions as briefly as a few seconds or even a fraction of a second, and seek to make profits on very small shifts in price.

The supporters of high frequency trading believe it makes the markets more efficient. They argue that it is a natural evolution of computerized trading, which replaced manual transactions and pit trading in the 1990s, and benefits individual investors using real-time trading platforms such as those used in the classrooms at Online Trading Academy. These platforms allow traders to see their transactions executed almost instantly and at commissions that are far lower than in the old days of manual trading.

But critics have blamed high frequency trading for increasing price and volume volatility in the markets, including the “Flash Crash” of May 2010 in which the DJIA fell nearly 1,000 points in a few minutes before recovering. High frequency trading firms rely on complex order types which, while available to anyone, are usually too complex for an average trader to understand and execute. Mark Cuban, who made his fortune in technology before he became known as an NBA basketball team owner, has called high frequency trading “the ultimate hacking”.

As a result of these concerns, regulations have been proposed in France, Germany and the European Union to reign in the practice—either by requiring the high frequency trading firms to increase liquidity, or to leave the markets altogether. The Wall Street Journal quoted Larry Tabb, founder and CEO of the research firm Tabb Group, as he was about to testify before a Securities and Exchange Commission panel in October 2012: “The macro goal of these rules seems to be to slow down the markets, decrease speculation and intermediation, reduce gaming and curtail short-term equity trading profitability, but if these rules are enacted, I’m not sure that we will experience the perfect market that regulators are hoping for.”

Tabb has also suggested that high frequency trading firms can counteract criticism through being more open in their practices (many are “very quiet” because they don’t have clients) and supported a Consolidated Audit Trail for trading as proposed by the SEC. “The consolidated audit trail is at the heart of the problem with US equity markets. Without the CAT the regulators are flying blind and can’t say one way or another that the market is fair or unbalanced. It is like a ref trying to call a game blindfolded and from outside the arena. Without the CAT it becomes impossible to know who was playing fair and who was playing street ball.”