Hedging Currency Risk

Post on: 6 Август, 2015 No Comment

Over the past couple of years, volatility in the currency-exchange markets has made life tough for everyone who’s involved with foreign currencies. Any executive or entrepreneur dealing with foreign currencies should know about hedging currency risks since it exposes a business to various new risks like exchange risks, interest rate risks, foreign exchange valuation exposure, etc. To counteract all these foreign exchange related risks, one must learn all about them.

Hedging Currency Risks

It is the act of reducing or negating the risks that arise out of changes in the prices of one currency against another. In simpler words, if you had a certain amount payable in dollars in two months’ time and had planned accordingly for it, only to find out that the dollar has appreciated with respect to your home currency, you’d be shelling out much more when the payable actually became due. The strategies that help in countering this risk of unexpected increase in payable and decrease in receivables come under the ‘hedging currency risks’ purview.

Note: There are three types of foreign currency risks, namely transactional risk (deals with changes in foreign currency exchange prices and their impact on a firm’s cash transactions), translation risk (assesses the effect of changes in exchange rate on the financial condition of a company) and economic risk (measures the impact of exchange price changes on a firm’s cash flow).

Options for Hedging Currency Risks

There are many ways to hedge foreign currency risks. You can use any of these foreign currency hedging methods to hedge foreign exchange risks and also for other risks, like for hedging interest rate risks.

Internal Hedging Strategies

Internal tactics like leading and lagging can ensure that you utilize the exchange rate movements to ensure that you always pay less and earn more. That is, when you can lead payments (pay them in advance) when you expect the home currency to depreciate with respect to the foreign currency. Similarly netting the payments and receipts that are in the same foreign currency will also help reduce the exposure.

Forward Transactions

Hedging currency risks with forward transaction is a relatively easy to implement hedging strategy. In this, the currency payment or receipt is locked in at a particular exchange rate for a pre-specified rate in the future, irrespective of what the actual market exchange rate at that time is. The idea behind forward contracts is that as the exchange rate is locked on both sides, both, the creditor and the lender do not have to worry about fluctuations in the income and expenditure respectively.

Currency Futures

Currency futures are the same as forward contracts and are just for locking in an exchange rate for a pre-set date of the transaction in the future. The advantage that currency futures have over currency forwards is that as these are exchange traded, counter-party risk is eliminated. It also helps that currency futures are more transparent in their pricing and are more easily available to all market participants.

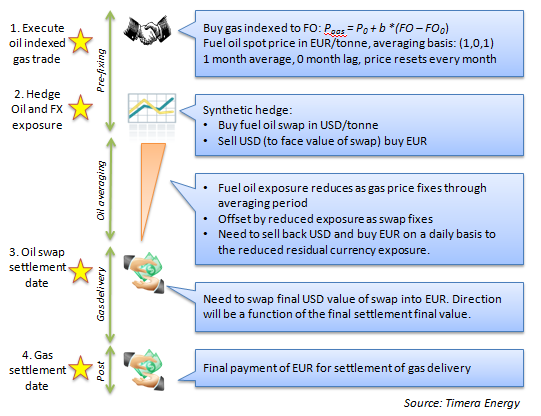

Currency Swaps

These exchange rate transactions are real-time transactions where one thing is just exchanged for another. These swaps can also be used for hedging interest rate risks where two parties can exchange their fixed and floating interest rate obligations with each other.

Currency Options

Currency options are financial instruments that give the owner the right but not the obligation to buy or sell a specific foreign currency at a predetermined exchange rate. While a call option gives the holder the right to buy the currency at an agreed price, a put option gives him the right to sell it at an agreed price, irrespective of an unfavorable market price for the same.

These were some of the traditional methods for hedging currency risks. Here are some of the newer strategies to achieve the same, that some companies like the UBS have brought forward for their customers.

Cancellable Forward

Some companies allow for cancellable forwards which are instruments that allow a regular currency cash flow to be hedged on a monthly rolling basis. The instrument requires no payment of premiums and gives better rates than those in the forward markets, but on the downside, the cash flows are not guaranteed and are always less favorable than the spot rates.

Range Reset Forward

This is an instrument based on market expectations and is perfect for you, if you think that the exchange rates between two currencies are going to be within a certain band or range. As long as the exchange rates remain in your predetermined range, you can effectively hedge currency risk by getting a favorable forward rate. This is a perfect plan to help protect against a worst case scenario and also does not require premiums. The flip side is that, if the prices fall below or shoot above your expected range, you may have to shell out a price that is actually more unfavorable than even the worst case scenario.

Risk Reversal

This hedging currency strategy provides protection against losses in the complete sense of the word. Unfortunately, this strategy limits participation in a favorable market with a cap and sometimes has rates that are worse than the actual forward rates being quoted in the market. Once again, the benefits are that you do not have to pay premiums, you are completely protected against the worst possible scenario and you have the option to restructure your risk reversal at anytime.

Kick Into Forward

Last but not the least, this hedging currency strategy, gives hedging protection for downside risk and conditional participation for upside price movements. While you benefit up to the kick-in level with no initial premiums, full hedging cover and restructuring facility, you are in for a worse off rate if the kick-in level is actually reached.

Companies around the world have long used financial instruments like futures contracts and currency swaps and hedged their currency exposure. But now, as debt markets around the world open to foreign borrowers, a growing number of firms are using bonds for hedging due to improving local economies and accessibility to more borrowers. Hedging is a very important step in financial planning and if done well, serves well in the long run financial management.