Hedge Funds Go Retail

Post on: 15 Май, 2015 No Comment

Hedge funds used to exist only for a very small demographic. They were the spoiled child of the ultra-rich, and were kept isolated and non-regulated. But over time, hedge funds have been breaking free and seeking out individual, retail investors. What will this do to an industry that has been largely without regulation or transparency. and should it be a viable option for retail investors at this point in the industry’s transition? This article will break down the current state of the industry and present some parting thoughts for investors considering adding alternative investments, such as hedge funds and private equity funds, to their portfolios.

Who Is Using Hedge Funds?

The hedge fund’s increase in popularity can be attributed to several factors. Some of the largest pension funds in the world have publicly declared that a portion of their assets would be put to use in hedge funds.

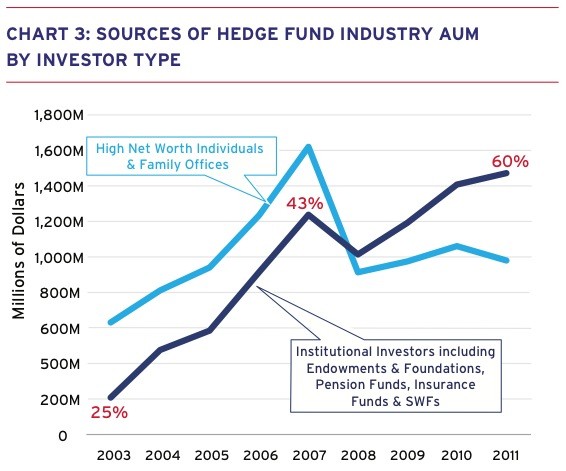

While the pensions are not devoting a large percentage of their portfolios. given the sheer size of the pensions themselves (California Public Employees’ Retirement System currently manages well over $200 billion in assets), this still amounts to a huge pool of assets for fund managers. Research firm Tremont Advisors estimates that total assets under management for hedge funds is currently in the range of $1.2 trillion, of which about 25% is made up of institutional money.

Secondly, many top economic strategists and money managers have been leaving their posts at notable asset-management and wire house firms to start hedge funds, all with high levels of publicity and investor demand. In addition, the bear market of 2000-2002 scared many investors, both institutional and retail, into seeking out investment opportunities that do not move lock-step with equity indexes. Hedge funds provide this opportunity. as most are not benchmark -driven, instead looking to create consistent and positive returns, year in and year out.

Absolute Vs. Relative Returns

Most hedge funds and private equity funds are focused on absolute returns as opposed to relative returns. For example, consider a year when the S&P 500 is down 10% or more. If a large cap mutual fund were to be down only 2 to 3% in that same year, most investors would consider that a good year, even though they had lost money. Most retail investors are trained to think in this relative performance way, but most hedge fund managers are simply looking to make money every year. Because of the focus on absolute returns. hedge funds may trail equity indexes during bull market years. It is during bear markets. however, that hedge fund indexes have shown their most promising results.

Hedge funds also have an inherent power at their disposal; like boxing without the gloves on, hedge funds are best known for their ability to use leverage. purchase derivative securities and have an extremely high turnover, all in the search of alpha — the investing promised land of positive returns that can’t be explained by overall stock market gains.

The chart below shows the growth of two popular hedge fund indexes (the blue being the HFRI Fund Weighted Composite Index and the green series being the Credit Suisee/Tremont Hedge Fund Index) measured against the S&P 500 index between 1994 and 2006:

In viewing the chart above, notice the returns of the three indexes during the period from 2000-2002, when major equity indexes were essentially cut in half. Hedge fund returns, on the other hand, were stable, posting marginally positive returns. And speaking of stock market returns, many pension and other institutional managers are a bit worried about the prospect of stock market returns not living up to the 12% plus per year the S&P has been earning since 1986. The long-term story on Wall Street is that returns tend to revert to the historical average, which is closer to 8%.

Most of the new fund of funds coming to market are aggregated and promoted by larger institutional managers such as Charles Schwab, Merrill Lynch and UBS, who then look to sell shares in the closed-end fund of funds to retail investors.

The Mass Affluent

In general, fund of fund managers seek investors that meet minimum accredited investor criteria established via Regulation D. such as the $200,000 annual income and $1 million net worth requirements. This is because only accredited investors can be charged performance fees by the fund, as mandated by the SEC. One common complaint among regulators is that $1 million in net worth is not the limiting factor it used to be. Regulation D is more than 20 years old; home prices are at record highs, and inflation alone has massively degraded the value of a million dollars from its original placement as the top 1.5% of households in the United States. Today, the group of potential accredited investors is large enough to have its own lexicon, being called in some hedge fund circles the mass affluent.

Fee structures and liquidity options are very different as one looks across the fund of funds landscape. While most traditional hedge funds have operated on a 1 and 20 fee structure (1% of assets, 20% of profits), funds of funds come with slightly lower performance-based fees but higher asset-based fees, in the range of 1.5% all the way to 3% of assets annually. The higher expense ratio is partly due to the layered fee structure, where not only the top-level manager is getting paid but also each underlying hedge fund. Compare these fee levels to those of the average equity mutual fund at 1.43%, and an equity index fund such as the Vanguard 500 Index, which only charges 0.18% of assets per year.

Investing strategies among hedge funds are as varied as the types of securities they use to implement them; there’s the market neutral. convertible arbitrage. long/short. event driven and global macro. just to name a few. Most funds of funds blend different investment strategies together to diversify risk and manager styles, but most of the underlying hedge funds will still adhere to the absolute return strategy.

Risks to Industry Growth — Risks to Investors

Overlapping strategies are a big concern for investors who are considering buying into a fund of funds structure; the fund of funds manager may be able to diversify the underling funds in terms of investing strategy, but it is a more daunting task to carry this through to the individual security level. If half of the underlying funds decide to make the same large bet on one security, the investor will suddenly be exposed to a large amount of company risk, and due to the lag in reporting, they may be completely unaware of the situation.

Liquidity and withdrawals are very limited within the alternative investment universe. For the large pension fund, liquidity is generally not a concern, but this is not the case for the individual investor. Most institutional money has the advantage of low liquidity requirements in their investments; they generally won’t mind if they can’t cash out their shares for two years. An individual investor, on the other hand, would be less likely to accept such an illiquid investment. To make themselves more marketable to retail investors, the new funds of funds coming to market have limited liquidity features such as quarterly withdrawal options. However, this is still a measured departure from the daily liquidity of a mutual fund or stock positions to which retail investors are accustomed.

Minimum investment amounts are still very high, although the retail funds coming to market ask for much less than the $200,000 average seen in traditional hedge funds. Most of the new funds of funds coming to market have minimum investments of $20,000 to $30,000 for investors who meet the sophisticated investor requirements.

Get into the Game with ETFs

For investors who don’t want to pony up that kind of money or don’t meet the net worth guidelines, there are some exchange-traded funds (ETFs) that use hedge fund strategies (like short selling ), such as the Schwab Hedged Equity Fund or the TFS Market Neutral Fund. In February 2007, the U.S. markets saw a rare first when Fortress Investment Group sold shares to the public in an initial public offering. the first pure-play alternative investment manager to do so.

Fund of Funds Risks

Regarding regulation, the SEC has found itself in an unenviable position, as they publicly agree that hedge funds contain good diversification benefits, but also demand a firmer regulatory environment to protect investors. This will become increasingly important as new fund structures are formed and more money flows into the investment space. Most retail hedge funds (as they have been registered with the SEC) must provide regular performance reporting to investors as well as allow themselves to be audited by securities regulators. Unlike the Global Investment Performance Standards guidelines for mutual funds, there are no established standards for hedge fund performance reporting, and because they use a number of different types of securities and employ leverage, some hedge funds cannot even provide market prices for all of their holdings.

The supply/demand status of the retail hedge fund industry is also worth noting as a risk. If demand for hedge funds continues to outpace supply, a demand-based bubble in valuations of funds of funds, relative to net asset value could occur.

As more money flows into alternative investments and hedge funds grow larger in terms of assets, overall returns could become depressed. Many renowned money managers, such as Warren Buffet and George Soros. have spoken publicly about the challenges of managing a huge pool of assets. In investing, nimbler is generally better; a fund won’t bother investing in a stock that is perceived to be undervalued if it must purchase half the outstanding shares in order to obtain a position. As hedge funds grow in size, managers with similar investing strategies may find themselves chasing after the same opportunities, eroding the value that can be extracted from any one investment thesis.

Thus far, most institutional investors have been using hedge fund investments as a proxy for fixed-income asset allocations, as the absolute return focus and low equity correlation matches up well with the fixed-income asset class. The more diversified a fund of funds becomes, the more its performance will resemble the stable returns seen in bonds and similar investments.

Conclusion

If the history of Wall Street is any indication, the retailization of hedge funds will happen; it is simply a question of how, and under what terms. Hedge funds and private equity represent a measured departure from other investment types, and that diversity is the alternative investment’s strongest selling point. With regulatory pressure on the upswing, investors may be best served by waiting out the awkward growth phase, instead seeking out funds with longer performance histories, clear financial reporting and moderate fee structures.