Gulf Keystone Petroleum Share Price

Post on: 9 Июнь, 2015 No Comment

Popular with adventurous investors

Nothing, it seems, can dampen down the long-running love affair between Gulf Keystone Petroleum and its core of loyal shareholders. Not a huge falling-out with a one-time partner (a spat that ended up spending three years in the High Court). Not an erratic share price performance that has seen the stock swing up and down in a manner that, were it a person, a spell in a care institution would be on the cards. Not even migration from the Alternative Investment Market (AIM), with its enticing tax breaks, to the more daunting environment of a full London Stock Exchange listing.

But then, Gulf Keystone shareholders are made of stern stuff, with a dash of adventurous spirit thrown in. They have to be, given their company is focused on drilling for oil in Kurdistan. That’s right, Kurdistan. The one in Iraq, currently abutting the savage insurgency that has gripped the country, one that many believe will see Kurdistan become fully self-governing. True, Gulf Keystone has been involved also in oil and gas exploration in Algeria, but announced a “strategic exit” in 2009. Perhaps Algeria did not offer enough excitement.

Finances moving in the right direction

Gulf Keystone is in the extraction business, an industry with maybe the longest lead times of any, outside perhaps agriculture and forestry. Thus the pre-tax loss of $31.84 million (£19 million) in 2013 actually suggests things are moving in the right direction when compared with the 2012 loss of $80.14 million (£47 million). The group is 13 years old, having been incorporated in Bermuda in 2001 and listed on AIM in 2004. But it was only at the end of 2007 that the Kurdistan region came into focus as what would become the company’s main area of interest.

Partnerships with regional authorities

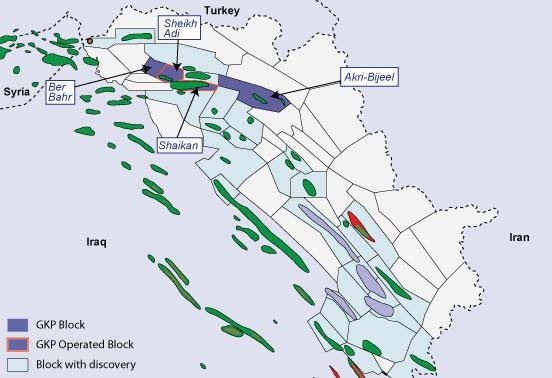

Gulf Keystone entered into production-sharing contracts (PSCs) with the regional authorities regarding two blocks of land for exploration purposes, Shaikan and Akri-Bijeel. PSCs are common in the world of oil and gas exploration; pioneered in South America and Indonesia, they represent a partnership in which the company shoulders the risk of exploration and, usually, undertakes to produce any resources that are discovered. The state is then entitled to a share of the production that varies in size from one country to another.

Two further PSCs were signed relating to the Sheikh Adi and Ber Bahr blocks in July 2009. The very next month, the company announced a “significant discovery” in Shaikan, but it was only in June last year that its plan to develop the oilfield was approved. Those long lead-in periods again. But the July 2009 discovery coincided with a High Court battle with one of Gulf Keystone’s former partners, Excalibur Ventures, which wanted an interest of up to 30 per cent of the company’s Kurdistan activities, claiming it had used its contacts in the region to introduce Gulf Keystone to the available opportunities. Legal action started in December 2010 and ended in victory for Gulf Keystone three years later, with all claims against the company being dismissed.

Again, those shareholders who had dug in for the long haul could perhaps look forward to some rewards, especially as Shaikan was now in production and global oil giants were rumoured to be interested in Kurdistan, prompting suggestions that investors could be bought out in a takeover bid. But a fresh strain on their nerves was emerging in the shape of the insurgency led by the extremist group Islamic State and the resulting threat of Iraq breaking into two or three pieces.

Unaffected by Iraq’s security situation

The fighting has raged along the borders of Kurdistan, and Todd Kozel, the company’s chief executive until July 2014, has said that “we remain alert to the current security situation in Iraq”. Furthermore, the central government in Baghdad has disputed the Kurds’ rights over natural resources, adding further to uncertainty. But plans are reportedly on track to increase production, and the number of wells in use in Shaikan is to be increased from six to 11. Furthermore, according to the International Energy Agency, production from Iraqi Kurdistan rose to 360,000 barrels a day in June, an increase of 130,000 barrels a day from May. The Kurdistan regional government said earlier this month that oil production has been unaffected so far by the fighting.

The rise of ‘frontier markets’

So-called ‘frontier markets’ have been all the rage recently, seen as more daring and risky versions of emerging markets such as China, India and Brazil. Frontier markets – in Africa, Asia and elsewhere – are “pre-emerging” and frequently have shaky institutional or political foundations. But for those who can take the pressure and the uncertainty, the rewards can be considerable. Or, as Simon Murray, Gulf Keystone’s chairman put it: “As one of the genuine early movers into the Kurdistan Region of Iraq, Gulf Keystone is a trusted and long standing partner [of the regional government] and of the people.

Analysis of the oil & gas sector

Companies engaged in the exploration for and drilling, production, refining and supply of oil and gas products.

Integrated oil and gas companies engaged in the exploration for and drilling, production, refining and distribution of oil and gas products. To see our view on the sector, Click here .

Although we don’t currently have a view on Gulf Keystone Petroleum (GKP), our preferred shares in the sector are:

BP and RDSB for lower risk options (compared to GKP) and pay attractive dividends.

We currently rate Afren as a hold, which also has as exposure to the Kurdistan Region of Northern Iraq