Guide to Stock Broker Commissions

Post on: 16 Март, 2015 No Comment

May 31, 2012 0 Comments

The next time you go shopping, take a look at your receipt. If you live in a place that has a sales tax – and chances are, you do – then you are probably already intimately familiar with having to pay a percentage of the overall bill in fees.

A stock broker’s commission is the same – a percentage of your trade added to the overall cost of making the trade. Just like with high taxes, high commissions can eat into your money and cut down on your profits.

Here, I’ll give you a quick overview of stock broker commissions and give you some advice on how to find a stock broker.

What is a Commission?

A commission is a fee, basically, that is paid to a broker in exchange for the broker helping you by submitting your trading orders to the market. There are several ways for a broker to earn a commission. Before the internet revolutionized the industry, brokers made their commissions by not only taking care of your orders (since they’re the only ones who can), but also giving you advice on which assets to pick and how to invest in them.

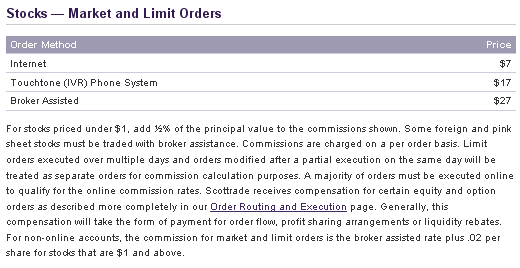

These days, though, many people who trade use online brokerages that simply take care of the stock transactions and don’t actually give advice. You can still use a broker-assisted trade, but most people don’t – primarily because they cost much more than a regular trade and low costs are some of the most attractive features about online brokerages.

A commission can be a percentage, or it can be flat rate. With online trading, a flat rate is the norm; with traditional brokerages, a percentage of your purchase is the commission.

How Are Commissions Calculated?

Commissions are calculated by either a flat rate per trade, cost per share or a percentage of the value of your trade.

Let’s say, for example, that you want to buy 100 shares of ABC for $10. If you have a flat-fee brokerage like OptionsHouse. you could pay would pay $4.95 for this trade and another $4.95 when you sell these shares down the road. A piece of advice: Multiply the stated flat fee from a brokerage by two. Since you’re probably going to want to sell these shares at some point, you might as well go ahead and factor it into your costs.

There are also brokers like Tradestation that offer the option to pay per share..

Why Commission Matters

As you can see, commissions can really eat into your profits – and fast. Every time you click that trade button, or pick up the phone and make a call to your broker, you’re being charged, and that comes directly from whatever profits you make. Even if you lose money on the trade, you still have to pay.

The best way to avoid that is to find stock brokers with the lowest commissions and the highest amount of commission-free trades in the business. After all, expensive brokers can hurt – you don’t want to have to take greater risks for higher returns just to cover your sky-high commissions!

Some possibilities are OptionsHouse who charge $4.95 per trade. E-Trade charge $9.99.

Fortunately, there are plenty of brokers with low, flat-rate trading fees. You can make trades for as low as $4.95 in some cases, and the average is only around $9.95. Plus, brokerages have gotten into the habit of offering a certain number of commission-free trades if you sign up with them. To encourage trading in ETFs (exchange-traded funds), for example, many brokerages are making those assets free of charge to trade.

Shop around and find a broker that doesn’t cost you an arm and a leg to interact with the market. You want to cut your costs as much as possible so your returns aren’t eaten alive by exorbitant fees. There’s no getting around paying high fees for broker-assisted trades; that is the cost you pay for interacting with and getting advice from a stock trading professional. But, if you are buying and selling alone, you can whittle down your costs by a pretty big margin with a little research.