Guide to Pairs Trading Part 1

Post on: 10 Апрель, 2015 No Comment

Jean Folger

Introduction

Pairs trading is a market-neutral trading strategy that matches a long position with a short position in a pair of highly correlated instruments such as two stocks, exchange-traded funds (ETFs), currencies, commodities or options. Pairs traders wait for weakness in the correlation, and then go long on the under-performer while simultaneously going short on the over-performer, closing the positions as the relationship returns to its statistical norm. The strategys profit is derived from the difference in price change between the two instruments, rather than from the direction in which each moves. Therefore, a profit can be realized if the long position goes up more than the short, or the short position goes down more than the long (in a perfect situation, the long position will rise and the short position will fall, but this is not a requirement for making a profit). It is possible for pairs traders to profit during a variety of market conditions, including periods when the market goes up, down or sideways, and during periods of either low or high volatility.

Pairs tradings origin is generally credited to a group of computer scientists, mathematicians and physicists assembled by Wall Streets Morgan Stanley & Co. in the early to mid-1980s. The team, which included computer scientists Gerry Bamberger and David Shaw, and quant trader Nunzio Tartaglia, was brought together to study arbitrage opportunities in the equities markets, employing advanced statistical modeling and developing an automated trading program to exploit market imbalances.

Central to their research was the development of quantitative methods for identifying pairs of securities whose prices exhibited similar historical price movements, or that were highly correlated. While the teams resulting black box was traded successfully in 1987 the group made a reported $50 million profit for Morgan Stanley the next two years of trading saw poor enough results that in 1989 the group disbanded.

Over the years, pairs trading has gained modest attention among individual, institutional and hedge fund traders as a market-neutral investment strategy. This is largely due to the advent of the Internet and advancements in trading technology. These two factors have helped level the playing field for individual investors, making real-time market data and powerful tools both available and affordable to more than just the institutional traders. True, the large hedge funds and institutional traders still have advantages (for example, robust proprietary systems and economies of scale). However, todays market participants whether retails traders or a team of highly-skilled mathematicians in a quant shop have access to real-time financial market data, direct access trading platforms, advanced computer modeling and the ability to automate complex trading strategies.

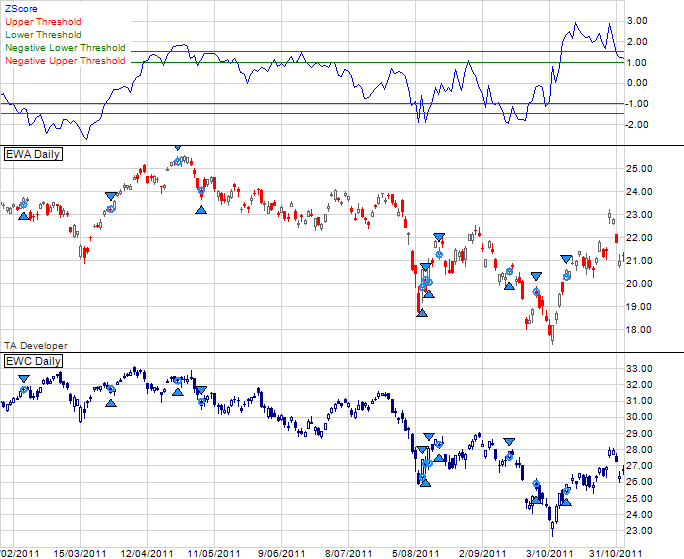

Using technology — as well as drawing on fundamentals, probabilities, statistics and technical analysis — pairs traders attempt to identify relationships between two instruments, determine the direction of the relationship and execute trades based on the data presented. Here, we introduce pairs trading, market-neutral investments, arbitrage and provide an example of a pairs trade.

Market Neutral Investing

The concept of market-neutral investing is relevant because pairs trading is a type of market-neutral strategy. Joseph G. Nicholas, founder and chairman of HFR Group, wrote in his 2000 book Market Neutral Investing: Long/Short Hedge Fund Strategies: Market-neutral investing refers to a group of investment strategies that seek to neutralize certain market risks by taking offsetting long and short positions in instruments with actual or theoretical relationships. These approaches seek to limit exposure to systemic changes in price caused by shifts in macroeconomic variables or market sentiment.

Market-neutral investing is not a single strategy. Numerous market-neutral strategies include:

Convertible arbitrage

Equity hedge

Equity market neutral

Fixed-income arbitrage

Merger arbitrage

Mortgage-backed securities arbitrage

Relative value arbitrage

Statistical arbitrage (StatArb).

The various market-neutral strategies invest in different asset types; for instance, convertible arbitrage takes long positions in convertible securities and short positions in common stock. As another example, merger arbitrage takes long and short positions in the stocks of companies involved in mergers. Market-neutrality can be achieved either at the individual instruments level or at the portfolio level. While the strategies are very different, both in terms of assets and methodology, they all fall under the market-neutral umbrella. This is because each derives returns from the relationship between a long and a short component either at the individual instruments level or at the portfolio level.

Pairs traders limit directional risk by going long on one stock (or other instrument) in a particular sector or industry, and pairing that trade with an equal-dollar-value (or dollar neutral) short position in a correlated stock (for example long $10,000 on stock A and short $10,000 on stock B), typically within the same sector or industry. Because it does not matter which direction the market moves, directional risk is mitigated. Profits depend on the difference in price change between the two instruments, regardless of the markets direction, and are realized through a gain in the net position.