Gold – Inflation Hedge Or Something More

Post on: 7 Август, 2015 No Comment

Gold serves numerous functions as an investment. Traditional reasons for investing in gold include:

Inflation

Investment market declines

Burgeoning national debt

Currency failure

War or other extreme events

Social unrest

Some would argue these entire phenomenon are related. For instance investment market declines can lead to war which can be followed by inflation which can lead to currency failure — just look to Germany in the 1920s for proof of this (albeit in a mixed order of events).

Basically, gold is protection against various ugly or undesirable societal, political, economic and financial occurrences. That reasoning broadly explains gold’s rise from $650 in 2007 to approximately $1800 today. Gold has risen over the last few years on the back of uncertainty and weakness in major global economies.

But of all the reasons given to invest in gold, the most common traditionally and the one we hear most often is protection against inflation. Inflation is often a consequence of increases in the supply of money that don’t coincide with an increase in the output of goods and services — basically, higher prices as a result of excess money competing for a fixed number of goods.

Central bankers can print all the FIAT currency they like which although not always, will generally precede inflation. Gold on the other hand is essentially fixed in supply and free from this burden. It cannot be inflated by central banks. Gold is essentially the ultimate alternative currency. It is the currency people head to when their paper currencies are falling to bits, as we’ve seen over the past few years.

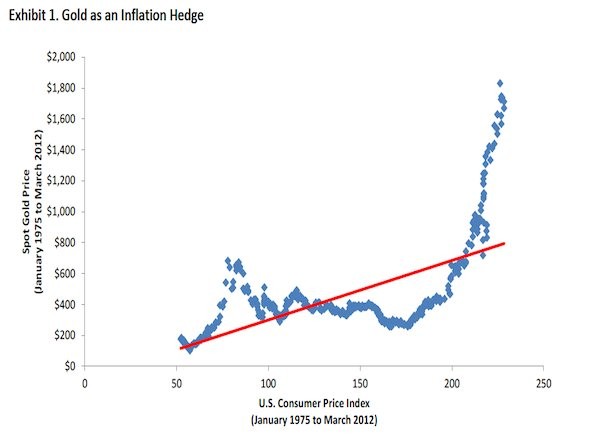

Let us investigate the relationship between inflation and the price of gold over the past 50 years to see if inflation really is the main determinant of the price of gold:

20141012.jpg?__SQUARESPACE_CACHEVERSION=1350195817185 /%

The R2 value of 0.1065 tells us 10.65% of the variation in the gold price can be described by inflation. Only one tenth of gold’s fluctuations being caused by inflation hardly gives credence to its status as a good inflation hedge.

If we restrict our timeframe to 30 years, the results are even more revealing:

20141012.jpg?__SQUARESPACE_CACHEVERSION=1350195852405 /%

The relationship actually turns negative! In times of inflation over the last 30 years, gold has generally lost value.

Clearly there are other, more important factors at play that have a greater bearing on the gold price than inflation. One must also keep in mind that during times of economic boom inflation can often run at higher levels, but gold will not be sought as an investment since stocks and other asset classes will be better performers.

We hypothesise that rather than being an inflation hedge, gold is better defined as protection against currency depreciation.

Currency depreciation is defined as a reduction in the value of one currency with respect to one or more other currencies. This is relative and speaks nothing of a currency’s absolute value. Measuring currency depreciation via exchange rates does not tell the whole story.

If for instance, the USD depreciates 20% against the Euro in a given year it has depreciated 20% only on a relative basis to the Euro. This gives us no information about the USD’s absolute value.

Imagine the Federal Reserve doubles the supply of USD tomorrow. And for whatever reason, the European Central Bank does the same and doubles the supply of Euros. In very basic supply & demand economic theory one would expect no change in the EUR/USD exchange rate and hence if that was the currency pair one used to determine the value of the USD they would say it was just as strong as it was yesterday. On a basis relative to the Euro they are correct, but on an absolute basis the dollar has depreciated significantly as a consequence of rapid monetary expansion.

The very nature of FIAT currencies necessitates perpetual increases in the supply of money, at an exponential rate. From day one, every FIAT currency has gradually depreciated. That is why goods in the early 20th century cost a fraction of what they do now, not because they were cheap then, but because the dollar was more valuable .

This is where the lines between inflation and currency depreciation are blurred. One could say that over the last 100 years the value of the USD has gradually deteriorated due to inflation. The flipside of that argument is this inflation is actually inherent in our monetary system and is attributable to the ever increasing supply of money that is a mathematical necessity with FIAT currency.

To illustrate the difference between inflation and currency depreciation we return to the 21stcentury. QE1 was launched in late 2008 as a response to the dire financial and credit market conditions as a result of the global financial crisis (GFC). QE1 involved the Fed purchasing around $2 trillion in mortgage backed securities and treasuries. The catch is they did it with newly created or printed money, and hence the money supply rose by around $2 trillion in little over a year.

Predictably, this reduced the value of the USD as it became far less scarce.

20141012.jpg?__SQUARESPACE_CACHEVERSION=1350195884802 /%

As we mentioned earlier, to gauge the actual value of a given currency one must look past its value relative to another currency.

The USD index on the above chart measures the relative value of the USD against a basket of currencies. When the Fed printed $2 trillion during QE1 the value of the USD deteriorated almost 8% relative to other currencies.

Can we say this was an absolute depreciation in the value of the dollar and not just relative to other currencies? In this specific scenario, the answer is yes. The GFC emanated in the US and hammered their economy and financial system harder and earlier than most. Hence, the Fed had to act before most other central banks did. Consequently, the monetary expansion and currency depreciation we’re now very familiar with worldwide began in the US with QE1. Therefore, the 8% net fall in the value of the USD over QE1 is indicative of an absolute depreciation in its value.

Now we’ve established QE1 = expansion of the money supply and supplementary USD depreciation, we can illustrate the difference between currency depreciation and inflation.

20141012.jpg?__SQUARESPACE_CACHEVERSION=1350195937407 /%

If currency depreciation and inflation were one and the same we’d expect a rise in inflation to coincide with QE1 (blue segment above). That did not occur to the extent many believed it would. Although inflation increased (from a deflationary environment) it still stayed low and has done for a significant period of time.

If one had of taken the traditional, one dimensional view that gold = inflation hedge they would have expected a very low return from gold over that period. Here’s what they would have missed out on:

20141012.jpg?__SQUARESPACE_CACHEVERSION=1350195977895 /%

Gold rose nearly 50%, coinciding with a 7.84% drop in the USD index, and all the while inflation remained contained or even negative.

Those that correctly identified gold’s fundamental value as protection against currency depreciation would have done very well for themselves during QE1, since, and going forward. Those that predicted low inflation and stayed away because gold = inflation hedge would be kicking themselves.

Those that claim gold = inflation hedge are not absolutely incorrect. Generally, inflation and currency depreciation are very closely linked and correlated. When one sees a spike in inflation and a corresponding increase in gold, cause and effect tells them gold = inflation hedge. What is actually happening is currency depreciation followed by, and visible in, inflation. Gold then rises with this increase in inflation. The root cause remains currency depreciation, and inflation is sometimes the most obvious embodiment of that phenomenon — so the two can be confused.

We’ve investigated the relationship between inflation and various other commodities, indexes and currency pairs. Among the commodities, corn, silver and copper were even weaker inflation hedges than gold.

The best inflation hedge we found is crude oil:

20141012.jpg?__SQUARESPACE_CACHEVERSION=1350196037326 /%

The relationship here shown by the R2 value is stronger than that of the other commodities, but still far from convincing. This tells us in times of inflation one is better off buying crude oil futures, or perhaps way out of the money call options on oil, as a hedge against diminishing purchasing power. This is quite a sensible conclusion. Crude oil is one of the most common input costs. In Western economies almost all goods have the cost of oil implicit in their price. Increasing oil prices cause an inwards shift of the short run aggregate supply curve, driving cost inflation.

Since 2007 the US’s oil consumption has tailed off somewhat, and hence oil is less of a determinant of inflation than it once was. However oil consumption has been tracking up in unison with GDP growth since 2009. Whether this trend continues is open to speculation. For the foreseeable future we predict oil will continue to be a better inflation hedge than gold. If one is worried about inflation, buy oil.

If one is worried about slowing growth, currency depreciation, political and financial certainty, unemployment and war, buy gold. Gold will generally perform given any of these scenarios. It is a far more diverse investment than oil which is best in times of inflation or strong growth. We see neither strong growth nor high inflation in the coming years.

Gold is essentially the best hedge against loose monetary policy and active currency depreciation by central banks.

The Fed’s response to lagging growth and persistent unemployment will be further rounds of QE. QE3 has been launched within the last month and sets the stage for the Fed to print at least $40 billion per month for the next three years or more. This means more monetary expansion and currency depreciation and is likely to send gold much higher, as it did during QE1 and QE2. To make the most of this please visit our website and consider subscribing to our premium options trading service. Our model portfolio has returned 500% since inception just over three years ago.

Disclaimer: www.gold-prices.net or www.skoptionstrading.com makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level or risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is not a guide nor guarantee of future success.