Gold ETF Double Gold ETF

Post on: 14 Май, 2015 No Comment

Double Leveraged Gold ETF & ETNs — Caution, Timing Is EVERYTHING!

One interesting development in Gold ETF products has been the introduction of leverage. When considering leveraged products you must realize that you are now moving from a pure Gold Storage vehicle into products that often utilize financial derivatives such as Futures, Options, Forward Contracts, Swaps etc. Some of these derivatives experience time decay, contango and other factors that affect performance. Also, when applying leverage timing is even more crucial as you will see in the charts below. Make sure you fully understand these products before investing.

Double Long Gold ETF (2x Leveraged Long)

UGL — Proshares Ultra Gold ETF is a classified as an ETF just as the name implies. According to the ProShares web site the goal of the fund is as follows: ProShares Ultra Gold seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of gold bullion as measured by the U.S. Dollar p.m. fixing price for delivery in London.

Based on their web site it appears the leverage is accomplished by the use of Gold Forward contracts and Gold Futures. As you can see the performance of UGL has been impressive since it’s inception 12/1/2008 strongly out perfmorming GLD. In most stock accounts a similar result could’ve been achieved by purchasing a traditional Gold ETF on margin, but the unique characteristic of Leveraged ETFs is that it allows investors to apply leverage in cash accounts (IRAs etc.) as well.

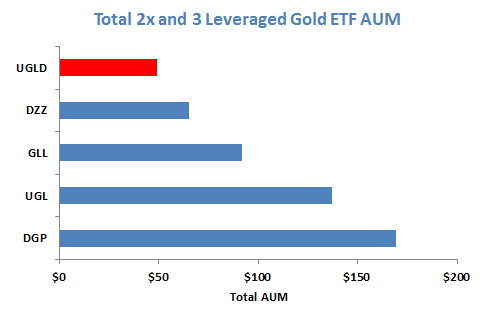

UGL has an annual expense ratio of .95% (95 basis points) and currently has a daily average trading volume of 164,208 making it a liquid investment but not as actively traded as DGP.

UGL VS. GLD Since Inception

Chart begins on UGL inception date.

Since financial derivatives are used as opposed to simple gold storage the annual expense ratio is more than double at .95% (95 basis points).

Double Long Gold ETN

DGP — PowerShares DB Double Long Gold ETN is an exchange traded note that attempts to provide 200% of the daily performance of Gold Bullion similar to the Gold ETF — UGL

DGP has an annual expense ratio of .75% (75 basis points) and currently has an average daily trading volume of 841,842 making it the most liquid double short gold product.

When you look at the following chart it would appear that UGL is far superior to DGP since if you bought DGP on it’s inception day on 2/27/2008 and held it until today you would have only gained approximately 30% or slightly outperformed GLD. However, this is very misleading, it’s all a matter of timing!

DGP VS GLD since inception

Time Frame Change: If you change the time frame of the DGP chart to begin on the inception date of UGL (12/1/2008) you can see that DGP has actually performed very similar to UGL over the same time period.

Chart begins on 12/01/2008 instead of fund inception date

What does this mean? This means that Timing Is Everything if you are going to purchase 2x Gold ETFs. As you can see right after DGP was launched in February of 2008 gold went through a serious deflationary correction. Between 2/28/2008 and 12/01/2008 gold went through a sharp correction which caused DGP to lose over 1/2 of it’s value. It has taken a long period of out performance to overcome that tremendous deficit.

In fact, when using the same exact time frame you can see that DGP (illustrated by the brown line) has actually slightly out performed UGL. Which you never would’ve guessed had you simply examined their performance since inception. DGP has a 20 basis point lower annual expense ratio so that could be a contributing factor as well.