Global Sector Rotation Low Volatility

Post on: 23 Апрель, 2015 No Comment

Project Description

The Global Sector Rotation Strategy (GSRS) is a good diversification to our other strategies. The strategy invests on a monthly basis in the top two performing global sectors. Global sectors ETFs normally present well-defined long lasting up and down trends which makes them fit well in rotation strategies. Another advantage of the Sector Rotation Strategy is, that even in sideways going makets you still find outperforming sectors.

The strategy gives you the possibility to invest in two different investment styles (the monthly strategy email shows you both strategy rankings) due to different risk weighting of the ETFs. The low volatility/risk strategy or the aggressive strategy. The low volatility sector rotation strategy has only half of the volatility of normal global market ETFs like SPY (S&P 500) or FEZ (Euro Stoxx 50). This strategy has only a slightly higher volatility than our Bond Rotation Strategy BRS and is a good choice for cautious investors. Another advantage of this strategy is that it invests normally in very liquid ETFs like for example IXJ (Global Healthcare Sector).

The second strategy is the aggressive sector rotation strategy. This strategy tries really to identify the top two performing sectors. These sectors are normally smaller sectors represented by ETFs with higher volatility. For example in 2003, the strategy was invested several month in the Global Solar Energy ETF TAN. TAN performed more than 100% in 2003, but the volatility is 4x the volatility of the Global Healthcare Sector ETF IXJ. The aggressive strategy can generate very high returns during some good months, but you will also have to accept some month with quite high losses.

The 27 Sector ETFs and 5 bond ETFs are:

During market corrections the strategy will invest in:

Risk and Performance Profile

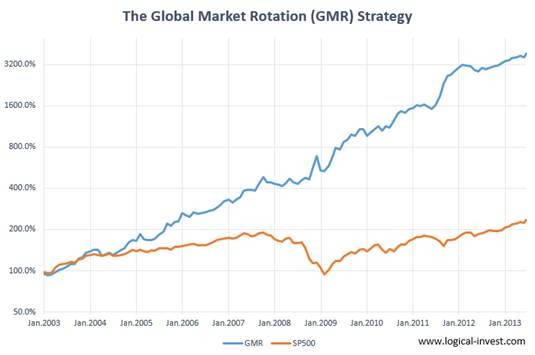

Note: This chart and table shows the core mechanical strategy without advanced execution options offered to our subscribers through our newsletter. See full performance statistics below.

The Global Sector Rotation Strategy (GSRS) is a good diversification to our other strategies. The strategy invests on a monthly basis in the top two performing global sectors. Global sectors ETFs normally present well-marked long lasting up and down trends which makes them fit well in rotation strategies. Another advantage of the Sector Rotation Strategy is, that even in sideways going makets you still find outperforming sectors.

The strategy gives you the possibility to invest in two different investment styles (the monthly strategy email shows you both strategy rankings) due to different risk weighting of the ETFs. The low volatility/risk strategy or the aggressive strategy. The low volatility sector rotation strategy has only half of the volatility of normal global market ETFs like SPY (S&P 500) or FEZ (Euro Stoxx 50). This strategy has only a slightly higher volatility than our Bond Rotation Strategy BRS and is a good choice for cautious investors. Another advantage of this strategy is that it invests normally in very liquid ETFs like for example IXJ (Global Healthcare Sector).

The second strategy is the aggressive sector rotation strategy. This strategy tries really to identify the top two performing sectors. These sectors are normally smaller sectors represented by ETFs with higher volatility. For example in 2003, the strategy was invested several month in the Global Solar Energy ETF TAN. TAN performed more than 100% in 2003, but the volatility is 4x the volatility of the Global Healthcare Sector ETF IXJ. The aggressive strategy can generate very high returns during some good months, but you will also have to accept some month with quite high losses.