Global Competitiveness and the Corporation Income Tax

Post on: 18 Август, 2015 No Comment

Global Competitiveness and the Corporation Income Tax

Taxes serve no necessity other than to finance government activities. Regrettably, policymakers often make the mistake of viewing taxes as only funds available for allocation among competing programs. In doing so, they ignore the dramatic effects of incentives created by taxes and the important influences of tax policy on economic activity. A more sophisticated approach recognizes these influences and seeks to raise only the necessary revenue in as economically benign a fashion as possible.

No area of taxation illustrates the need to recognize the incentive effects of taxes better than the taxation of U.S. corporations. The U.S. corporate income tax raises roughly $350 billion annually, about 14 percent of total federal revenue, but its impact extends far beyond its contribution to federal coffers. Any assessment of these effects highlights the fact that the United States urgently needs to reform its corporate tax.

While the need for reform has long been recognized, the ill effects of the tax and the best path forward should be evaluated in light of the emerging dynamics of the global economy. In this paper, we set corporate reform in the context of U.S. competitiveness in a global economy. A review of the prevailing literature and global trends suggests that the U.S. needs to improve the effectiveness of the tax because it hinders firms’ ability to compete internationally at the expense of economic growth and because it encourages financial engineering instead of competitiveness.

The Traditional View of the Corporation Income Tax

A large body of research pioneered in the 1960s analyzed the corporation income tax as a partial factor tax—an additional tax on the return to capital invested in the corporate sector—in the context of an economy closed to international flows of goods and capital.[1] Even when viewed from this narrow perspective, the tax has many flaws.

First, it introduces significant distortions in the behavior of firms, including reducing the incentive to organize business activity as a Schedule C corporation in favor of other forms of organization. (Schedule C corporations benefit from limiting financial liability to the corporation’s assets—not those of the owners.) The large increase in limited liability partnerships, sub-chapter S corporations, and limited liability corporations and other entities that protect personal assets without incurring an additional layer of taxation reflects this distortion. The effect on firm organizational form has been found to impose a cost by misallocating entrepreneurial talent in the economy—a cost that had otherwise been left out of prior literature.[2]

Of course, some corporations continue to organize and be subject to the tax. For these, the asymmetric treatment of debt and equity distorts their financial structure. Corporate interest expenses are a deductible expense, while dividends and returns to equity are not. The tax disparity between debt and equity financing is glaring: According to the U.S. Department of the Treasury, debt financing exposes firms to a marginal effective tax rate of -2.2 percent, compared to 39.7 percent on equity financing. This disparity considerably distorts corporate finance decisions and firm capital structure.

For example, a business that needs to raise $100 million to finance a new factory can raise it by issuing corporate debt or otherwise borrowing the needed funds, or it can finance the new project with equity by issuing new stock or investing retained earnings. Under the first scenario, the interest paid on the $100 million in debt is tax deductible, which contributes to the low effective tax rate of -2.2 percent on the investment returns. In contrast, the dividend payments associated with equity finance are not deductible, leading to the higher effective rate of 39.7 percent on returns to the equity investment. The result is an incentive for greater leverage and an increased possibility of bankruptcy.[3]

A further distortion of firm financial policy stems from the differential between personal income tax treatment of dividends and capital gains. The lower effective tax rate on capital gains leads to a preference for share repurchases over dividend distributions, which distorts corporate payout behavior to shareholders.[4] For example, a shareholder receiving a dividend would be required to pay the personal income tax rate—currently as high as 35 percent— on that income, versus a top rate of 15 percent on a capital gain realized through share repurchases. Moreover, even if the tax rates on dividends and capital gains are equalized, the ability to defer realization of capital gains leads to a lower effective rate. These distortions highlight the desirability of treating the corporate and personal income tax systems as an integrated whole.

Finally and most important, the corporate income tax raises the pre-tax return needed for capital investments to meet the market test. The result is that too little capital is allocated to the corporate sector, with an efficiency cost measured in terms of lower aggregate income. In the process, it drives down the return to capital elsewhere in the economy. That is, the economic burden of the tax is borne by owners of capital everywhere in the economy.[5]

In short, while the corporation income tax has traditionally been a part of tax structures in the United States and elsewhere, it has accumulated a long list of indictments in the research literature.[6] To date, reform efforts have focused on balancing the treatment of debt and equity finance and integrating the corporate and personal tax systems to reduce the distortion costs, although these disparities persist.

The High U.S. Corporate Tax

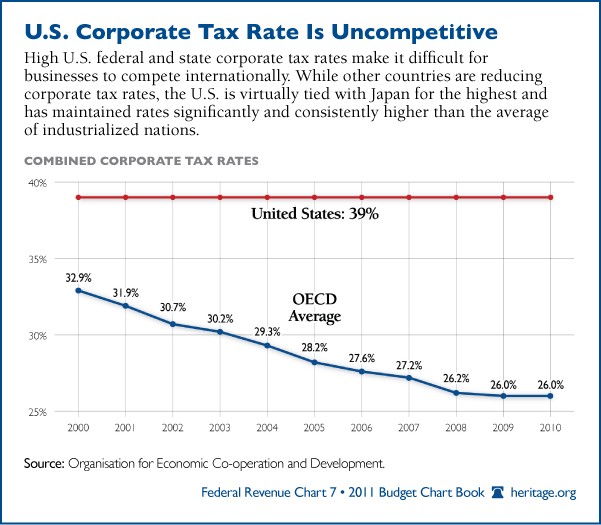

At present, the dominant feature of the U.S. corporate tax is that it is quite high by international standards. The U.S. has the second highest combined statutory tax rate among OECD countries. Chart 1 depicts the five highest and five lowest countries in the OECD by corporate taxation, which provides a clear measure of the U.S.’s international position with respect to corporate taxation.

Chart 1 reflects a significant international trend over the past several decades toward lower corporate tax rates. Importantly, while other nations have generally lowered their rates, the U.S. has kept its rate largely unchanged, as a relatively low-tax nation in 1986 to the second highest today.[7]

One feature of these reforms is that they permit researchers to review more than two decades of international tax data replete with significant movement. This has informed a new empirical literature that reveals significant wage, growth, and employment effects from the corporate tax. This research suggests that the global competitiveness aspects of the corporate tax merit close examination.

Globalization and the Corporation Income Tax

Recognizing the global dimensions of the corporation tax expands the number of decisions that are influenced by tax policy. If a multinational firm wants to enter another national market (for example, a country in the Asia-Pacific region), it must decide whether to produce the goods for that market in the United States and export them or to locate production abroad. If the firm takes the export route, it will face the U.S. corporate income tax. Alternatively, if production is located abroad, it will incur taxes imposed by the foreign government on the value of production (and perhaps an additional tax on any earnings that are repatriated to the United States).

If the multinational elects to produce abroad, it must also choose the nation in which to locate its facility. Of course, taxes play a role in that decision as well because the effective tax rate partly dictates overall profitability. After this decision, the tax code will continue to have the traditional effect on the amount of capital the firm invests.

Finally, a multinational company may also have the ability to manage where it would like to have its earnings taxed. Profits can be moved to a relatively low-tax country through the use of intra-company loans or transfer pricing of intermediate goods between two jurisdictions. Of course, earnings cannot be moved without constraint, but to the extent it is feasible, the company can lower its overall tax burden in this way.

These various decisions are influenced by different measures of the tax rate. Location decisions will be driven by the average effective tax rate, the scale of investment will be governed by the marginal effective tax rate, and the location of taxable profits will be affected by the statutory marginal tax rate.[8] The average effective tax rate is the ratio of the present value of taxes that will be paid on investment returns to the present value of pre-tax profit on that investment.[9] In contrast, the marginal effective tax rate is the difference between the pre-tax return and post-tax yield to an incremental investment in the chosen location, accounting for the statutory tax rate, tax credits, depreciation, and other factors of the tax system. The statutory marginal rate is the rate at which the next dollar earned by an investment will be taxed as determined by law or statute. This measurement is most often associated with tax rates.[10]

Viewed from a global perspective, these additional economic decisions suggest that the scale and structure of the U.S. corporate tax can significantly affect capital investment and profitability in the U.S. trade patterns, and overall economic growth.

Recent Research on the Corporate Tax’s Impact

The potentially pernicious distortions introduced by capital taxes generally and by corporate taxes specifically have been well documented by the literature. However, as the international economy has expanded and markets have become increasingly interdependent, the literature has reviewed corporate taxation in an increasingly global context. Indeed, while the pathbreaking work that informed the traditional view of corporate taxation still provides the principal theoretical and empirical bases for assessing corporate taxation, recent research has significantly expanded this literature to suit an ever more global economy.

Among the most common misperceptions about corporate taxation—perhaps the one that has most impeded significant reform—is that it burdens only the wealthy or those who hold capital. Faced with revenue pressures and the desire to distribute the tax burden equitably, policymakers may be less inclined to reduce the corporate tax. However, recent research advances increasingly challenge the common perception that the corporate tax is a progressive tax on the affluent.

The modern globalized economy is characterized by ever more mobile capital. Increasingly, investment can flow to areas of lower taxation with greater ease than other factors. Other options being equal, an investor deciding between a high-tax jurisdiction and a low-tax jurisdiction will choose to invest in the lowest-taxed region. However, a worker cannot make the same decision. Labor is by nature less mobile than capital. A worker who lives in the low-tax jurisdiction will generally benefit as more capital flows to firms, buttressing labor productivity and, ultimately, wages. Conversely, workers in high-tax jurisdictions will see the capital in their firms diminish, harming productivity and, therefore, wages. This is a simplified narrative, but it illustrates the nature of corporate taxation in a global economy: Everyone bears the burden.

Important contributions in the theoretical literature include similar findings. Indeed, Arnold Harberger, who first determined that capital bore the burden of corporate taxes in a closed economy, has since determined that labor bears most of the burden of corporate taxation in an open economy—over 80 percent.[11] More recent studies have confirmed this view. One noteworthy study from the Congressional Budget Office found that labor bears 70 percent of the corporate tax burden in an open economy.[12]

In addition to theoretical advances, a series of recent papers have found empirical evidence that labor bears a significant share of the corporate tax burden in an open economy.[13] While each study employed a unique approach to assess the incidence of corporate taxes, each found that corporate taxes negatively affect wages. Using data for 72 countries over 22 years and hourly manufacturing wage data, Hassett and Mathur found that for every 1 percent increase in corporate tax rates, wages decrease 1 percent.[14] Using a separate approach with firm-level data, Arulampalam, Devereux, and Maffini found that $1 in additional corporate tax reduces wages by 92 cents in the long run.[15] Using cohorts of data covering 1979 to 2000, Felix found that a 1 percent increase in the marginal corporate tax rate would decrease wages by 0.7 percent.[16]

In addition to these overall wage effects, some studies provide additional insight into corporate tax incidence. For example, Hassett and Mathur found a correlation between high-tax neighbors and high domestic wages. This suggests that nations would engage in tax competition to draw capital by lowering their tax rates relative to their neighbors. Second, Felix found that the wage effects of corporate taxation did not vary with worker skill level—an important finding that should further dispel the notion that labor generally does not bear the corporate tax burden.

Recent findings that recast the corporate tax burden as more than the concern of the privileged are key to moving forward with essential reforms to improve and mitigate its influence on economic activity. Beyond wages, recent studies have revealed further harmful economic effects of the corporate tax.

Corporate taxes have long been deemed to have a negative effect on investment and capital formation.[17] However, several recent studies indicate the extent to which corporate taxes harm capital formation and economic growth.[18] One study in 2008 examined tax data across 85 countries and determined that raising the effective corporate tax rate by 10 percentage points reduces the investment rate by 2.2 percentage points. Investment and capital formation is essential to enduring economic growth. Tax policies that inhibit such activity necessarily impede growth, which the study also finds.

The OECD also has recently released several studies that effectively sort tax structures according to their respective economic effects. According to the OECD, corporate income taxes have the most negative effect on GDP per capita,[19] which is consistent with previous findings that the corporate tax reduces investment and, therefore, economic growth. The OECD found that reducing the statutory corporate tax rate from 35 percent to 30 percent increases the ratio of investment to capital by approximately 1.9 percent over the long term.[20]

Simple Reforms to Improve Competitiveness

As detailed above, the impact of the corporate tax is manifested through lower wages, investment, and output. These reflect the open economy of mobile capital in which the U.S. competes. These findings beg the question: Why would any rational U.S. tax policy impose the second highest statutory tax rate among industrialized nations? Reform of the U.S. corporate tax code is essential to meeting the challenges of a global economy, but it should give due consideration to the nature of taxation in an open economy.

Perhaps the most obvious reform to consider would be to reduce the statutory rate to improve competitiveness and stimulate economic growth. Lee and Gordon found that a 10 percent reduction in the corporate tax could increase economic growth rates by 1 to 2 percent.

From a budgetary perspective, a tax cut necessarily requires a way to maintain budget balance. The most obvious choice is to reduce government outlays, but this is typically a difficult political task. Interestingly, some research suggests the possibility that the U.S. tax rate is higher than the revenue optimizing point on the Laffer curve. As Hassett and Brill noted, the revenue optimizing rate has decreased over time, from roughly 34 percent to 26 percent in the most recent period observed. (The U.S. federal rate is 35 percent.) This study builds on prior work that identified a Laffer curve in the international corporate tax.[21] This approach suggests that reducing the corporate rate would move closer to the revenue optimizing point, obviating any need for offsetting spending reductions.

Assuming a simple rate cut is not self-financing or that it is not feasible to reduce spending, a second approach embraces a rate cut coupled with base broadening. The U.S. Department of the Treasury has examined two potential options. The first option offered a 31 percent rate (down from 35) by eliminating certain preferential tax provisions, while the second offered a steeper cut to 28 percent and more aggressive base-broadening measures. While the first, more modest option yielded a 0.5 percent increase in long-run growth, the more aggressive rate cut and base broadening offered negligible growth effects. This seemingly counterintuitive finding reflects the important principle that base broadening is also a higher tax and may harm overall economic growth even when combined with otherwise pro-growth policy.

The corporate rate cut is the approach favored in recent tax legislation (H.R. 3970) introduced by Representative Charles Rangel (D-NY), chairman of the House Ways and Means Committee. While any meaningful tax reform must necessarily end the hodgepodge of distortionary, narrow breaks that litter the tax code, base-broadening measures need to be determined with overall growth in mind.

While policymakers should always remain mindful of the economy-wide effects of tax policies, narrower, although more pointed perspectives can often provide essential context for assessing key decisions in economic strategies. U.S. manufacturing, while robust, faces considerable challenges in an increasingly global economy. Manufacturing is particularly capital intensive, which is reflected in the prevailing organization form of manufacturers. Only half of manufacturers are Subchapter S pass-through entities compared with a national average of two-thirds of all U.S. businesses. Manufacturers are disproportionately subject to the corporate tax because many require the ability to raise capital from many investors in a manner not permitted by S-corps. As such, manufacturing is particularly sensitive to potential corporate tax reform and is, therefore, a useful canary for signaling the effects of any reform.

According to a study, the mix of tax reforms proposed in the Rangel bill would reduce economic output by an estimated $416.3 billion and result in 5.6 million fewer jobs over 10 years, with the manufacturing sector accounting for $130.5 billion of the reduced output and 446,000 of the lost jobs.[22] These estimates are driven largely by the base-broadeners proposed in the bill—particularly eliminating the domestic production deduction and repealing LIFO (last-in-first-out) as an acceptable accounting practice—which significantly affect manufacturing activity.

A third approach, as noted by the OECD, would be to shift part of the revenue base toward another form of taxation that is less harmful to economic activity, such as property or consumption taxes.

Beyond rate adjustments and base broadening are broader-based reforms that offer more fundamental change by moving the corporate tax structure toward a form of consumption taxation, a cash-flow tax structure.[23] Under such a reform, businesses would be subject to tax on sales of goods and services less expenses, which include capital expenditures and wages. An important feature of this approach is that it excludes from tax computations any financial flows, such as interest, capital gains, and dividends. As a result, this would eliminate the double taxation on corporate earnings and offer the potential for simpler rules, which would also reduce the cost of tax compliance. In addition, moving to a cash-flow base eliminates the differential treatment of debt and equity, one of the more glaring disparities in the current tax code.

Finally, the cash-flow approach can be augmented with border adjustability. That is, exports from the United States could be exempted from tax, while imports could be included in the tax base. This reform would place U.S. manufacturing on a more even playing field with international competitors.

However, a tax base that does not include the financial flows could introduce the opportunity for sheltering real profits in financial activity and increase the difficulties of directly taxing financial firms. This suggests that addressing financial firms’ activity would require a separate tax schedule. Nevertheless, such a reform is vastly superior to the current code, which punishes capital formation at the expense of economic growth and international competitiveness.

Conclusion

The U.S. faces considerable fiscal and economic challenges. Recent and likely federal expenditures underscore the imperative for the federal government to have a robust and efficient revenue collection system. The U.S. has mounting fiscal obligations and requires the means to finance them. However, these imperatives should not preclude improving this mechanism. Indeed, there are better and worse ways to tax.

Less than one-fifth of federal revenue is collected by the corporate tax, yet its very existence has been found to lower wages, diminish investment, and slow economic growth—more so than any other tax structure. While other nations have been gradually reducing their tax rates, the U.S. has failed to act, leaving the U.S. corporate tax rate as the second highest among major industrial nations. While other nations are competing for scarce capital by lowering rates, the U.S. entertains potentially anti-growth corporate reforms. The considered theoretical and empirical research literature leaves little doubt that in an open global economy, capital will flow to low-tax jurisdictions, ultimately driving economic growth.

It is imperative that the U.S. not cede this opportunity or its preeminence in the world economy to intransigence by failing to enact sensible reforms to its corporate tax code.

Douglas Holtz-Eakin is President of DHE Consulting, LLC, and a Visiting Fellow at The Heritage Foundation. Gordon Gray is a Senior Adviser at DHE Consulting, LLC.

/html>

[1] Arnold C. Harberger, The Incidence of the Corporation Income Tax, Journal of Political Economy ,Vol. 70, No. 3 (June 1962), pp. 215-240.

[2] Jane G. Gravelle and Laurence J. Kotlikoff, The Incidence and Efficiency Costs of Corporate Taxation When Corporate and Non-Corporate Firms Produce the Same Good, Journal of Political Economy ,Vol. 97, No. 4 (August 1989), pp. 749-780. Later studies also found significant, but smaller, deadweight costs resulting from the impact of corporate taxes on firm organization choice. See Jeffrey K. Mackie-Mason and Roger H. Gordon, How Much Do Taxes Discourage Incorporation? Journal of Finance. Vol. 52, Issue 2 (June 1997), pp. 477-505, and Austin Goolsbee, Taxes, Organizational Form, and the Deadweight Loss of the Corporate Income Tax, Journal of Public Economics ,Vol. 69, Issue 1 (July 1998), pp. 143-152.

[3] See Martin Sullivan, Deleveraging the Tax Code,Tax Notes. September 29, 2008, and U.S. Department of the Treasury, Office of Tax Policy, Approaches to Improve the Competitiveness of the U.S. Business Tax System for the 21st Century,www.ustreas.gov/press/releases/reports/hp749

_approachesstudy.pdf (April 3, 2009).

[4] B. Doug Bernheim, Tax Policy and the Dividend Puzzle, RAND Journal of Economics ,Vol. 22, No. 4 (Winter 1991), pp. 455-476. See also Gustavo Grullon and Roni Michaely, Dividends, Share Repurchases, and the Substitution Hypothesis, Journal of Finance. Vol. 57, Issue 4 (August 2002), pp. 1649-1684.

[5] Robert E. Hall and Dale W. Jorgenson, Tax Policy and Investment Behavior, American Economic Review ,Vol. 57 (June 1967), pp. 391-414.

[6] The research literature includes a robust finding that the optimal taxation on capital in general should be zero. See Kenneth Judd, Redistributive Taxation in a Simple Perfect Foresight Model, Journal of Public Economics. Vol. 28, Issue 1 (October 1985), pp. 59-83, and Christophe Chamley, Optimal Taxation of Capital Income in General Equilibrium with Infinite Lives, Econometrica ,Vol. 54, Issue 3 (May 1986), pp. 607-622.

[7] See Robert Carroll, Comparing International Corporate Tax Rates: U.S. Corporate Tax Rate Increasingly out of Line by Various Measures,www.taxfoundation.org/publications/show/23561.html (April 3, 2009).

[8] For more on these discrete firm decisions, see Alan J. Auerbach, Michael P. Devereux, and Helen Simpson, Taxing Corporate Income, National Bureau of Economic Research Working Paper No. 14494, November 2008.

[9] See Thomas Dalsgaard, Japan’s Corporate Income Tax—Overview and Challenges, International Monetary Fund Working Paper. March 2008, at /static/reportimages/87CD8F32F8C7F3D5F305C1E3592CFA77.pdf (April 3, 2009), and Michael P. Devereux, Rachel Griffith, and Alexander Klemm, Corporate Income Tax Reforms and International Tax Competition, Economic Policy. Vol. 17, Issue 35 (October 2002).

[10] See Congressional Budget Office, Taxing Capital Income: Effective Rates and Approaches to Reform, October 2005, and Alex Brill, Taxing Capital, American Enterprise Institute Tax Policy Outlook. February 2008.

[11] Arnold C. Harberger, The ABCs of Corporation Tax Incidence: Insights into the Open-Economy Case, chap. 2 in Tax Policy and Economic Growth (Washington, D.C. American Council for Capital Formation, 1995), pp. 51-73.

[12] William C. Randolph, International Burdens of the Corporate Income Tax, Congressional Budget Office Working Paper No. 2006-09, at /static/reportimages/41161DC90991375A896B7ED2BC672DF9.pdf (April 3, 2009). One way to illustrate this is the approach used by Harvard economist N. Greg Mankiw. He provided a simple theoretical model wherein well-informed workers can effectively set tax rates by decree. Under the old view of the burden of the tax, they would then prefer for capital to bear the burden of taxation. However, as he demonstrates, the workers would enjoy higher returns due to higher capital stock through low (zero) capital taxation and would, therefore, choose set tax rates accordingly. See N. Gregory Mankiw, Commentary: Balanced-Budget Restraint in Taxing Income from Wealth in the Ramsey Model, in Kevin A. Hassett and R. Glenn Hubbard, eds. Inequality and Tax Policy (Washington, D.C. AEI Press, 2001).

[13] For a more detailed review of recent advances in the literature on the incidence of corporate taxes, see William M. Gentry, A Review of the Evidence on the Incidence of the Corporate Income Tax, U.S. Department of the Treasury Office of Tax Analysis Paper No. 101, December 2007, at /static/reportimages/A48C43E978A7A77C0B3B350621A87D09.pdf (April 3, 2009).

[14] Kevin A. Hassett and Aparna Mathur, Taxes and Wages, American Enterprise Institute Working Paper No. 128, June 2006.

[15] Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini, The Direct Incidence of Corporate Income Tax on Wages,users.ox.ac.uk/

mast1732/RePEc/pdf/WP0707.pdf (April 3, 2009).

[16] R. Alison Felix, Passing the Burden: Corporate Tax Incidence in Open Economies,www.kc.frb.org/Publicat/RegionalRWP/

[17] See Kevin A. Hassett and R. Glenn Hubbard, Tax Policy and Business Investment, chap. 20 in Alan J. Auerbach and Martin Feldstein, eds. Handbook of Public Economics. Vol. 3 (Amsterdam: North Holland, 2002), pp. 1293-1343.

[18] Young Lee and Roger Gordon, Tax Structure and Economic Growth, Journal of Public Economics. Vol. 89, Issues 5-6 (June 2005), pp. 1027-1043, and Simeon Djankov, Tim Ganser, Caralee McLiesh, Rita Ramalho, and Andrei Shleifer, The Effect of Corporate Taxes on Investment and Entrepreneurship, National Bureau of Economic Research Working Paper No. 13756, January 2008.

[19] Jens Arnold, Do Tax Structures Affect Aggregate Economic Growth? Empirical Evidence from a Panel of OECD Countries,www.olis.oecd.org/olis/

2008doc.nsf/LinkTo/NT00005C32/$FILE/JT03252848.PDF (April 3, 2009).

[20] See Åsa Johansson, Christopher Heady, Jens Arnold, Bert Brys, and Laura Vartia, Tax and Economic Growth,www.olis.oecd.org/olis/2008doc.nsf/LinkTo/NT0000

[21] Kevin A. Hassett and Alex Brill, Revenue-Maximizing Corporate Income Taxes: The Laffer Curve in OECD Countries,www.aei.org/docLib/200707