Global AllAsset Strategies

Post on: 20 Июль, 2015 No Comment

The industrys largest portfolios vary their approach.

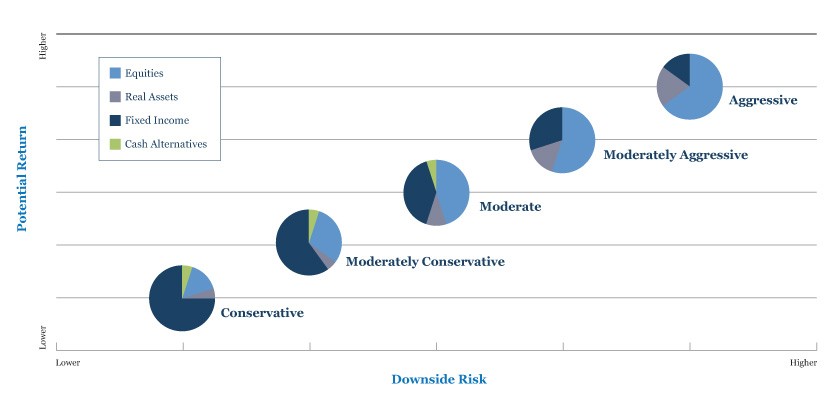

ETF managed portfolios are investment strategies that typically invest more than 50% of portfolio assets in exchange-traded funds. Primarily available as separate accounts, they represent one of the fastest-growing segments of the managed account universe. Morningstar has developed a proprietary classification system for ETF managed portfolios that identifies the investments portfolio attributes. The new structure consists of four main attributes: universe, asset breadth, portfolio implementation, and primary ETF exposure type. This system helps investors better understand the philosophies underlying these investment strategies. The latest Morningstar ETF Managed Portfolio Landscape Report (which can be accessed here ) is a comprehensive industry review of strategies that report information to Morningstars separate account database.

In this series were taking an inside look at the industry using the combination of universe and asset breadth attributes as a starting filter. This commentary is focused on global (universe) all asset (asset breadth) strategies, and upcoming commentaries will discuss other attribute combinations.

Thank You, Technology

Relative to other ETF managed portfolio strategies, global all asset strategies have benefited the most from the ETF boom over the past decade, particularly in the past five to six years. When viewed as a technology, rather than as an investment, the ETF has made it easy to allocate capital across asset classes in a cost-effective way that was previously available only to large institutional managers. Today, you can gain access to virtually any slice of the equity market around the globe, and product development focused on fixed-income offerings has kicked into high gear. More importantly, volatility plays and asset classes like gold and agriculture are now available with the purchase of just one share of an ETF. Previously it would have taken a combination of futures, options, swaps, and thousands of individual securities to replicate such exposures.

The popularity and growth of the ETF market is evident in net flows into ETFs, which topped $191 billion in 2012, the highest year ever. Global asset-allocation strategies have a tool box sufficient to express their global views in a cost-effective manner and can be positioned as stand-alone strategies or complete portfolio solutions. When comparing ETF managed portfolios by Morningstars universe and asset breadth classifications, global all asset strategies top the total-assets list.