Gamma Neutral Hedging by

Post on: 10 Апрель, 2015 No Comment

Gamma Neutral Hedging — Definition

Gamma Neutral Hedging is the construction of options trading positions that are hedged such that the total gamma value of the position is zero or near zero, resulting in the delta value of the positions remaining stagnant no matter how strongly the underlying stock moves.

Gamma Neutral Hedging — Introduction

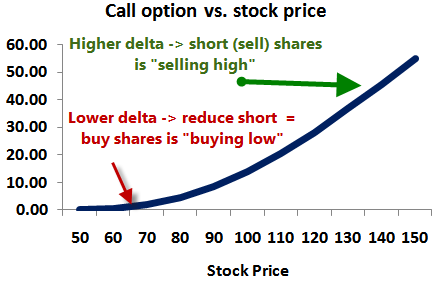

The problem with delta neutral hedging is that even though it prevents the position from reacting to small changes in the underlying stock, it is still prone to sudden big moves which can take option traders off guard with no time to dynamically rebalance the position at all. This is where Gamma Neutral hedging comes in. By hedging an options trading position to Gamma Neutral, the position’s delta value is completely frozen and when used in conjunction with a delta neutral position, the position’s delta value stays at 0 no matter how widely the underlying stock moves, thereby keeping the value of the position completely stagnant. Such a position is known as a Delta Neutral Gamma Neutral Position.

Purpose Of Gamma Neutral Hedging

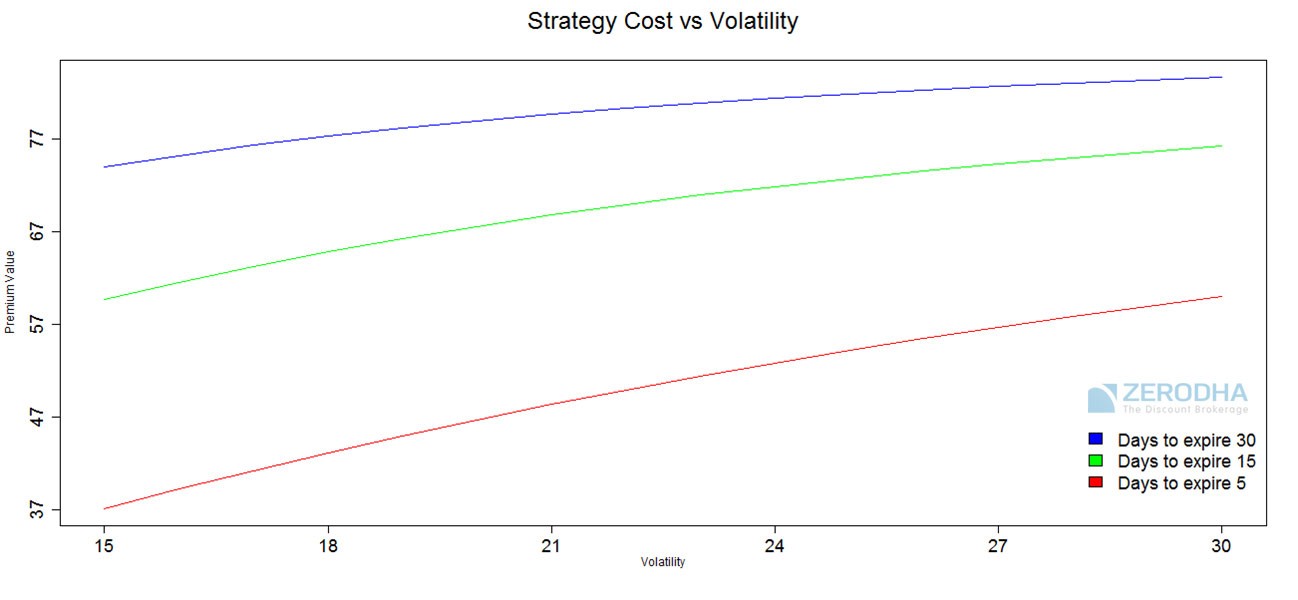

As explained above, the main purpose of Gamma Neutral Hedging is to keep the delta value of a position completely stagnant no matter how the underlying stock moves. This has 3 purposes; 1. To reduce the volatility of an options trading position by keeping delta low and stagnant so that the value of the position neither surges nor ditches strongly with the underlying stock. 2. To make a profit from speculating in implied volatility. which is represented by Options Vega. 3. To seal in profits made so far during volatile times.

Reduction Of Position Volatility

Gamma is another way of representing the amount of volatility of an options trading position. Big Gamma values lead to big changes in delta value, resulting in exponential gains or losses. By going Gamma Neutral, position delta is fixed no matter how much the underlying stock moves, producing a highly predictable and calculable income based on the delta value. This is known as a Delta Positive, Gamma Neutral Position.

Delta Positive, Gamma Neutral Example:

I want to keep delta value at about 0.6 so that I make $0.60 out of every $1 rise in MSFT without any surprises. MSFT’s trading at $28.60 and its May27.5Calls have 0.779 delta and 0.18 gamma while its Oct27.5Calls have 0.697 delta and 0.085 gamma. I would short 1 contract of May27.5Calls for every 2 Contracts of Oct27.5Calls.

Position Delta = (0.697 x 2) — (0.779) = 0.615