Gamma Explained

Post on: 10 Апрель, 2015 No Comment

The option’s gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a one point movement of the underlying stock price.

Like the delta, the gamma is constantly changing, even with tiny movements of the underlying stock price. It generally is at its peak value when the stock price is near the strike price of the option and decreases as the option goes deeper into or out of the money. Options that are very deeply into or out of the money have gamma values close to 0.

Suppose for a stock XYZ, currently trading at $47, there is a FEB 50 call option selling for $2 and let’s assume it has a delta of 0.4 and a gamma of 0.1 or 10 percent. If the stock price moves up by $1 to $48, then the delta will be adjusted upwards by 10 percent from 0.4 to 0.5.

However, if the stock trades downwards by $1 to $46, then the delta will decrease by 10 percent to 0.3.

Passage of time and its effects on the gamma

As the time to expiration draws nearer, the gamma of at-the-money options increases while the gamma of in-the-money and out-of-the-money options decreases.

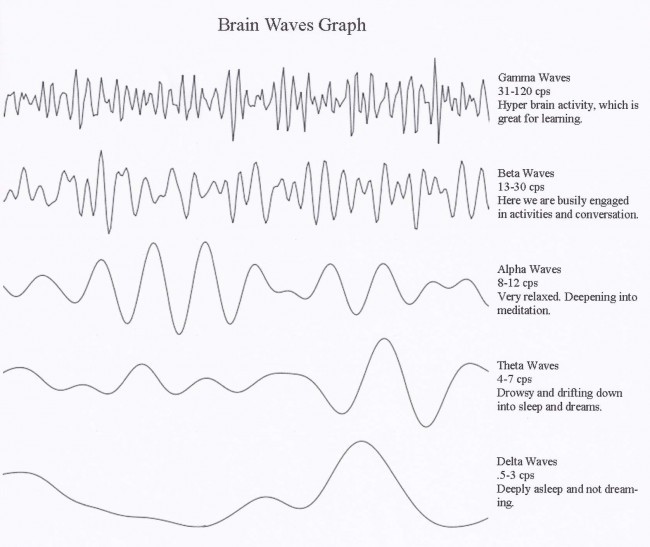

The chart above depicts the behaviour of the gamma of options at various strikes expiring in 3 months, 6 months and 9 months when the stock is currently trading at $50.

Changes in volatility and its effects on the gamma

When volatility is low, the gamma of at-the-money options is high while the gamma for deeply into or out-of-the-money options approaches 0. This phenomenon arises because when volatility is low, the time value of such options are low but it goes up dramatically as the underlying stock price approaches the strike price.

When volatility is high, gamma tends to be stable across all strike prices. This is due to the fact that when volatility is high, the time value of deeply in/out-of-the-money options are already quite substantial. Thus, the increase in the time value of these options as they go nearer the money will be less dramatic and hence the low and stable gamma.

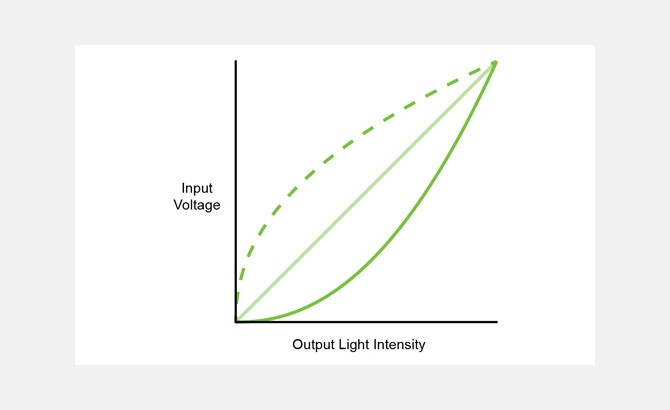

The chart above illustrates the relationship between the option’s gamma and the volatility of the underlying security which is trading at $50 a share.

Your new trading account is immediately funded with $5,000 of virtual money which you can use to test out your trading strategies using OptionHouse’s virtual trading platform without risking hard-earned money.

Once you start trading for real, your first 150 trades will be commission-free! (Make sure you click thru the link below and quote the promo code ’90FREE’ during sign-up)