Fundamental Analysis Investment U

Post on: 11 Май, 2015 No Comment

by Guest Editorial Tuesday, July 26, 2005 Technical Analysis

Fundamental Analysis: Three Screens For Technical Traders

By Dean Albrecht, Contributing Editor

Tuesday, July 26, 2005: Issue #228

I am a quant. In trading terms, that’s short for quantitative analyst, and means I base my investing decisions largely on stats, probabilities, numbers, angles, slopes, etc. that are often completely computer generated.

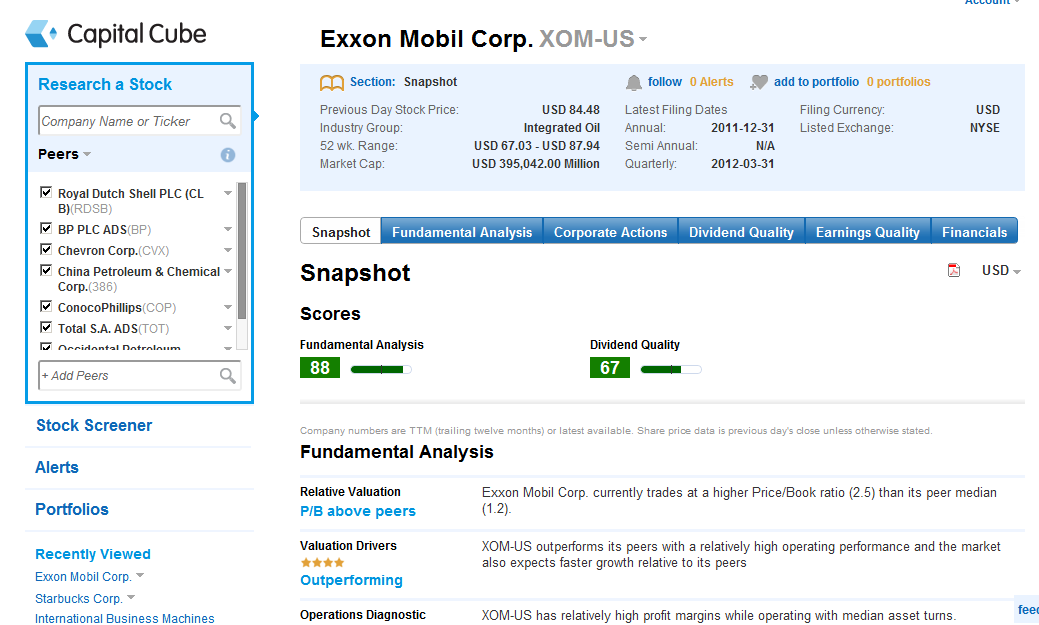

But that doesn’t mean I don’t take advantage of fundamental analysis — good old-fashioned sales, price-to-book ratios, price-to-sales ratios, debt and other similar factors related to the fundamental health of the companies.

Today, I’m going to reveal to you the three fundamental analysis screens the world’s best quants use to increase their probability of success with every stock and option play.

Let’s get right to them…

Fundamental Screen #1: Turn Up the Volume

We pull from a basket (or list) of stocks for our buys and sells. Putting that list of stocks together is a multi-step process. What we do is called screening. And when we screen, we are looking to see that the stocks we add to our basket have volume, first and foremost.

If the stock does not trade frequently, I sure don’t want to be the one holding the bag when no one else is interested in holding the stock. Furthermore, if the stock doesn’t trade and we move into it like a pride of lions attacking a pack of gazelles, then the price of the stock is going to move up fast and only some of us are going to be able to acquire it.

The next fundamental things we look at in some of our screens are sales increases and profitability.

We like these two screens for obvious reasons:

Fundamental Screen #3: Sector Performance

When the stocks we screen pass the test, we then load them into our stock database and separate them by sector.

We look at sector performance… then we look at how the stock is performing in relation to the sector. Of course, we prefer stocks that are outperforming within hot sectors.

Why Fundamentals and Options Profits Go Hand-in-Hand

Okay, so now we have our fundamental screens done. In many cases, this is enough. We don’t need to know everything about the company. We just want to protect ourselves as best we can.

We don’t want to enter into, or recommend, illiquid stocks or options on companies that have no business, or future sales, or profitability prospects… We don’t want to take unwise risk.

Bottom line: If fundamental market forces lead a stock and the stock acts correctly within the market cycles, then our statistics and probabilities have a good chance of playing out to our advantage.

When it comes to options, we are usually looking to get a move of at least 20% out of an option after brokerage commissions and the spread are both factored in.

Knowing that options can lose value quickly we like to stick to fundamentally strong companies, in many cases — that way, if the company opens up OR down, we have a good chance of the options moving our way sometime prior to expiration.

If the fundamental screening is done well, and the timing is right, and our systems pick the stock at the correct juncture… then we get what we want, a winner!

Even an old quant like me understands that proven formula… and now you can put it to work in your own portfolio, starting with the three screens above.