Fox On Stocks Should You Buy Hold Sell or Short in Today s Confusing Stock Market Fox On Stocks

Post on: 11 Октябрь, 2015 No Comment

SUBSCRIBE NOW And Receive

E-mail updates on stock market related issues that are eye-opening and noteworthy

The Fox on Stocks 8Core videos to go from Zero to Opening your own trading account

The Fox on Stocks questionnaire that will uncover your unique trading and investing needs, and show you the best trading platform options for you

Should You Buy, Hold, Sell, or Short in Todays Confusing Stock Market?

How should you trade or invest with all the opposing economic and stock market signs? Should you Buy, Hold, Sell, or Short?

“Signs. signs, everywhere are signs. Blockin’ out the scenery, breakin’ my mind, Do this, don’t do that, can’t you read the signs?” Five Man Electrical Band. Lyrics for “Signs”

I’m fearless. I parasail, I cliff dive, I’m a working actress, I ride all the rides at Cedar Point…. and I day trade. I look forward to the thrill of pushing the BUY button and I generally don’t worry over things. As of late, though, there are so many conflicting economic and stock market signs that read — Do this, don’t do that, can’t you read the signs.

So I’m wondering… are the conflicting economic signs making traders scared, or is the fear over the economy and the stock market making traders and investors conflicted? BlogTime….

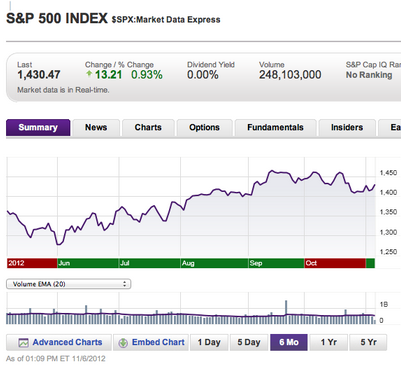

According to Bloomberg, in a March 28, 2013 article on IPOs, “The Dow Jones Industrial Average climbed to a record this month and the MSCI World Index rose to its highest in almost five years.” The S&P 500 has hit new record highs and by those indicators alone, it would seem like a good time to buy some undervalued stocks, like $AAPL and $BIDU, for the long-term, or trade on those that are volatile like $SQNM, $SKUL, or $MNKD either long or short sell – in a market that is sitting at all-time highs. Essentially, in a healthy economy, people should be fearless and happy to invest and trade.

NOTE: I do not currently hold positions in any of these stocks, nor do I intend to do so in the next 72 hours. This is not advice to buy, sell, hold, or sell short in any way whatsoever, but instead to use concrete, real-world examples to make trading and investing concepts more clear.

But there are conflicting indicators….”signs, signs, everywhere are signs, Blockin’ out the scenery breakin’ my mind, Do this, don’t do that, I can’t read the signs.” There are dozens of articles that indicate the opposite of what the Dow, the MSCI, and the S&P 500 indicate. In fact, the articles describe the current economic situation as being bad, with doom on the near horizon. Look at some of these articles:

• “Scientist Predicts 60% Market Collapse.” Newsmax. March 13, 2013

• “Stockman Warns of Crash of Fed-Fueled Bubble Economy,” by Richard Rubin. Bloomberg. April 1, 2013

• “Markets Sending Unusual Signals,” by Mohamed El-Erian, Guest Blog for CNBC. March 28, 2013.

• “The Economy Will Get Worse, Not Better,” by Thomas H. Kee, Jr. MarketWatch. October 10, 2012

• “Jim Rogers: Major Crash Ahead for U.S. Investors,” by Terry Weiss. Money Morning.

In addition to the articles predicting doom, here are statistics that indicate that the economy and, therefore the market, are not doing so well.

- The 10-year Treasury rate is at 1.85%

- The Nations international trade balance in goods and services worsened to -$44.4 billion in January 2013 from -$38.1 billion in December 2012 (revised), as imports increased and exports decreased.

- Sales of new single-family houses in February 2013 were at a seasonally adjusted annual rate of 411,000. This is 4.6 percent below the revised January 2013 estimate of 431,000.

- The Consumer Price Index increased 0.7 percent in February 2013. Over the last 12 months, the all items index increased 2.0.

- The gasoline index rose 9.1 percent in February 2013 to account for almost three-fourths of the seasonally adjusted all items increase.

- U.S. economic confidence fell slightly to -16 in March, from -13 in February, and is at its lowest level since December. Monthly economic confidence was at a five-year high in February, tied with the January 2013 and November 2012 scores. Gallups Economic Confidence Index is based on Americans ratings of current economic conditions in the United States as well as their assessments of whether the economy is getting better or worse.

Then again, here are some indicators that show the economy is healthy or improving:

• Housing Starts as of February 28, 2013 are 917,000, up from 910,000 last month and up from 718,000 a year ago. That is also up from 551,000 in May 30, 2011.

• Unemployment is down to 7.7, the lowest it’s been since January 2009. (Really? Hmmmm. Just reporting what my research is showing.)

• New orders for manufactured goods in February 2013 increased $14.5 billion (over January 2013) or 3.0% to $492.0 billion.

• After-tax profits for retail corporations with assets of $50 million and over were $23.1 billion for the fourth quarter 2012, up $7.8 billion from third quarter 2012.

I know…after a while, it all sounds like Charlie Brown’s teacher. Wha Wha Wha Wah waaaaaa.

The best thing to do may be to cover our eyes and stop looking so hard at the signs. Then cover our ears to stop hearing all the noise about doom and decline. I’m not suggesting we ignore what’s happening. I am suggesting that we see and hear and then close off the noise when it becomes repetitive and overabundant, and listen to the quiet for a second. After that, then we can take our clear minds and focus and watch the price behaviors of stocks, seeking out the volatile ones that are back-page news. Once we have a clear, unnoisy look at our target, then we can pounce on those chosen stocks in a long or short position to make the kill just when the time is right.

Let’s shut out the sensory overload and keep our eye on the ball. Crack